|

Getting your Trinity Audio player ready...

|

- Metaplanet raised $1.4B to expand its Bitcoin holdings by nearly 50%.

- Nakamoto Holdings committed $30M, fueling a 17% stock rally.

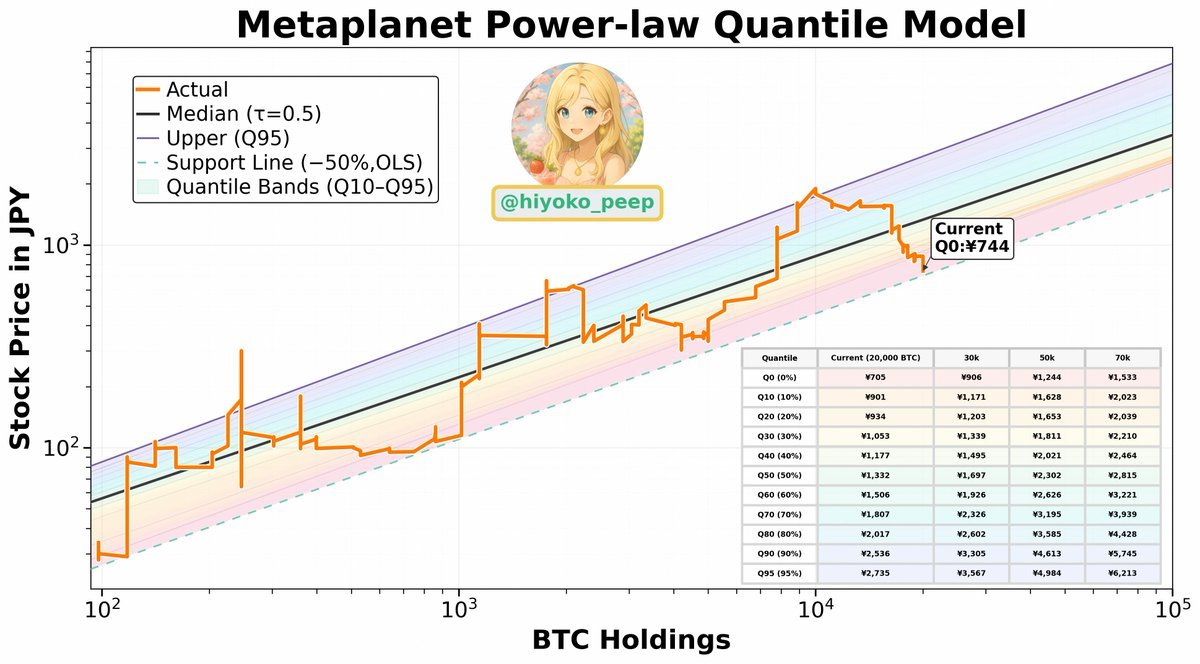

- Analysts see fair value at 1,332 JPY, signaling recovery potential.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Metaplanet shares surged 17% on Wednesday, September 10, reversing part of last month’s steep decline. The rally followed two major catalysts: a $30 million investment from Bitcoin treasury firm Nakamoto Holdings and Metaplanet’s expanded $1.4 billion capital raise aimed at bolstering its Bitcoin strategy.

Nakamoto Holdings Backs Metaplanet with $30 Million

The announcement from Nakamoto Holdings, via its Nasdaq-listed subsidiary KindlyMD, sent investor sentiment soaring. The $30 million investment forms part of Metaplanet’s international equity financing, with the deal set to close on September 16 and stock issuance confirmed for September 17.

David Bailey, Chairman and CEO of KindlyMD, emphasized the strategic importance of the deal, noting Metaplanet’s growing leadership in Japan’s Bitcoin sector and its role in advancing institutional adoption worldwide.

$1.4 Billion Fundraise to Expand Bitcoin Holdings

Metaplanet recently upsized its fundraising efforts to $1.4 billion, doubling down on Bitcoin acquisitions. With 20,136 BTC already in its reserves, the Japanese firm aims to increase its Bitcoin allocation from 5% to 10% of total capital reserves. Analysts estimate the fresh funding could enable the purchase of up to 11,000 additional BTC, boosting holdings by nearly 50%.

Stay ahead with real-time updates and insights—Join our Telegram channel!

The company has also outlined that returns from its Bitcoin strategy will be distributed as dividends, further enticing long-term investors.

Also Read: Metaplanet Stock Falls 54% as Bitcoin Plan Stalls

Stock Valuation Outlook Strengthens

After peaking at 1,900 JPY in June, Metaplanet’s stock had corrected nearly 70%, bottoming at 705 JPY. However, the Power-law Quantile model now places fair value at 1,332 JPY, suggesting the stock has significant room for recovery. With renewed institutional support and a stronger Bitcoin allocation strategy, investor confidence appears to be stabilizing.

Metaplanet’s sharp rebound highlights the growing intersection between corporate treasury strategies and Bitcoin exposure. With Nakamoto Holdings’ backing and an aggressive expansion of its BTC reserves, the company is positioning itself at the forefront of Asia’s Bitcoin-driven institutional finance movement.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!