|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Active address growth is stagnant, suggesting low retail engagement in the current DOGE rally.

- MVRV Z-Score shows undervaluation, but without a rebound, it lacks bullish confirmation.

- Technical structure remains bearish, with RSI divergence and triangle resistance limiting upside potential.

While Dogecoin (DOGE) has shown signs of upward momentum recently, new on-chain data reveals troubling undercurrents. Despite early bullish cues like positive funding rates and whale inflows, the current lack of retail activity and stagnant network participation suggest that this rally might not be sustainable.

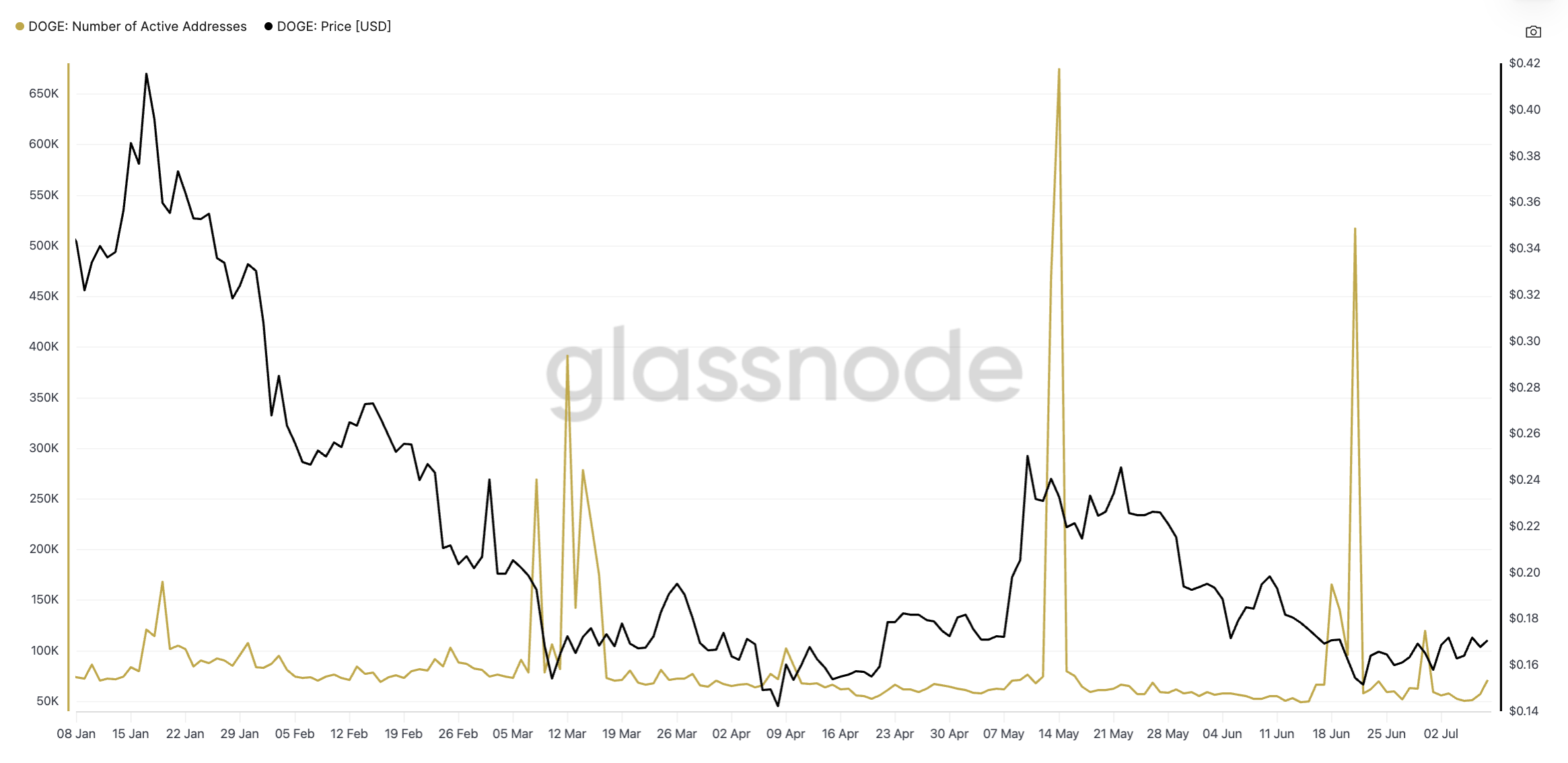

Active Addresses Signal Weak Retail Demand

Despite the price moving higher in late June, Dogecoin’s active address count remains flat. According to Glassnode, there’s been no meaningful increase in daily transacting wallets, a key indicator of organic demand.

Historically, strong DOGE price rallies have been accompanied—or even preceded—by spikes in active wallet activity. The current divergence between price and address count suggests a lack of conviction behind the move, pointing to a fragile rally largely unsupported by user engagement.

MVRV Z-Score Shows Undervaluation, But No Recovery Yet

Another metric painting a nuanced picture is the MVRV Z-Score, which remains below zero. This indicates that most holders are still underwater, and broadly, the asset is undervalued.

