|

Getting your Trinity Audio player ready...

|

- Tether is reportedly seeking up to $20B in funding at a $500B valuation.

- SoftBank and Cathie Wood’s Ark are among potential investors.

- A successful raise could place Tether among the world’s most valuable private firms.

Tether, the world’s largest stablecoin issuer, may be closing in on its biggest fundraising effort yet. According to Bloomberg, heavyweight investors SoftBank and Cathie Wood’s Ark Investment are in early discussions to back a multibillion-dollar round that could value Tether at around $500 billion.

Tether’s Ambitious Capital Hunt

Bloomberg reported that Tether is seeking as much as $20 billion in new capital. If completed, the deal would put Tether in the same league as tech giants like SpaceX and OpenAI in terms of private company valuations. Cantor Fitzgerald, already a Tether shareholder, is said to be advising on the potential raise.

The talks come amid a broader surge in institutional interest in digital assets, even as regulatory pressure on stablecoins intensifies globally. Leaks about such negotiations often serve as a way to gauge investor appetite and market sentiment.

Key Players in the Mix

SoftBank and Ark Investment bring decades of experience financing high-growth tech firms. Both firms are no strangers to bold bets, and a Tether deal would mark one of their most significant moves into crypto infrastructure. Tether already has existing ties with SoftBank and Cantor Fitzgerald through Twenty One Capital, a Bitcoin treasury firm holding billions in BTC.

Tether’s Expanding Footprint

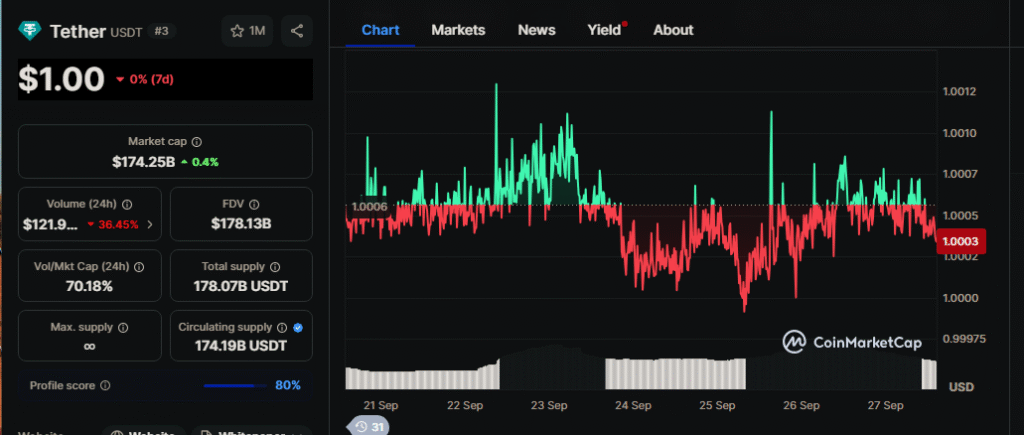

Tether has grown into the dominant stablecoin issuer with $173 billion USDT tokens in circulation. The company is also pushing deeper into the U.S. market, recently announcing plans for a USD-pegged coin under a newly launched American subsidiary. Despite reports of fundraising, Tether U.S. CEO Bo Hines told attendees at a Seoul conference this week that the firm “has no plans to raise money.”

Also Read: Tether Mints $1 Billion USDT: Crypto Bulls Eye Potential Market Pump

If confirmed, a $20 billion raise would mark a historic milestone for the crypto sector, signaling that some of the world’s biggest investors see long-term value in stablecoins. For Tether, it could mean additional firepower to expand, innovate, and reinforce its market dominance.

In short, Tether’s potential mega-raise—backed by names like SoftBank and Ark—underscores how far stablecoins have come from their niche origins to becoming pillars of global finance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.