|

Getting your Trinity Audio player ready...

|

Bitcoin has once again breached the $90,000 mark, reaching levels unseen since March, as investors increasingly turn to cryptocurrencies as a safe haven Amid a weakening U.S. dollar. The leading digital asset has experienced a robust two-day rally, buoyed by prevailing macroeconomic uncertainties and growing anticipation of potential interest rate cuts by the Federal Reserve.

The U.S. Dollar Index (DXY) has notably declined to its lowest point in three years, consequently enhancing the attractiveness of Bitcoin as a hedge against the erosion of fiat currency value. This trend mirrors the recent upward trajectory of gold, another asset frequently perceived as a reliable store of value during times of economic instability.

Altcoins Ride the Bullish Wave

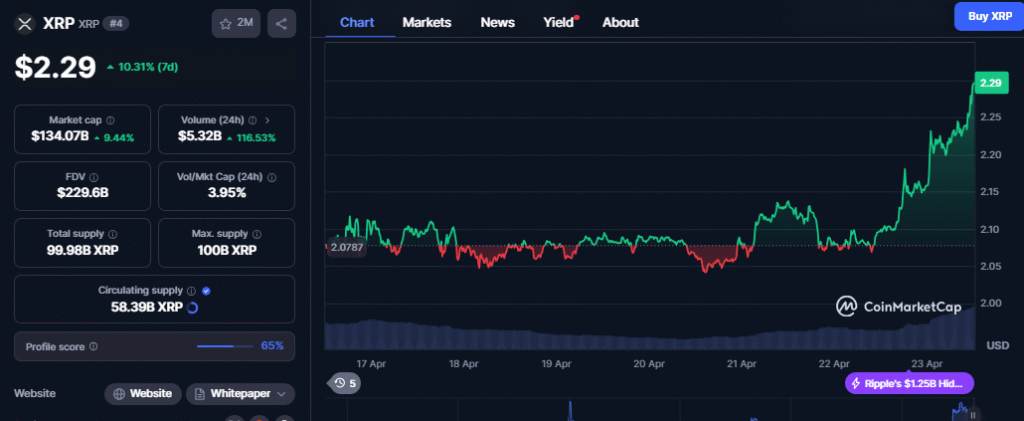

The positive sentiment permeating the cryptocurrency market extends beyond Bitcoin. Ethereum (ETH) has witnessed a significant surge, climbing by 13%. Similarly, XRP and Solana (SOL) have both registered substantial gains of 7%. Notably, Dogecoin (DOGE) has outperformed its peers with an impressive 14% increase, fueled by renewed interest from retail investors and a general inclination towards riskier assets.

XRP Eyes Potential Breakout After Holding Firm

Within the broader altcoin rally, XRP has demonstrated resilience, maintaining its position within a defined trading range. Currently trading above a crucial support zone between $1.21 and $1.55, analysts point out the structural integrity of this level despite minor price fluctuations. There is speculation among Elliott Wave analysts that a final upward wave could still materialize.

For XRP to confirm a bullish breakout, it would need to decisively surpass the recent high of $2.25 recorded on April 13th. Successfully breaching this resistance level could pave the way for a potential ascent towards $3.30, with further targets in the $5.00 to $5.65 range contingent on overall market momentum. At the time of reporting, XRP has gained over 7% and is trading at the $2.25 mark.

However, analysts caution that the path to higher prices is not guaranteed. A drop below $1.82 could indicate a shift towards a more significant downward correction. While current short-term analysis does not suggest a clear five-wave decline that would typically precede a deep correction, the market has yet to provide definitive confirmation of a strong bullish reversal.

The U.S. Dollar Index (DXY) has notably declined to its lowest point in three years, consequently enhancing the attractiveness of Bitcoin as a hedge against the erosion of fiat currency value. This trend mirrors the recent upward trajectory of gold, another asset frequently perceived as a reliable store of value during times of economic instability.

Altcoins Ride the Bullish Wave

The positive sentiment permeating the cryptocurrency market extends beyond Bitcoin. Ethereum (ETH) has witnessed a significant surge, climbing by 13%. Similarly, XRP and Solana (SOL) have both registered substantial gains of 7%. Notably, Dogecoin (DOGE) has outperformed its peers with an impressive 14% increase, fueled by renewed interest from retail investors and a general inclination towards riskier assets.

XRP Eyes Potential Breakout After Holding Firm

Within the broader altcoin rally, XRP has demonstrated resilience, maintaining its position within a defined trading range. Currently trading above a crucial support zone between $1.21 and $1.55, analysts point out the structural integrity of this level despite minor price fluctuations. There is speculation among Elliott Wave analysts that a final upward wave could still materialize.

Also Read: XRP Price Jumps 7.8% as SEC Optimism Grows — Analysts Predict $25 Target by 2026

For XRP to confirm a bullish breakout, it would need to decisively surpass the recent high of $2.25 recorded on April 13th. Successfully breaching this resistance level could pave the way for a potential ascent towards $3.30, with further targets in the $5.00 to $5.65 range contingent on overall market momentum. At the time of reporting, XRP has gained over 7% and is trading at the $2.25 mark.

However, analysts caution that the path to higher prices is not guaranteed. A drop below $1.82 could indicate a shift towards a more significant downward correction. While current short-term analysis does not suggest a clear five-wave decline that would typically precede a deep correction, the market has yet to provide definitive confirmation of a strong bullish reversal.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.

![Onyxcoin [XCN]](https://chainaffairs.com/wp-content/uploads/2025/01/onyxcoin-xcn-coin-stacks-cryptocurrency-3d-render-illustration-free-png.webp)