|

Getting your Trinity Audio player ready...

|

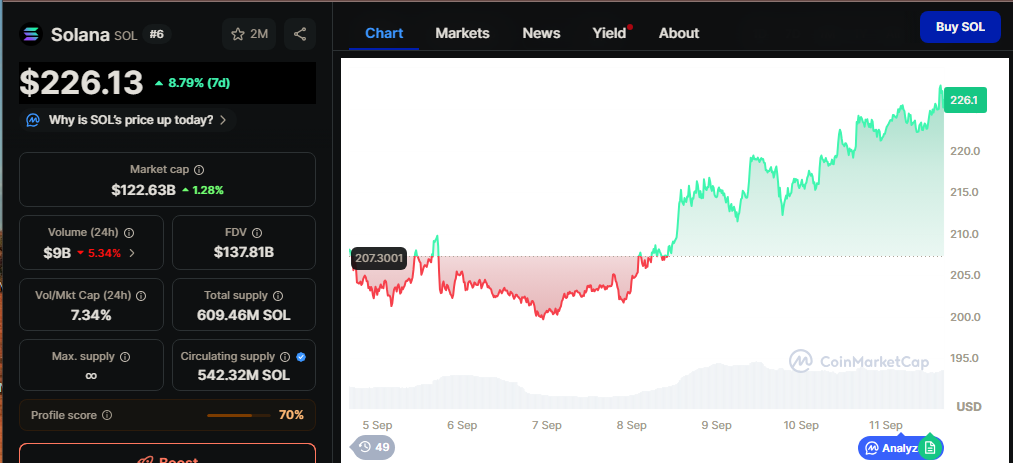

- Solana’s price climbs above $227 after major $1.65B treasury deal.

- Institutional and angel investors show growing confidence in SOL.

- Boardroom shakeup and network upgrades signal long-term ecosystem growth.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Solana (SOL) surged past $227 on Wednesday, marking a 1.41% daily increase and cementing gains of nearly 30% over the past month. The rally comes after Nasdaq-listed Forward Industries (NASDAQ: FORD) secured $1.65 billion in a landmark funding round to build a dedicated Solana treasury. This milestone underscores growing institutional confidence in the Solana ecosystem, signaling a potential shift toward wider adoption.

Institutional Investors Drive the SOL Rally

The $1.65 billion financing round was spearheaded by major crypto firms Galaxy Digital, Jump Crypto, and Multicoin Capital, contributing over $300 million collectively. Other institutional participants included Bitwise Asset Management, Borderless Capital, FalconX, ParaFi, Ribbit Capital, RockawayX, and SkyBridge Capital. Angel investors such as Cindy Leow, Guy Young, Howard Lindzon, and Tarun Chitra also participated, highlighting broad confidence in Solana’s long-term growth potential.

Boardroom Shakeup Strengthens Strategic Oversight

The PIPE deal has also triggered notable changes in Forward Industries’ leadership. Kyle Samani, co-founder of Multicoin, was appointed Chairman of Forward’s Board, while Chris Ferraro of Galaxy and Saurabh Sharma of Jump Crypto joined as board members. Interim CEO Michael Prutti will continue leading day-to-day operations. These appointments illustrate the increasing influence of leading digital asset firms over Forward’s strategic direction, likely to benefit Solana adoption and liquidity.

Solana Ecosystem Growth and Network Upgrades

Forward Industries’ ambitious investment could significantly expand liquidity for SOL and encourage broader institutional participation. The network continues to evolve with upgrades like the Alpenglow proposal, which aims to enhance speed and efficiency. Analysts suggest these developments, combined with substantial institutional backing, may position Solana for further gains in the months ahead.

The $1.65 billion Solana treasury initiative underscores a rising wave of institutional interest, combining strategic funding with network upgrades and influential leadership. As SOL extends its rally, the crypto community is closely watching whether these developments will translate into sustained growth and adoption.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Galaxy Digital Bets $40M on Solana as DeFi TVL Hits $12.35B

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.