|

Getting your Trinity Audio player ready...

|

3 Key Takeaways

- XRPH11, the world’s first spot XRP ETF, is down over 20% since launch, reflecting XRP’s ongoing price volatility and limited momentum in Brazil’s market.

- Analysts attribute the ETF’s weak performance to Brazil’s modest market size and XRP’s failure to sustain gains, with limited institutional participation dampening investor enthusiasm.

- Investor focus now turns to the U.S. SEC’s June 17 decision on XRP ETFs, which could significantly influence market sentiment and determine the next move for XRP’s price.

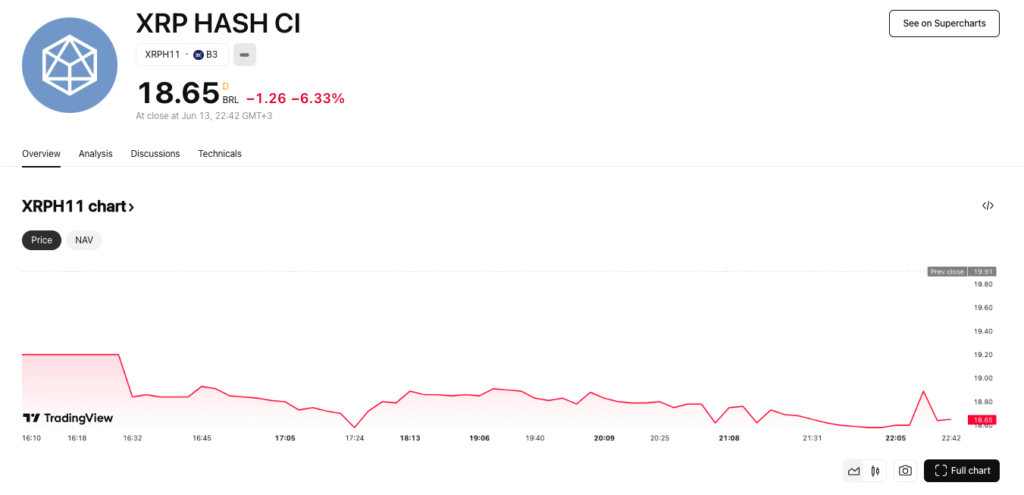

The world’s first spot XRP ETF, XRPH11, launched on Brazil’s B3 exchange by asset manager Hashdex, has fallen over 20% from its recent peak. Despite high expectations, the product’s early performance has mirrored XRP’s own volatility and market hesitation. The ETF closed at 18.65 BRL ($3.37) on June 13, marking a 6.33% daily drop and a 6.75% decline from its highest recorded value.

ETF Mirrors XRP’s Price Struggles

XRPH11’s lack of traction has raised concerns about investor appetite. Since its late-April launch, the ETF has failed to maintain a positive trajectory, following XRP’s repeated inability to hold above the $2 mark. While the ETF was expected to provide institutional exposure and price support, the continued price instability has so far undercut that potential.

In the past 30 days alone, the ETF has fallen 20.6%, underlining the fragile investor sentiment and XRP’s broader underperformance.

Also Read: SEC Delays Decisions on Ether Staking and XRP ETFs, Analysts Not Surprised

Limited Market Scope Weakens Impact

Analysts suggest that the ETF’s muted debut is partly due to the limited scale of Brazil’s capital markets. While XRPH11 is a first for XRP-based products, its liquidity and institutional impact are restrained by local market conditions. Without significant retail or institutional participation, the fund struggles to influence XRP’s global valuation.

In contrast, ETFs launched in larger markets like the U.S. or Europe tend to attract deeper pools of capital, often resulting in stronger price reactions.

Attention is now shifting to the U.S. Securities and Exchange Commission (SEC), which is reviewing two key XRP spot ETF applications — the Franklin XRP Fund and WisdomTree XRP Trust. A decision on Franklin’s application is expected by June 17, a pivotal moment that could reshape global investor sentiment around XRP.

The outcome may hinge on the Ripple vs. SEC lawsuit, which saw both parties file a motion on June 12 requesting a court ruling that could ease restrictions on XRP’s institutional sales. The resolution of this legal battle may directly impact the SEC’s stance on XRP ETFs and their future approval.

Cautious Optimism Amid Uncertainty

While XRPH11 marked a historic step for XRP’s integration into traditional finance, its early losses highlight the importance of regulatory clarity and global market scale. With XRP trading at $2.16, near-term sentiment will largely depend on whether the SEC opens the door for U.S.-listed XRP ETFs. A favorable outcome could propel XRP toward $2.50, but without it, the risk of slipping below $2 remains real.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses