|

Getting your Trinity Audio player ready...

|

Stay ahead with real-time updates and insights—Join our Telegram channel!

- Bitcoin surged above $117K as Powell hinted at September rate cuts.

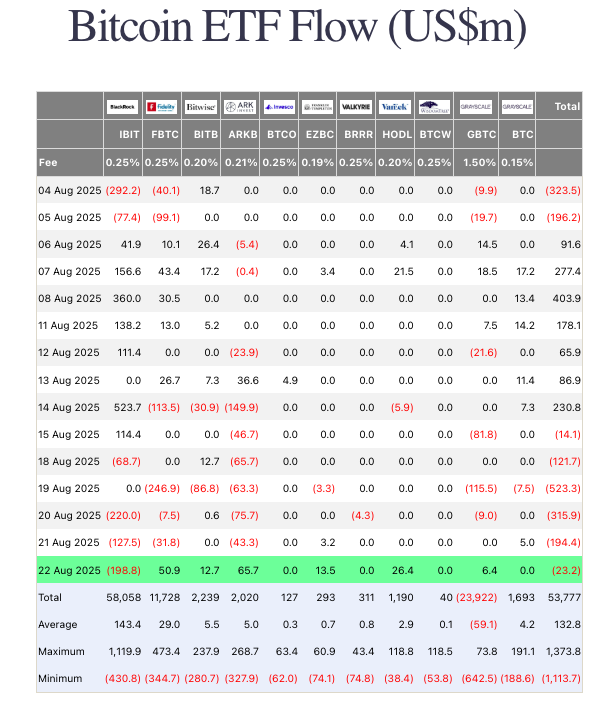

- Spot Bitcoin ETF outflows dropped sharply, signaling institutional confidence.

- $752M in liquidations fueled forced buying, driving altcoin gains.

The cryptocurrency market is roaring back, fueled by a mix of Federal Reserve policy signals, easing institutional selling, and a wave of short liquidations. Bitcoin surged past $117,000 on Friday, lifting the entire digital asset market cap close to $4 trillion — a nearly 4% jump in just 24 hours.

Powell’s Dovish Signal Sparks Risk-On Rally

Federal Reserve Chair Jerome Powell’s Jackson Hole speech hinted strongly at an interest rate cut in September. The CME FedWatch tool now places a 75% probability on a cut, sparking investor appetite for risk assets like Bitcoin and altcoins. Bitcoin reacted swiftly, climbing from $111,600 to above $117,000, underscoring how sensitive markets remain to Fed signals.

Also Read: Crypto Sentiment Flips to Greed After Powell Hints at September Rate Cut

ETF Outflows Ease, Boosting Institutional Confidence

A second driver came from the sharp slowdown in Spot Bitcoin ETF outflows. After heavy redemptions earlier in the week — $523 million on August 19, $315 million on August 20, and $194 million on August 21 — outflows plunged to just $23 million on August 22. The move suggests institutions are holding their positions, signaling confidence in Bitcoin’s long-term trajectory.

Liquidations Trigger Forced Buying

The rally was amplified by over $752 million in liquidations, primarily from short sellers. CoinGlass data shows more than 176,000 traders were liquidated in the past 24 hours, with Bitcoin and Ethereum accounting for the bulk of losses. Forced buying from these liquidations helped accelerate the market’s upward move.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Altcoins and Ethereum Join the Surge

Ethereum jumped toward $4,735, backed by fresh institutional support, including a $1.5B buyback announcement from SharpLink and SBI Bank’s investment in Circle. Lower gas fees further bolstered adoption. Meanwhile, altcoins such as XRP, Solana, Cardano, and Dogecoin followed Bitcoin’s lead, with the Altcoin Season Index rising to 57 — signaling altcoin season may be approaching.

With Powell’s dovish signals, slowing ETF outflows, and a massive short squeeze, crypto markets are surging with renewed energy. Bitcoin’s rally has revived confidence across altcoins, fueling speculation that this could be the beginning of a broader bull run heading into September.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!