|

Getting your Trinity Audio player ready...

|

- Ethereum futures volume on CME jumped 82% to $118 billion in July.

- ETH price climbed 17% in a week, nearing its all-time high of $4,300.

- Institutional interest grows as CME futures offer regulated exposure to ETH.

Ethereum (ETH) futures trading volume on the Chicago Mercantile Exchange (CME) surged to a new record of $118 billion in July, marking an 82% jump from June. This remarkable increase highlights strong investor demand for Ethereum futures as the digital asset continues its upward price momentum.

Record-Breaking Futures Volume and Open Interest

Alongside soaring futures volume, Ethereum’s open interest on CME also rose sharply. The total value of unsettled contracts grew 75%, from $2.97 billion in June to $5.21 billion in July. This indicates growing participation and confidence from traders who use futures to hedge spot positions or speculate on price movements without owning ETH directly.

This surge at CME reflects a broader trend across all exchanges. Total monthly Ethereum futures volume hit $2.12 trillion in July—a 38% increase over June and a new all-time record surpassing the previous $1.87 trillion set in May 2021. Open interest across all markets neared $36.3 billion by early August, signaling sustained interest in ETH futures globally.

ETH Price Nears New All-Time High

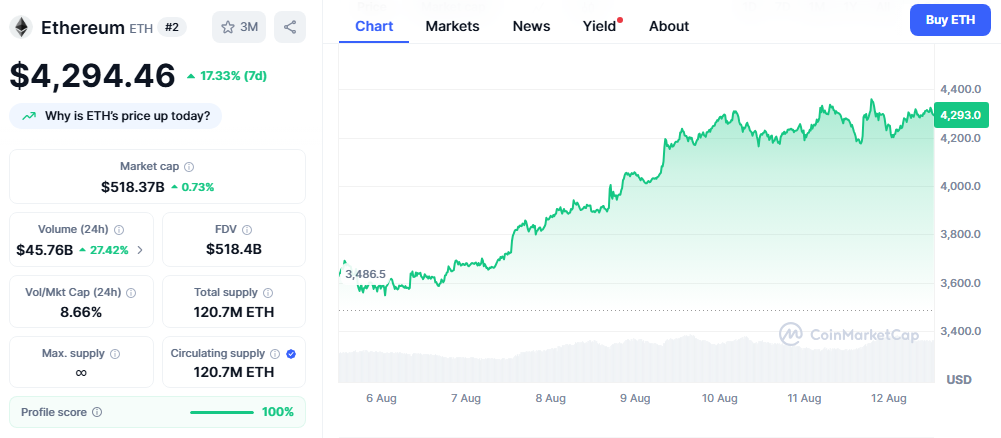

Ethereum’s price has responded to futures market activity, climbing over 17% in the past week to trade near $4,300. While about 13% shy of its previous all-time high, the momentum indicates strong bullish sentiment. Notably, futures funding rates remain below late-2024 levels, suggesting some traders are still cautious despite the rally.

The growing adoption of Ethereum in decentralized finance (DeFi) and smart contract applications underpins this demand. Additionally, ETH is increasingly held as a strategic reserve by institutions, further driving price appreciation.

Also Read: Today in Crypto — Debanking Scandal, Ethereum Billionaire Returns, DC Power Shift

Institutional Adoption and Market Maturity

The record volumes and open interest on CME underscore Ethereum’s rising acceptance within traditional finance. Regulated futures products like CME’s enable institutions to engage with ETH under a trusted framework, bridging the gap between crypto and mainstream markets. This trend may boost liquidity, reduce volatility, and foster broader adoption.

As CME Ethereum futures volumes soar, the market signals growing trust in ETH as a financial asset. Futures trading offers a regulated path for risk management, making Ethereum more accessible to institutional investors and retail traders alike.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!