|

Getting your Trinity Audio player ready...

|

- BitMine reportedly added 46,255 ETH worth $201M to its treasury.

- Its total ETH holdings now top 2.13 million, valued at $9.3 billion.

- BitMine aims to control 5% of Ethereum’s total supply, boosting its market dominance.

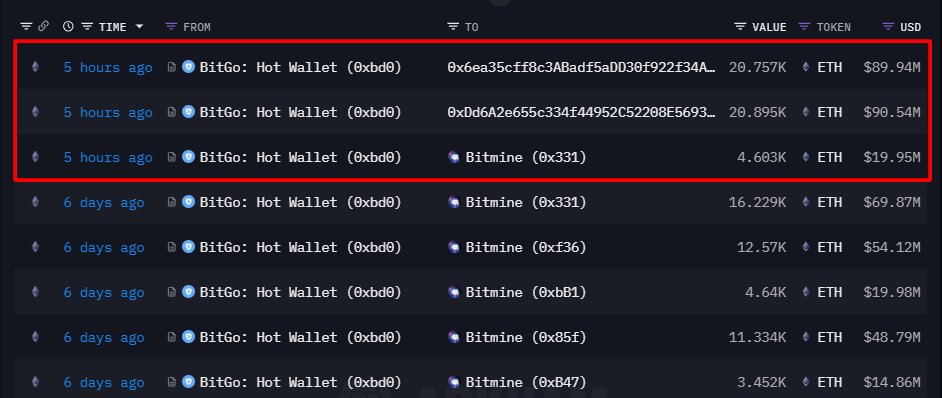

Blockchain analytics platform Onchain Lens has revealed that BitMine Immersion Technologies made another significant move in the crypto market, acquiring 46,255 Ethereum (ETH) worth about $201 million. The transfer reportedly came from a BitGo wallet across three addresses, with one confirmed as BitMine’s and two others still unmarked.

Onchain Lens said it linked the two unmarked addresses to BitMine using forensic analysis and proprietary algorithmic tools, though the company has not officially confirmed the purchase. If accurate, this would push BitMine’s total ETH holdings to 2,126,018 — valued at nearly $9.3 billion — further solidifying its position as the world’s largest corporate holder of Ethereum.

Aiming to Control 5% of Ethereum Supply

BitMine has been aggressively building its Ethereum treasury with the stated goal of controlling 5% of the total ETH supply. Just two days ago, the company reported its holdings had reached 2.069 million ETH, and this new acquisition underscores its accelerated push to dominate the Ethereum treasury market.

This strategy places BitMine well ahead of other corporate holders and highlights the growing institutional competition to secure large reserves of leading crypto assets.

Diversification Strategy: Eightco Investment Signals Broader Ambitions

BitMine’s aggressive Ethereum accumulation is part of a wider digital asset strategy. On Monday, the company announced a $20 million strategic investment in Eightco Holdings (OCTO) as part of a $270 million PIPE deal. Eightco plans to make Worldcoin (WLD) its primary treasury asset, signaling BitMine’s interest in shaping the future of corporate crypto treasuries beyond Ethereum.

Stock Soars as Investors Reward Aggressive Crypto Push

BitMine’s bold approach has boosted investor confidence, with its stock (BMNR) closing 2.24% higher at $45.6 on Wednesday. Over the past six months, BMNR has surged over 500%, reflecting the market’s strong approval of its treasury expansion and aggressive positioning in the crypto space.

With its ETH holdings nearing 2.13 million, BitMine has firmly cemented itself as the leading corporate Ethereum holder. Its ambitious strategy to control 5% of the ETH supply could reshape the corporate crypto treasury landscape in the years ahead.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!