|

Getting your Trinity Audio player ready...

|

- Solana recorded $148M in application revenue and 2.9B transactions in August.

- High-value wallet accumulation indicates long-term bullish confidence.

- Technical signals support potential SOL price targets above $250.

August proved pivotal for Solana (SOL), not just in market movements but in ecosystem growth. While the price fell short of retesting its all-time high, the blockchain recorded record-breaking adoption and activity metrics that may set the stage for a sustained rally.

Record Ecosystem Growth

Solana’s ecosystem surged in August, posting $148 million in application revenue—a 92% year-over-year (YoY) increase—outpacing all other major blockchains. The network also hit unprecedented trading milestones, with perpetual futures volume reaching $43.8 billion and decentralized exchange (DEX) volume soaring 180% YoY to $144 billion.

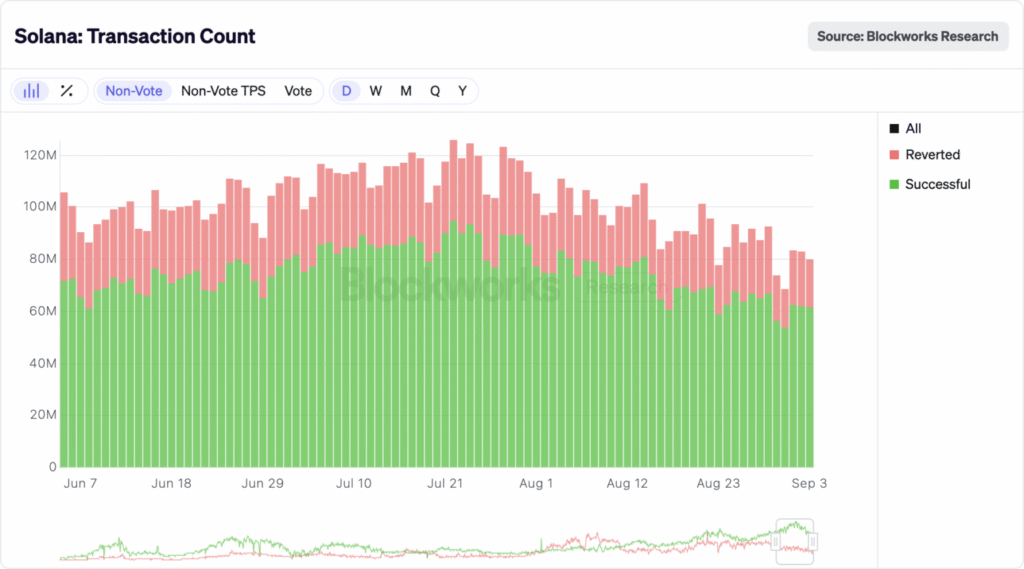

Transaction activity exploded, with 2.9 billion processed transactions—a 46% YoY rise—outstripping the combined volume of competing networks. The number of active addresses doubled to 83 million, reflecting accelerating user engagement. Token creation also surged, with 843,000 new tokens launched, 357 of which achieved valuations above $1 million.

Price Dip Offers Buying Opportunity

Despite these achievements, SOL’s price peaked near $215 in August and has since retreated to $27.74. While this may appear bearish, on-chain data suggests otherwise. The rising number of wallets holding over 10,000 SOL signals confidence among large investors and a potential reduction in circulating supply. Such accumulation trends often presage bullish momentum, indicating that SOL could be poised for higher valuations.

Also Read: Solana Reaches $500M RWAs as Galaxy Digital Tokenizes Nasdaq Shares On-Chain

Technical Outlook Remains Bullish

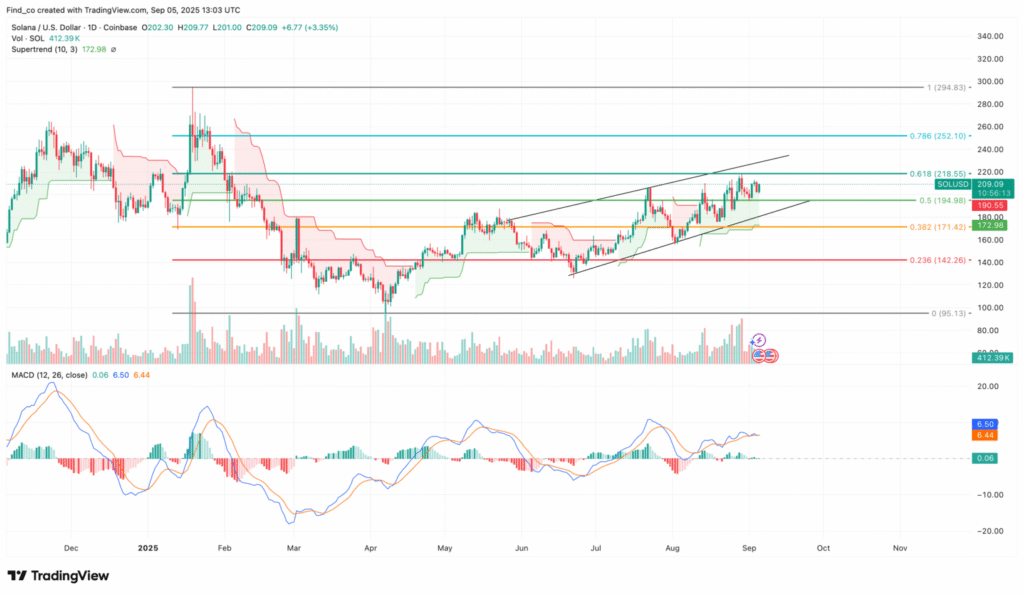

Technically, Solana is trading within an ascending channel—a pattern associated with sustained bullish momentum when support levels hold. The Supertrend indicator remains favorable, and the Moving Average Convergence Divergence (MACD) continues to print positive readings. If buyers maintain control, SOL could break the $218.55 resistance and target $252.10 near the 0.786 Fibonacci level. Conversely, failure to breach resistance might see prices test $171.42.

August highlighted Solana’s ecosystem growth and robust adoption metrics, even amid price volatility. With rising high-value wallet accumulation, positive technical indicators, and strong transactional growth, SOL appears well-positioned for potential upside in the coming months. Investors may view the current price dip as a strategic entry point into a fundamentally strong blockchain.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.