|

Getting your Trinity Audio player ready...

|

- Solana rebounded to $198.01 after PPI data rattled markets.

- Technicals and positive funding rates suggest continued bullish momentum.

- SOL could surge toward $294.92 if key support levels hold.

Solana (SOL) has demonstrated resilience despite hotter-than-expected U.S. Producer Price Index (PPI) data rattling the broader crypto market. On Thursday, SOL slipped from $207.89 to $192.43 after the July PPI surged 3.3% year-over-year, exceeding the 2.5% forecast and marking the highest reading since February. Monthly growth of 0.9% also heightened concerns over tighter monetary policy and cast doubt on a potential September rate cut.

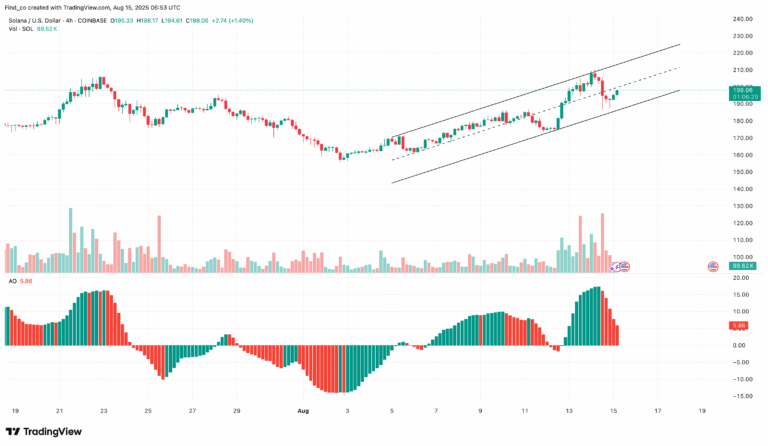

Yet, SOL bulls have refused to blink. By the time of writing, the altcoin rebounded to $198.01, trading within an ascending parallel channel. The Awesome Oscillator shows shrinking red bars, indicating fading bearish momentum and easing selling pressure.

Bullish Signals Strengthen Recovery

SOL’s funding rate remains positive, reflecting strong demand for leveraged long positions. Traders holding these positions pay shorts, signaling confidence in further upward movement. Combined with the recent price action, this bullish sentiment suggests that buyers are regaining control.

Technical indicators also support a potential rally. Solana’s daily chart shows an inverse head and shoulders pattern, with a breakout above the $188.70 neckline. A bullish MACD crossover reinforces upward momentum, while the Bull Bear Power remains in positive territory, indicating that buyers dominate the market.

Also Read: Chainlink (LINK) Breaks $19.50 as Solana (SOL) Eyes Next Crypto Breakout

Potential Price Targets

If bullish momentum continues, SOL could challenge the resistance at $218.73 and potentially surge toward $294.92, marking a new record high. Conversely, a failure to hold above the neckline could trigger a decline to $142.53, underscoring the importance of market support in the coming sessions.

Despite the PPI shock, Solana has demonstrated strong resilience, with multiple technical indicators and funding rates pointing to a bullish recovery. Traders remain optimistic that SOL could continue its ascent, offering a potential opportunity for gains as broader market uncertainty persists.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.