In past cycles, Dogecoin has rallied after entering negative MVRV territory—once buyers started accumulating again. But that buying pressure is still absent. The Z-Score has stayed flat, signaling a delay in bullish sentiment returning. Without a turnaround in this indicator, a sustainable move higher seems unlikely.

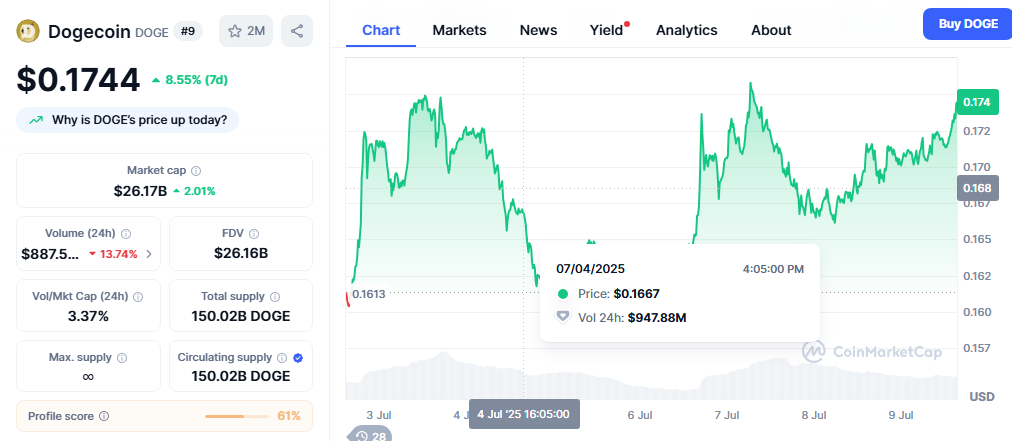

Bearish Technical Structure Remains Intact

Technically, DOGE continues to trade within a descending triangle pattern, with resistance at $0.17555 being repeatedly tested and support around $0.161 showing signs of strain.

More concerning is the bearish divergence in RSI. While DOGE price is making higher lows, RSI is trending downward—indicating waning momentum. Unless bulls can clear the $0.17555 resistance with strength and rising volume, the rally remains at risk of reversal.

Also Read: Dogecoin Price Forecast: Bulls Hold $0.171, Eyes on Breakout Above $0.175

A decisive drop below $0.1567 would confirm the bearish triangle pattern and could open the door to a deeper correction. On the flip side, a breakout above $0.17555 could trigger a move toward $0.1832—but only if backed by improved fundamentals.

Dogecoin’s price may be holding up, but the lack of support from on-chain metrics like active addresses and MVRV Z-Score raises concerns about its staying power. Unless renewed demand emerges, particularly from retail users, the current rally could fizzle out.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!