|

Getting your Trinity Audio player ready...

|

- 24.5 million SOL accumulated at $189–$191, creating a strong support zone.

- On-chain data shows sustained investor confidence and long-term positioning.

- This level could stabilize Solana price or act as a springboard for rallies.

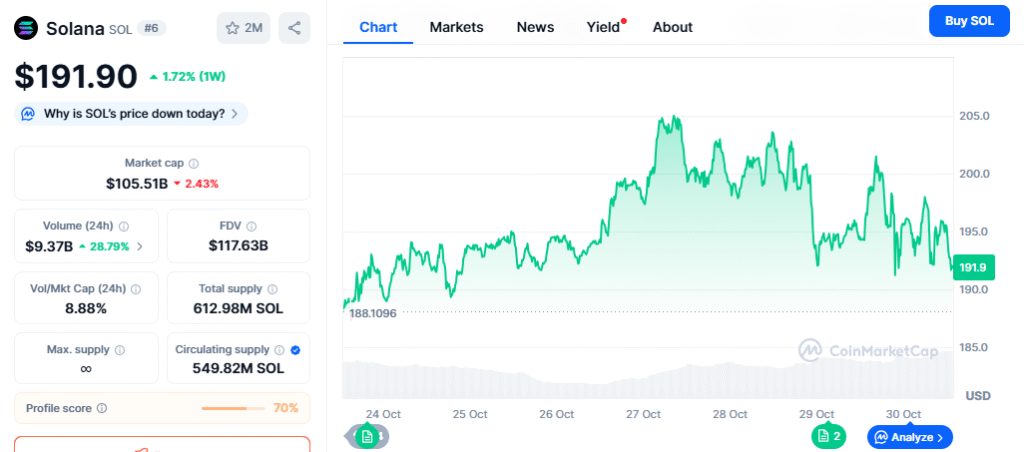

Fresh on-chain insights suggest that Solana ($SOL) has established a critical support level near $189, marking a pivotal point for traders and long-term holders. Analysis from Glassnode’s latest cost basis distribution heatmap shows that approximately 24.5 million SOL were accumulated between $189 and $191, signaling strong investor confidence in this price range.

On-Chain Metrics Highlight Structural Strength

The heatmap, which visualizes token distribution across price points, reveals a dense clustering around $189. This concentration reflects both retail and institutional accumulation over the past few months, particularly from late August through October 2025. Analysts interpret these clusters as natural stabilizers during market dips, indicating that many investors see $189 as a fair long-term valuation for Solana.

24.5 million Solana $SOL were accumulated around $189. That's now a major support zone to watch! pic.twitter.com/fj0VdPm6NL

— Ali (@ali_charts) October 29, 2025

The warm color bands in the heatmap correspond to areas of heavy accumulation, illustrating where investor demand is strongest. With 24.5 million tokens concentrated within a narrow range, this zone now acts as a major support level, reducing the likelihood of sharp downward moves and providing a foundation for potential price rallies.

Investor Behavior and Market Implications

The accumulation pattern suggests that Solana investors are prioritizing long-term growth over short-term speculation. Historically, such concentrated holding zones have helped stabilize price during volatile periods, offering both a psychological and technical anchor for traders.

Also Read: Solana Dips 5% After BSOL ETF Launch: What Investors Should Watch

As cryptocurrency markets experience heightened volatility, the $189 support level gains additional significance. Market observers believe this zone could dictate Solana’s near-term trajectory. If the price dips, the cost basis cluster may buffer losses; if the market remains stable, it could serve as a springboard for renewed upward momentum.

$189 as a Critical Level to Watch

Solana’s on-chain activity signals confidence in its current valuation. The heavy accumulation at $189–$191 not only strengthens its market foundation but also provides a clear reference for traders and long-term holders. Monitoring this zone will be essential in assessing Solana’s potential to maintain its uptrend through the remainder of 2025.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.