|

Getting your Trinity Audio player ready...

|

Solana [SOL] roared back to life this week, notching a 20% rally to reclaim the $130 mark—its highest level in weeks. The surge marked a sharp reversal from Q1’s bearish trend, placing SOL ahead of many high-cap rivals, including Ethereum [ETH], in both price momentum and on-chain performance.

A key highlight of this rally was the SOL/ETH ratio breaking past a resistance level last tested in early February, signaling a decisive outperformance. Fueling this strength, Solana’s DeFi revenue has now eclipsed Ethereum’s all-time total, with lifetime fees exceeding $2.56 billion—surpassing ETH’s $2.27 billion.

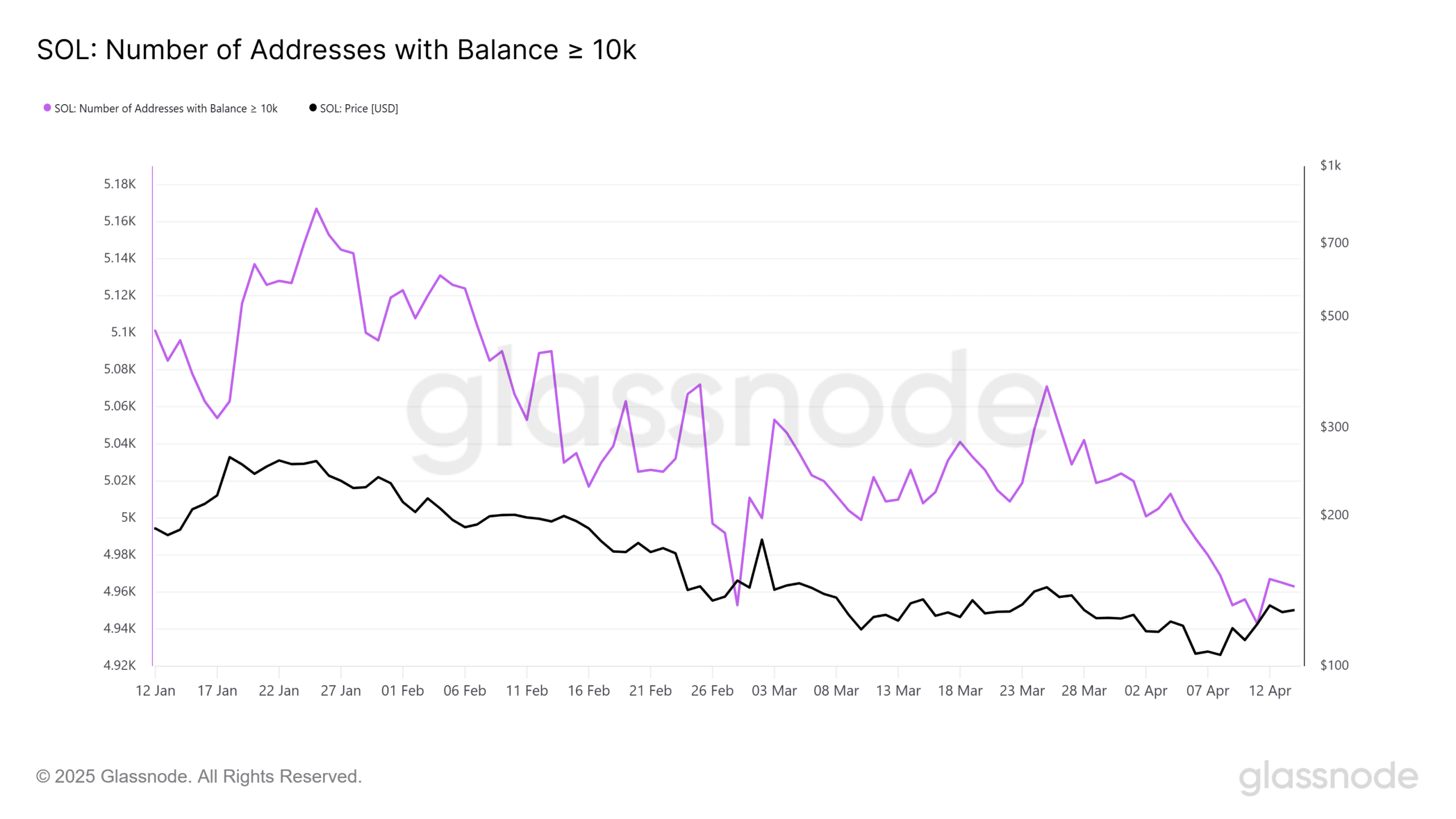

This momentum comes after a rocky Q1 where SOL fell over 30%, shedding its $100 billion market cap and slipping to the sixth spot among crypto assets. A wave of token unstaking and heavy whale distribution contributed to a bearish overhang, with liquidity metrics flashing red across the board.

However, the tide appears to be turning. Solana’s Total Value Locked (TVL) has rebounded sharply, hitting an April peak of $8.54 billion. More significantly, HODLer Net Position Change has flipped positive, signaling renewed long-term confidence. The network has now recorded its longest accumulation streak in over six months—often a precursor to major rallies in past cycles.

Yet, not all metrics are flashing green. New address creation has dropped to a six-month low, suggesting retail interest remains muted. This divergence between deep-pocket accumulation and grassroots dormancy implies a phase of structural reaccumulation is underway.

For now, SOL may remain range-bound as it consolidates gains and tests investor patience. Retail participation will be crucial to sustain momentum. Until then, long-term holders may have to shoulder the load as Solana battles to reclaim its former glory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Canada Launches First Solana ETFs with Staking Capabilities

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.