|

Getting your Trinity Audio player ready...

|

- Whales sold 90,000 ETH, briefly pushing prices under $4,500.

- Citi forecasts $4,300, while analysts see upside toward $8,500.

- Staking inflows and low exchange supply support bullish momentum.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Ethereum (ETH) faced selling pressure this week as on-chain data revealed that large holders dumped 90,000 ETH within 48 hours, according to analyst Ali Martinez. The sudden liquidation briefly dragged prices below $4,500 before a swift rebound lifted ETH back to $4,543—still up more than 5% over the past week. This sharp move has stirred debate over whether whales are signaling an impending correction or simply locking in profits.

Whales sold 90,000 Ethereum $ETH in the last 48 hours! pic.twitter.com/YqFfmqs38Z

— Ali (@ali_charts) September 17, 2025

Citi’s Bearish Target Faces Pushback

Adding to the uncertainty, Reuters reported that Citigroup set a conservative year-end 2025 target of $4,300 for Ethereum, citing macroeconomic risks, possible regulatory headwinds, and potential post-rally pullbacks. The bank’s stance contrasts with market sentiment, as ETH previously touched an all-time high of $4,955. CryptoQuant analysts counter that Citi’s forecast likely represents a support floor rather than a realistic ceiling, pointing to stronger underlying fundamentals.

Staking Surge and Shrinking Supply Fuel Optimism

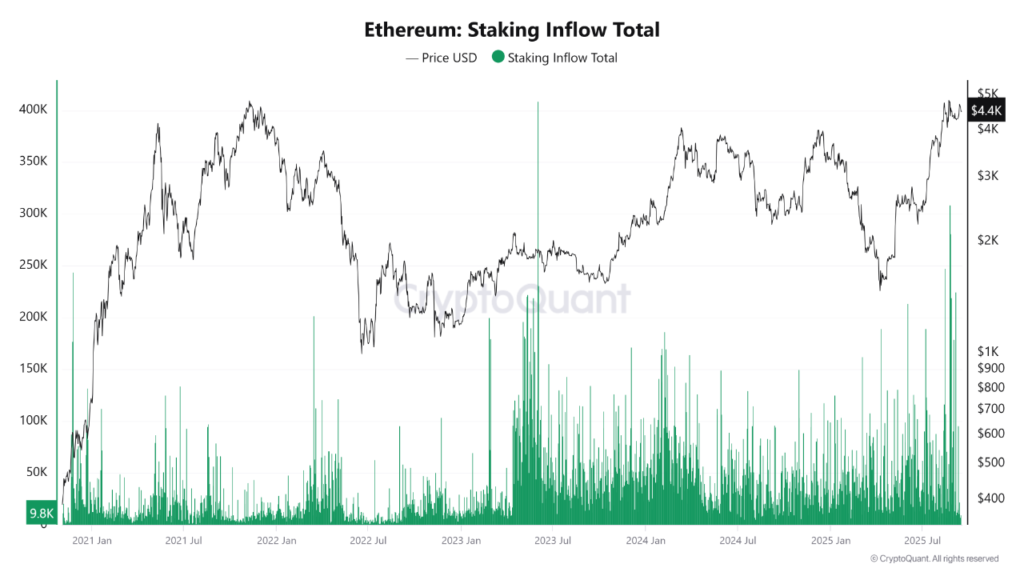

On-chain data paints a more bullish picture. Ethereum staking inflows have climbed to their highest levels since mid-2023, peaking at 308,000 ETH on August 25. The seven-day average hit 150,000 ETH by August 30, signaling reduced liquid supply and rising validator confidence. Meanwhile, ETH balances on centralized exchanges continue to hit multi-year lows, further tightening available supply and reducing the risk of sudden sell-offs.

Rally May Resume After Healthy Pullback

Ethereum recently tapped $4,811 before retracing. Analyst Javon Marks argues that reclaiming this level could ignite a rally toward $8,557—a potential 77% upside. With ETH holding above $4,500 despite whale selling, signs point to the correction phase ending and momentum building for a new leg higher.

While whales may have sparked short-term jitters, Ethereum’s shrinking supply, surging staking activity, and resilience above key levels suggest its uptrend could be far from over.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Aave Revenue Soars to $192M as Ethereum Borrowing Surges Past $28B

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!