|

Getting your Trinity Audio player ready...

|

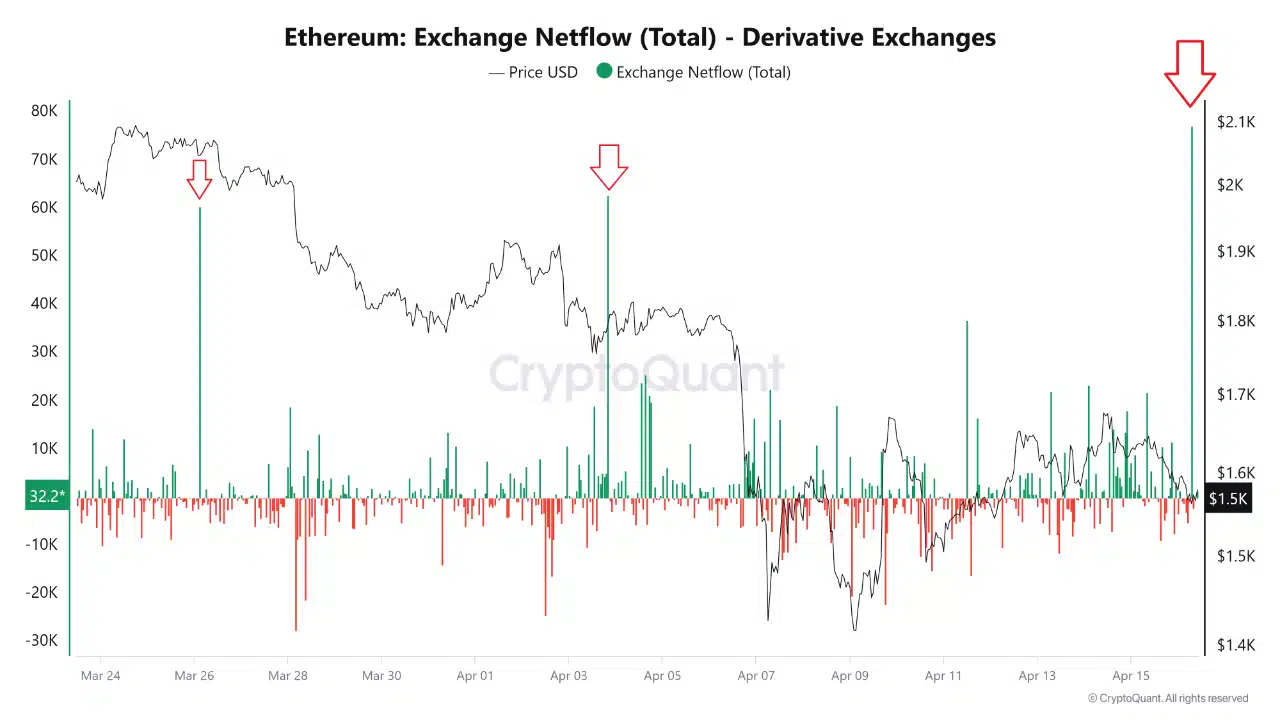

Ethereum (ETH) witnessed a major shift as over 77,000 ETH flowed into derivative exchanges in just one day. This marked Ethereum’s largest single-day net inflow of the year, dwarfing the previous spikes of 65K ETH on March 26th and 60K ETH on April 3rd. The influx of ETH into derivative platforms, typically used for leverage, hedging, or speculation, is raising eyebrows across the crypto community.

At the time of this inflow, Ethereum’s price hovered around $1,500 — its lowest point since late 2023. This price action suggests that the movement was not driven by market euphoria, but likely by caution, as investors brace for potential downside. Given the uncertainty in global markets, this surge in derivative inflows points to institutional players possibly repositioning for further volatility.

A Familiar Bearish Pattern

This latest Ethereum inflow follows a troubling pattern seen earlier this year. On both March 26th and April 3rd, large ETH movements into derivative exchanges preceded notable price declines. In both instances, Ethereum’s price dropped significantly as the inflows were largely used to open short positions or hedges, indicating a bearish sentiment.

The current inflow mirrors these past events, which is why it’s important to consider the broader market context. The recent geopolitical tensions, including China’s retaliatory tariffs, have added to global risk-off sentiment, suggesting that the current ETH inflow could signal further downside pressure in the short term.

Also Read: Buy the Blood? Ethereum Dominance Falls to 7.3%, Sparking Bullish Analyst Calls

Ethereum’s Price Outlook: A Mixed Picture

Despite the massive inflow, Ethereum briefly bounced off its recent lows on April 17th, reclaiming the $1,600 level. The MACD indicator shows a faint bullish crossover, hinting at weaker selling pressure, but momentum remains lackluster. The RSI, hovering around 40, indicates a continued bearish dominance, with limited buyer interest.

In this current technical setup, Ethereum appears poised for a short-term relief bounce, but without significant volume or macroeconomic improvements, the price could revisit the $1,500 support zone. As traders remain defensive, much will depend on broader market conditions and geopolitical developments in the coming weeks.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.