|

Getting your Trinity Audio player ready...

|

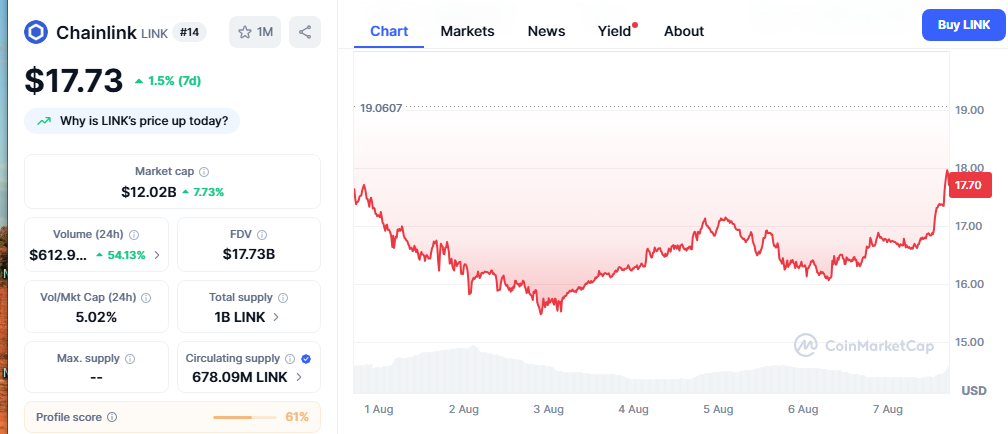

Key Takeaways:

- Chainlink’s LINK Reserve converts enterprise revenue into LINK to boost long-term utility.

- Over $1M in LINK has already been deposited; no withdrawals planned for years.

- LINK price jumped 9.14%, signaling investor optimism over Chainlink’s evolving model.

Chainlink has officially launched the LINK Reserve, a pioneering move that ties the utility and demand of the LINK token directly to real-world, revenue-generating use cases. Designed to convert enterprise payments into LINK, the new Reserve marks a significant shift in Chainlink’s tokenomics, strengthening its long-term value proposition across DeFi and TradFi ecosystems.

Payment Abstraction Converts Real Revenue into LINK

The LINK Reserve functions as an on-chain pool funded by payments from institutional users and protocol-level services. Chainlink utilizes Payment Abstraction to automatically convert these payments—originally made in gas tokens or stablecoins—into LINK using infrastructure like Uniswap V3.

This innovation eases payment friction and expands LINK’s role as the end-value settlement asset across the entire Chainlink ecosystem. Notably, enterprise users making off-chain payments now see those funds converted directly into LINK via smart contract automation.

Over $1 million in LINK has already been added to the Reserve during its early phase, signaling strong adoption.

Long-Term Model Replaces Emissions with Real Utility

Chainlink stated that no funds will be withdrawn from the Reserve for several years, prioritizing steady accumulation over time. Additionally, the protocol will redirect 50% of staking-verified service fees into the Reserve—funds that previously rewarded node operators.

This shift reduces reliance on inflationary emissions and reinforces Chainlink’s sustainable economic model rooted in actual usage rather than speculation.

Also Read: Chainlink Price Dips Below $20 as Bearish Momentum Builds and Exchange Inflows Surge

LINK Price and Volume Surge After Announcement

Following the announcement, LINK surged 9.14%, breaking the $17.66 barrier. Trading volume also spiked by 40%, with over $589 million in daily turnover. The token’s market cap now stands at $11.98 billion, reflecting growing investor confidence in Chainlink’s evolving tokenomics.

With over 2,000 data feeds powering $80 billion in value across 60+ blockchains, Chainlink’s LINK Reserve cements the protocol’s role in driving real-world blockchain adoption.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.