|

Getting your Trinity Audio player ready...

|

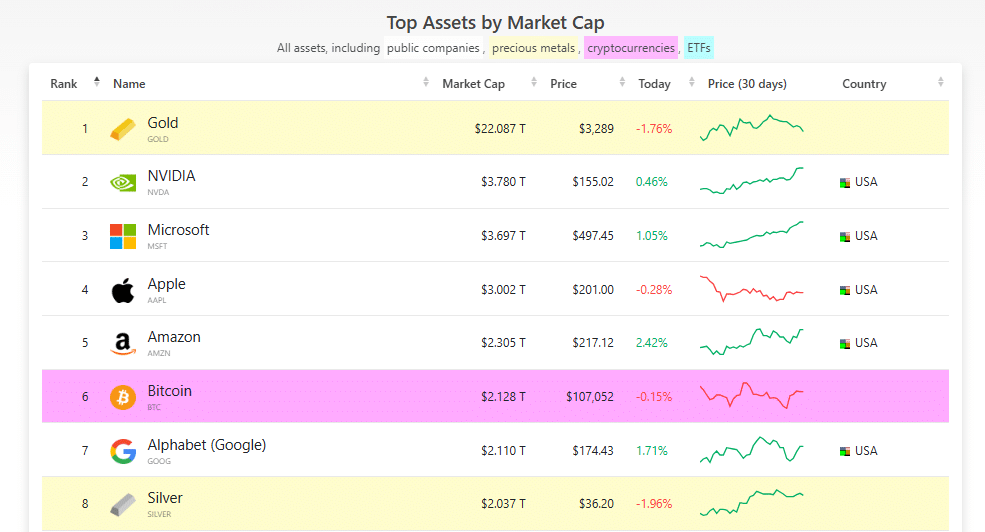

Bitcoin has reached a historic milestone, overtaking Alphabet—Google’s parent company—in total market capitalization. As of now, Bitcoin boasts a market cap of $2.128 trillion, compared to Alphabet’s $2.110 trillion. This places Bitcoin as the sixth most valuable asset globally, a clear sign of its growing influence in the financial world.

Trading at $107,052 per BTC, the leading cryptocurrency has officially outpaced not only top-tier tech giants but also precious metals like silver. The news has stirred excitement among crypto enthusiasts, especially as institutional adoption accelerates.

Bitcoin Joins the Elite Asset Class

Bitcoin now stands shoulder to shoulder with the world’s largest and most trusted assets. Only gold ($22.087T), NVIDIA ($3.780T), Microsoft ($3.697T), Apple ($3.002T), and Amazon ($2.305T) are ahead in value. Just behind Bitcoin sit silver ($2.037T), Meta Platforms ($1.825T), and Saudi Aramco ($1.567T).

This shift not only underscores Bitcoin’s staying power but also reinforces its role as a legitimate alternative investment. Bitcoin is proving its capability to rival—and in some cases surpass—traditional giants in both tech and commodities.

Institutional Investors Fuel Bitcoin Growth

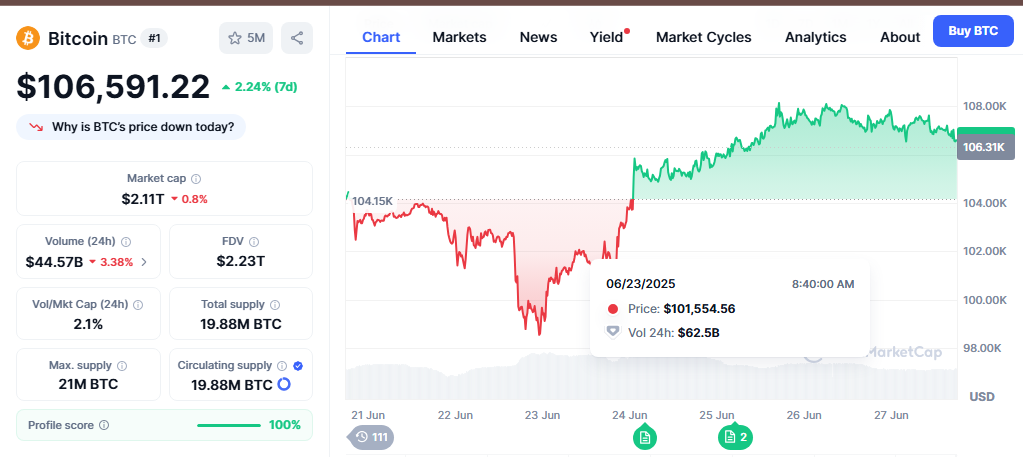

Much of Bitcoin’s recent surge is tied to increased institutional interest. Major asset managers, hedge funds, and corporate treasuries are now adding Bitcoin to their portfolios, viewing it as a hedge against inflation and a long-term growth opportunity.

Also Read: Coinbase Unveils CFTC-Compliant Bitcoin and Ethereum Futures, Launching July 21

This shift is also reflective of growing belief in decentralized finance (DeFi) and blockchain technologies. Bitcoin’s transparent, borderless, and finite nature appeals to investors seeking alternatives to centralized financial systems.

Road to $165K: Could Bitcoin Outpace the Entire Crypto Market?

Currently, Bitcoin’s market cap makes up nearly 65% of the entire crypto market, which totals $3.27 trillion. For Bitcoin alone to exceed the market cap of all other cryptocurrencies combined, its price would need to reach at least $165,990. While this remains speculative, the momentum behind Bitcoin’s institutional adoption and growing retail demand continues to fuel bullish sentiment.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!