|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- MetaMask may soon launch “mmUSD” with Stripe to embed a stablecoin natively into its wallet ecosystem.

- The move follows MetaMask’s crypto debit card rollout, hinting at neobank ambitions.

- With $250B in stablecoins circulating, mmUSD could help MetaMask redefine how users transact in Web3.

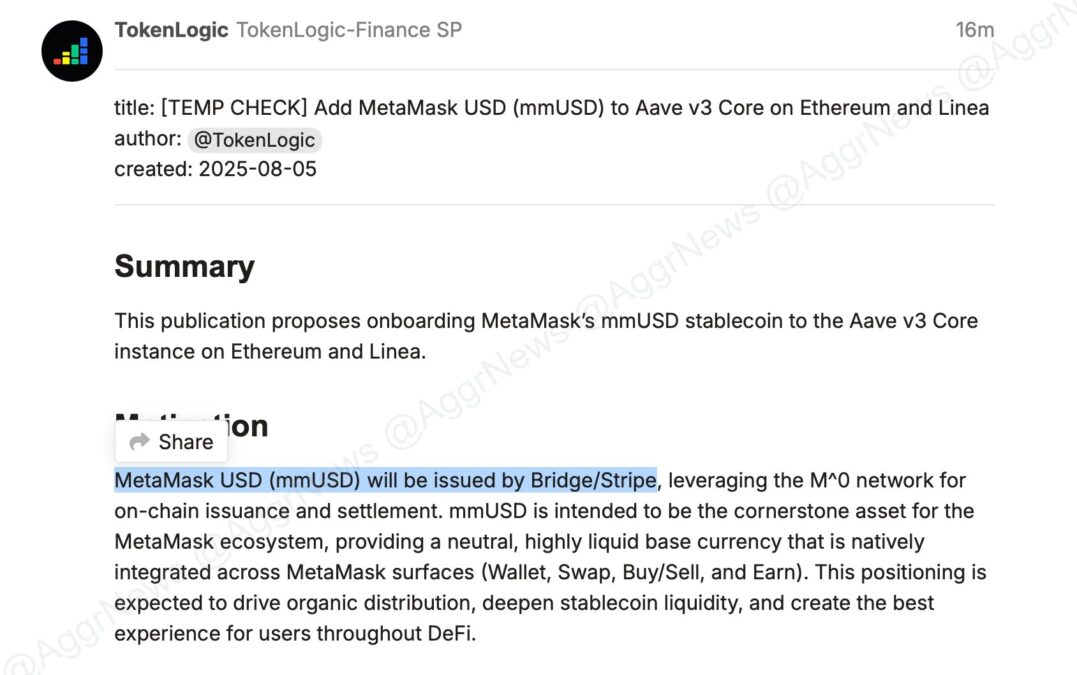

MetaMask, one of the most widely used Web3 wallets, is reportedly preparing to launch its own native stablecoin—MetaMask USD (mmUSD)—in collaboration with global payments giant Stripe. The proposal, still in early stages, signals a major evolution in MetaMask’s long-term product strategy.

A Native Currency for Web3 Wallets

The mmUSD stablecoin would be issued by Stripe and built on the M^0 decentralized infrastructure for issuance and settlement. According to an internal governance proposal, mmUSD aims to become the default stable, liquid currency embedded directly into MetaMask’s ecosystem. That includes token swaps, peer-to-peer payments, and future financial services.

The move reflects the explosive growth of stablecoins in recent years. The total stablecoin market has surged to over $250 billion, making it one of the most critical building blocks in crypto. MetaMask’s entry into this sector positions it to offer users faster, smoother, and more cost-efficient transactions.

Building a Decentralized Financial Stack

This announcement comes just weeks after MetaMask launched its crypto-linked debit card in partnership with Mastercard and Baanx. That card allows users to spend crypto directly from their MetaMask wallets, skipping traditional banking rails. Baanx CCO Simon Jones called it a step toward a “non-custodial neobank”—one where users retain control over their funds while accessing everyday financial tools.

If mmUSD launches successfully, it would reinforce MetaMask’s goal to be more than a wallet—it’s becoming a full-fledged financial interface for the decentralized economy.

Strengthening the Dollar’s Global Reach?

Interestingly, mmUSD’s introduction also mirrors a broader trend: nearly 99% of all stablecoins are USD-pegged, a point recently highlighted by U.S. Federal Reserve Governor Christopher Waller. Far from challenging the dollar, stablecoins may actually entrench its global influence—now extending deep into Web3 platforms like MetaMask.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!