|

Getting your Trinity Audio player ready...

|

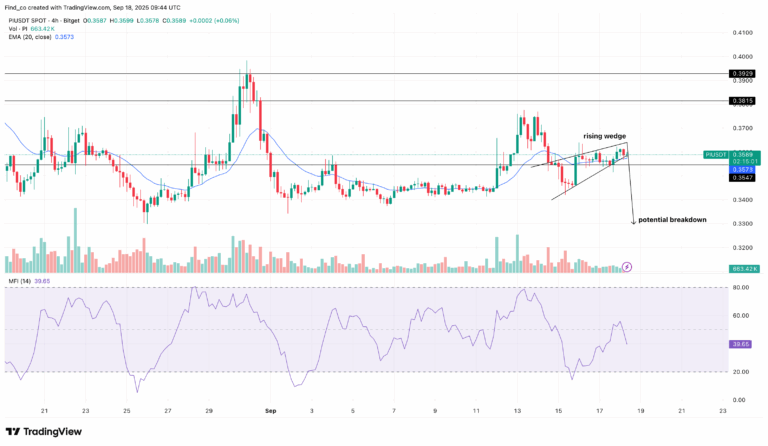

- PI holds near $0.36 but faces weakening buying pressure.

- Rising wedge and descending triangle patterns signal potential downside.

- Macro easing may not boost PI without fresh catalysts.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Pi Network (PI) has stabilized after weeks of decline, hovering around the $0.36 support level. Despite optimism across global markets following the Federal Reserve’s recent rate cut, PI shows little sign of benefiting from broader risk-on sentiment. Trading volume remains thin, and speculative interest appears muted, leaving the cryptocurrency’s short-term outlook fragile.

Technical Barriers Limit Recovery

Technical indicators suggest PI faces significant hurdles. The 20-day Exponential Moving Average (EMA) continues to cap recovery attempts, while the Money Flow Index (MFI) points to declining buying pressure. Additionally, PI is forming a rising wedge pattern, a bearish signal that could trigger further declines if selling intensifies. On the upside, immediate resistance sits near $0.38, but momentum remains weak.

Macro Relief Fails to Spark Demand

Normally, a Fed rate cut injects liquidity into risk assets, lifting equities and major cryptocurrencies. PI, however, is not responding in kind. Its weak performance appears driven more by internal factors, including thin trading volume and fading market enthusiasm. Even with a broader appetite for risk, PI may struggle without fresh catalysts or renewed investor interest.

Also Read: Pi Network Faces Make-or-Break Moment at TOKEN2049 as Community Demands Clarity

Outlook Remains Fragile

Daily chart analysis shows PI trading in a descending triangle, with the Ichimoku Cloud signaling strong resistance above. A failure to breach key resistance could push PI lower to $0.32, while a recovery could see gains up to $0.64. In a highly bullish scenario, PI might even reach $0.83, though such a rebound would require significant positive momentum.

In summary, Pi Network’s price may have stabilized near recent lows, but underlying weakness and cautious investor sentiment suggest any rebound could be limited. Traders and holders should watch support and resistance closely, as the next move could define PI’s near-term trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!