|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- A hawkish Powell could send Bitcoin below key support levels.

- A dovish message may spark a breakout rally above $63K.

- A neutral tone could leave Bitcoin consolidating in its current range.

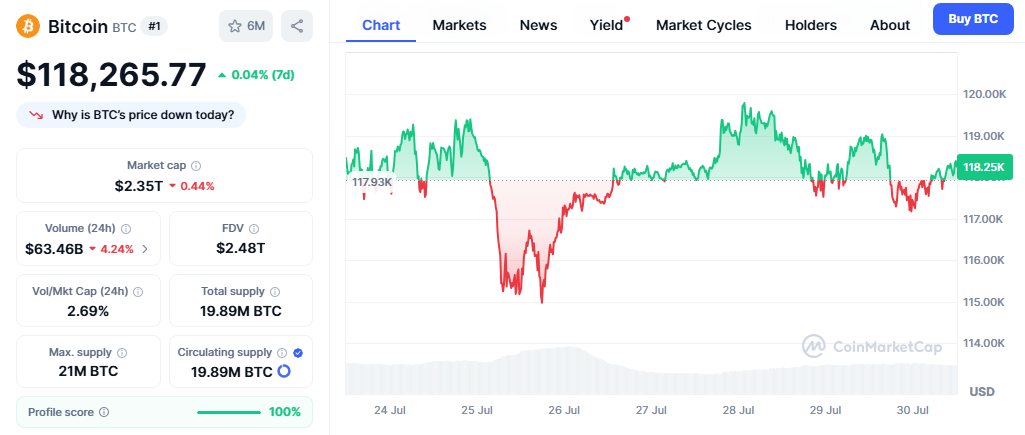

Federal Reserve Chair Jerome Powell is set to speak today, and crypto markets are bracing for volatility. Bitcoin (BTC), which has been trading within a tight range, could see a sharp move depending on Powell’s tone and any policy clues he offers. With inflation still elevated and interest rate cuts hanging in the balance, traders are closely eyeing three key scenarios that could shape Bitcoin’s next direction.

Scenario 1: Hawkish Tone Triggers Risk-Off Reaction

If Powell emphasizes inflation concerns and signals that rate cuts are not imminent, markets could react negatively. A hawkish Powell would strengthen the U.S. dollar and pressure risk assets, including Bitcoin. This would likely drive BTC below key support zones, potentially retesting the $58,000–$60,000 area. Crypto investors are particularly sensitive to interest rate outlooks, which affect liquidity and speculative appetite.

Scenario 2: Dovish Hints Spark Bitcoin Rally

Alternatively, if Powell acknowledges disinflation progress and opens the door to rate cuts later in the year, Bitcoin could surge. Such a scenario would be seen as a green light for risk-on assets, boosting BTC above its recent resistance levels near $63,000. Traders are hoping for language that suggests the Fed is willing to respond to weakening labor market data or softening inflation metrics.

Also Read: Strategy Acquires $2.46B in Bitcoin Following 2024’s Largest STRC IPO

Scenario 3: Neutral Stance Keeps Bitcoin Rangebound

A third possibility is that Powell delivers a balanced message—acknowledging economic risks without committing to a policy shift. In this case, Bitcoin may remain stuck in its current range, as uncertainty lingers. The lack of a clear signal could delay directional moves in both crypto and equities until more decisive data arrives.

Markets will be hanging on every word of Powell’s statement today, and Bitcoin’s short-term path may depend entirely on his tone. Whether hawkish, dovish, or neutral, the implications for crypto could be immediate.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!