|

Getting your Trinity Audio player ready...

|

The United States has emerged as the world’s most crypto-friendly real estate market, topping a comprehensive analysis of 30 countries as cryptocurrency adoption in property transactions experiences explosive 220% growth globally.

A new study by Taurex reveals that over 560 million people worldwide now own cryptocurrency, with real estate purchases becoming an increasingly popular use case beyond traditional investment methods. The research evaluated countries based on cryptocurrency ownership rates, Bitcoin ATM infrastructure, public interest, and crucially, legal acceptance of digital assets for property transactions.

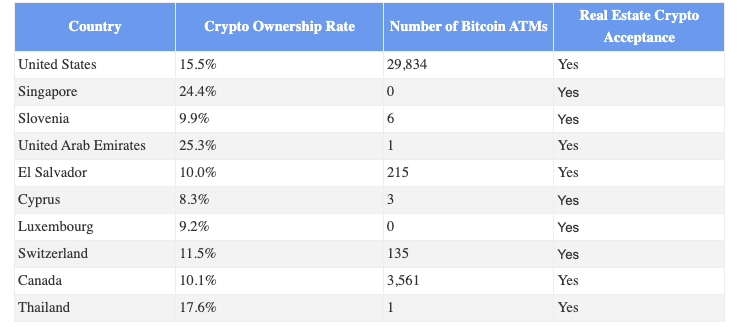

Top 10 Crypto-Friendly Real Estate Markets

America Dominates Crypto Property Infrastructure

The United States secured first place with an impressive network of 29,834 Bitcoin ATMs nationwide – the world’s largest infrastructure enabling seamless crypto-to-cash conversion for property purchases. With a 15.5% cryptocurrency ownership rate among Americans, the country’s real estate markets actively accept cryptocurrency payments, supported by widespread availability of crypto debit cards.

“The United States leads not just through adoption rates, but through comprehensive infrastructure that makes crypto transactions practical for everyday property buyers,” explains Conor, senior market analyst from Taurex.

Small Nations Outperform Major Economies

Surprisingly, smaller countries are proving more agile in embracing cryptocurrency real estate transactions than larger economies. Singapore claims second place with an exceptional 24.4% crypto ownership rate and 150% adoption growth, while imposing zero income tax on cryptocurrency gains – making digital asset property investments highly profitable.

The United Arab Emirates demonstrates the highest cryptocurrency ownership rate at 25.3%, coupled with impressive 210% growth in crypto adoption. Like Singapore, the UAE maintains zero crypto income tax while actively accepting cryptocurrency for real estate transactions.

Slovenia rounds out the top three despite its modest 2.1 million population, offering zero crypto income tax and sufficient Bitcoin ATM infrastructure relative to its size. The country’s 9.9% crypto ownership rate demonstrates how smaller markets can effectively integrate cryptocurrency into real estate transactions.

Also Read: Do You Have a Crypto Inheritance Plan? Here’s Why You Absolutely Need One

Revolutionary Crypto Integration

El Salvador has achieved the most comprehensive crypto integration, making Bitcoin legal tender alongside the US dollar for all transactions, including property purchases. The nation operates 215 Bitcoin ATMs specifically supporting real estate transactions, representing full cryptocurrency adoption in its property market.

Canada maintains the study’s second-largest Bitcoin ATM network with 3,561 machines, while Thailand boasts a 17.6% crypto ownership rate – among the highest in Southeast Asian markets.

Global Transformation Spans Continents

The top 10 crypto-friendly real estate markets span North America, Europe, Asia, and the Caribbean, with countries like Cyprus, Luxembourg, and Switzerland all accepting cryptocurrency for property transactions. This geographic diversity indicates cryptocurrency real estate isn’t a regional phenomenon but a global transformation.

Cyprus serves as a Mediterranean crypto property hub with 8.3% cryptocurrency ownership among its 1.4 million residents, while Luxembourg facilitates high-value international property transactions through cryptocurrency acceptance in its established financial center.

The analysis demonstrates that cryptocurrency is fundamentally reshaping traditional real estate markets worldwide, creating new opportunities for international property investment and establishing digital assets as legitimate payment methods in high-value transactions across three continents.

Credit: https://www.tradetaurex.com

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!