|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Pump.fun’s July revenue dropped 80% from its January peak to just $25M.

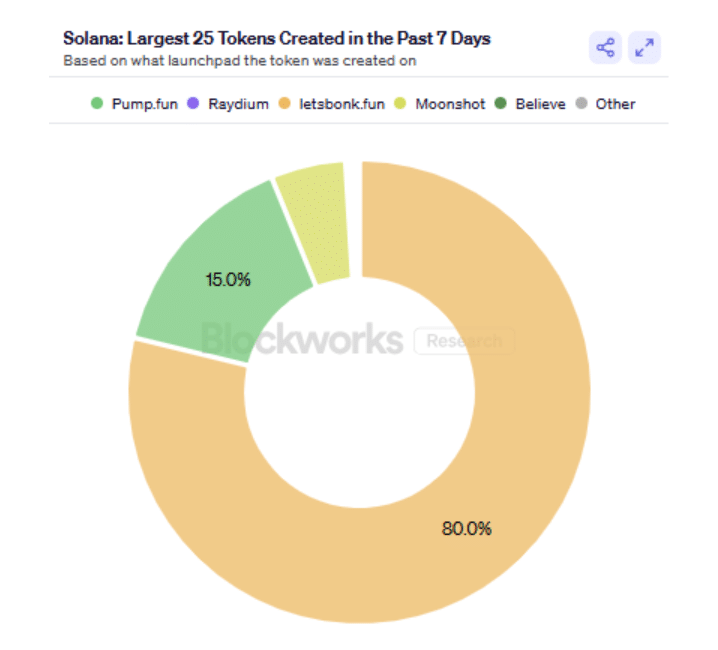

- LetsBonk now dominates Solana memecoin launches, taking 80% market share.

- Legal issues and fading hype may signal deeper trouble for Pump.fun.

Pump.fun, the popular memecoin launchpad built on Solana [SOL], has seen its revenue crash by over 80% since January 2024. After peaking at an estimated $130–137 million in monthly revenue earlier this year, the platform brought in just $24.96 million in July 2025 — its lowest monthly figure yet.

The drop hasn’t been sudden but consistent: February saw $90 million, March dipped to $37 million, and revenue stagnated around $40 million before July’s steep fall. On July 28, daily revenue dipped below $300k — a first since September — compared to $7 million+ daily highs at the start of the year.

User Activity and Token Value Both in Decline

Pump.fun’s slump extends beyond revenue. Trading volume shrank from a peak of $700 million to just $150 million by early August, signaling reduced user engagement. Even Pump [PUMP], the platform’s native token, is down 50% from its $0.006 launch price to $0.003, showing classic post-ICO depreciation.

These trends raise a pressing question: is this a short-term correction, or a sign of broader disinterest in memecoins?

Competitors Surge as Legal Troubles Mount

The broader memecoin market is also contracting. Market cap fell from $85 billion to $65 billion, while daily trading volumes dropped over 65%. But Pump.fun’s decline is particularly steep due to two major headwinds: legal issues and surging competition.

A class-action lawsuit filed in January 2025 accuses Pump.fun of facilitating pump-and-dump schemes and launching unregistered tokens — a legal cloud that may be deterring new users.

Also Read: Pump.fun Revenue Plunges 80% in 2025 as Solana Network Activity Stays Strong

Meanwhile, competitors like LetsBonk are capitalizing. LetsBonk’s dominance in Solana token launches has jumped from 12% to 80%, crushing Pump.fun’s share down to just 15% — a near one-to-one match with its revenue collapse.

Hype Fades, and Pump.fun Faces a Make-or-Break Moment

With declining revenue, user attrition, token underperformance, and legal pressure, Pump.fun’s future looks uncertain. Unless it adapts fast, it risks being left behind in a rapidly evolving memecoin ecosystem.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!