|

Getting your Trinity Audio player ready...

|

- Bitcoin trades near $111K as traders await Friday’s US jobs report.

- Dip buyers continue accumulating despite volatility and weak labor data.

- A Fed rate cut in September could be the catalyst for BTC’s rebound.

Bitcoin and traditional markets are treading cautiously ahead of Friday’s US jobs report, with traders on “pins and needles” as they await fresh labor market data. Despite the uncertainty, Bitcoin dip buyers continue to accumulate, signaling confidence in a potential rebound.

Jobs Data Adds Pressure to Risk Assets

On Wednesday, Bitcoin briefly rallied to $112,600 before slipping to $109,329 during the Asian session, erasing its gains. The drop coincided with disappointing ADP private payrolls data, which showed just 54,000 jobs added in August—well below analysts’ expectations of 75,000. This weak reading rattled equities and weighed on crypto markets.

Friday’s nonfarm payrolls report is seen as more significant, with economists expecting 80,000 jobs added. However, labor data already shows the number of unemployed Americans (7.24 million) has overtaken the employed (7.18 million), raising concerns that the labor market may be losing momentum.

Fed Rate Cuts in Focus

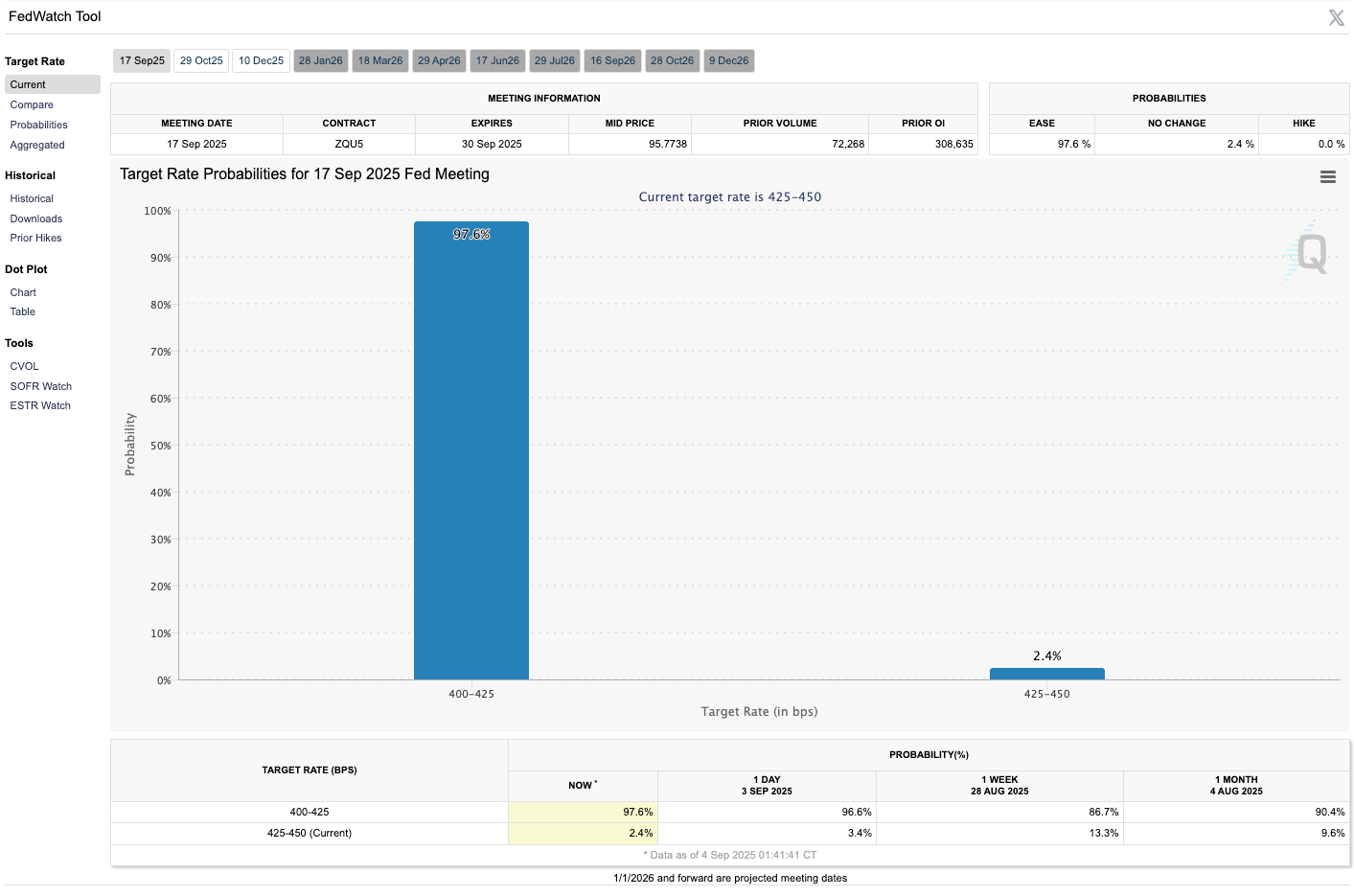

For Bitcoin traders, a weaker jobs report could have bullish implications. Signs of a slowing labor market increase the likelihood of the US Federal Reserve cutting rates, a move that typically supports risk assets like BTC. The CME FedWatch tool now shows a 97.6% probability of a 25-basis-point cut in September, which many investors hope will fuel a recovery rally.

Dip Buyers Accumulate Despite Volatility

Market data shows that retail and institutional traders continue to “buy the dip,” entering both spot and leveraged positions. According to Hyblock, BTC/USDT price action is trapped between $109,000 and $111,200, with short-term traders taking profits near range highs. Reclaiming $112,000 remains a crucial resistance level for any sustained upside move.

As Bitcoin hovers near $111,000, the market’s next big catalyst will likely be Friday’s US jobs report. With traders positioning for rate cuts and dip buyers continuing to accumulate, BTC’s near-term path hinges on whether the labor data confirms economic slowdown—or surprises to the upside.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losse

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.