|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- SUI surged 9% to $3.91, outperforming major altcoins amid Bitcoin’s record rally.

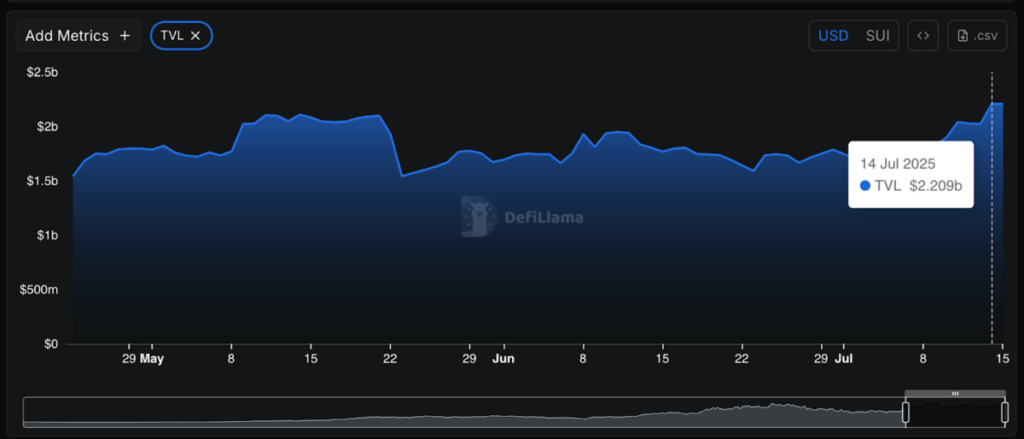

- TVL on Sui rose to $2.2 billion, supporting the price increase with real DeFi demand.

- A breakout above $4.30 could lead to $5, but RSI warns of short-term overheating.

SUI extended its winning streak on Monday, July 14, gaining another 9% to trade at $3.91, propelled by Bitcoin’s new all-time high and a surge in demand for decentralized finance (DeFi). The move brought SUI close to the psychological $4 mark, placing it ahead of Chainlink (LINK) and Cardano (ADA) to become the 13th largest cryptocurrency by market cap.

With on-chain fundamentals flashing bullish and technical indicators suggesting strong upward momentum, traders are now eyeing the next key resistance level around $4.30, with a potential breakout towards $5.

DeFi Inflows Fuel Fundamental Demand for SUI

The explosive growth in Total Value Locked (TVL) on the Sui blockchain highlights the underlying demand supporting its price rally. According to DefiLlama, SUI’s TVL jumped from $1.6 billion to $2.2 billion in just ten days—its highest level since the network’s May 2023 launch.

This 35% price increase over the past week coincides with the broader crypto market rally triggered by Bitcoin’s historic rise to $123,500. However, unlike many altcoins showing weaker gains, SUI’s move appears fundamentally driven by increased DeFi participation, not just speculative hype.

Technical Indicators: RSI Flashes Overbought, But Momentum Strong

Sunday’s 10.44% surge pushed SUI to reclaim the $3.45 resistance, marking its strongest daily close since mid-May. On Monday, the token cleared another hurdle by approaching the $4.03 Donchian Channel resistance, with the next major target at $4.29—a level last touched in April.

What an amazing run by $SUI!

— Momin (@mominsaqib) July 14, 2025

Clearly running harder than major alts, showcasing that the institutional demand is derriving the price!

Sui is the solana of this cycle, don't forget!

Leading chain rn building towards consumer crypto! https://t.co/HT5qPA8NaT pic.twitter.com/5Of11UPkIV

However, the Relative Strength Index (RSI) currently sits at 71.24, signaling overbought conditions and a possible short-term cooldown. Still, as long as SUI holds above $3.50, the bulls remain in control, eyeing higher highs if momentum persists.

Best Wallet Presale Heats Up as SUI Sparks Ecosystem Growth

SUI’s price action is also sparking interest in related infrastructure tokens. Best Wallet ($BEST)—a non-custodial DeFi wallet—has already raised $13.8 million in its ongoing presale. With SUI users looking for efficient staking and governance tools, $BEST has emerged as a potential beneficiary of the ecosystem’s growth.

Also Read: Coinbase Files Lawsuit Against Oregon Over Sudden Crypto Crackdown

Now priced at $0.025, with a scheduled increase on the horizon, the Best Wallet presale may attract SUI holders looking to rotate profits into promising utility tokens.

With DeFi metrics, price momentum, and trader sentiment aligning in SUI’s favor, a move beyond $4.30 could open the door to $5 in the short term. However, overbought technical indicators suggest traders should remain cautious of potential pullbacks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!