|

Getting your Trinity Audio player ready...

|

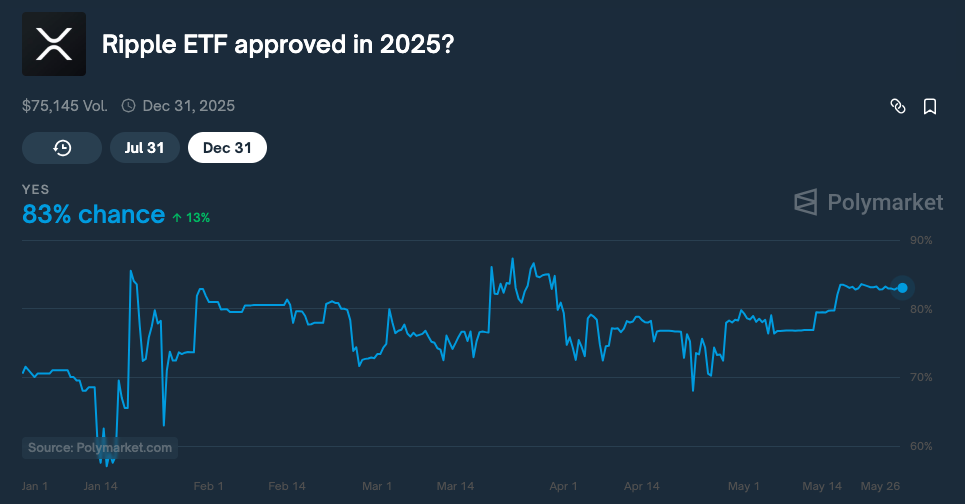

- XRP ETF Approval Odds Jump to 83% – Prediction platform Polymarket reports a 13% increase in XRP spot ETF approval odds, despite recent SEC delays.

- Institutional Demand Accelerates – XRP futures ETFs have launched on Nasdaq and CME, signaling growing institutional interest in XRP-based investment products.

- Ripple CEO Highlights ETF Importance – Brad Garlinghouse emphasizes that ETFs make crypto more accessible to institutions, comparing XRP’s potential to Bitcoin ETF success.

The odds of a U.S. Securities and Exchange Commission (SEC) approval for a spot XRP exchange-traded fund (ETF) have jumped to 83%, up from 70% earlier this week, according to data from prediction market platform Polymarket. Despite recent delays from the SEC, market sentiment suggests that approval could be on the horizon, driven by rising institutional demand and the launch of XRP futures ETFs on major exchanges.

Asset managers such as Bitwise, CoinShares, Franklin Templeton, and Grayscale are all awaiting the SEC’s ruling on their XRP ETF applications. The agency’s latest round of delays mirrors previous extensions seen in May, which analysts consider routine as part of the regulatory process. October is now seen as a likely timeframe for a final decision.

This surge in approval odds comes alongside growing institutional interest in XRP, as evidenced by recent futures product launches. Last week, Volatility Shares debuted the first-ever XRP futures ETF on the Nasdaq under the ticker XRPI. This follows the May 19 rollout of XRP futures trading on CME Group’s platform. These developments provide regulated exposure to XRP, a feature long sought by institutional investors.

Tectrium has further expanded the XRP product suite with its 2x Long Daily XRP ETF—a leveraged trading instrument for those looking to gain amplified exposure to the asset’s price movements. Together, these products underscore the increasing appetite for XRP in traditional financial markets.

Also Read: Is XRP Set to Drop 20%? Analyst Eyes $1.80 as Ideal Entry Amid BTC Pair Slide

Ripple CEO Brad Garlinghouse recently highlighted the importance of crypto ETFs in expanding institutional access. Speaking on the company’s Crypto in One Minute podcast, he noted, “Wall Street and other institutional investors have struggled to directly access crypto markets. ETFs offer them a regulated path.” Garlinghouse pointed to the rapid rise of Bitcoin ETFs, which became the fastest in history to hit $1 billion and then $10 billion in assets under management, as a model for future XRP-related offerings.

While the SEC has yet to make its final decision, the momentum behind XRP ETF products suggests a shift in institutional sentiment. If approved, an XRP spot ETF could mark a pivotal moment in the asset’s evolution into mainstream finance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!