|

Getting your Trinity Audio player ready...

|

The memecoin sector posted modest gains over the past 24 hours, with CoinMarketCap data revealing a nearly 2% rise in total Market capitalization and an 8.5% uptick in trading volume. This came in the wake of Bitcoin’s [BTC] sharp recovery above the $82.5K resistance on April 11, breathing temporary life into the broader altcoin market.

Among the standout performers was Dogwifhat [WIF], the Solana-based meme coin, which climbed 9% in the last day. WIF mirrored SOL’s recent 18% rally, though technical indicators suggest that the bullish momentum may be short-lived.

Despite the price bump, WIF continues to trade within a bearish structure on the daily chart. A closer look reveals a key resistance zone between $0.5 and $0.55—a region marked by a bearish order block and the 50% Fibonacci retracement level from its six-week downtrend. The upper Bollinger Band also aligns with this range, further strengthening the resistance.

Volume indicators paint a cautious picture. The Accumulation/Distribution (A/D) line saw a minor bounce but failed to surpass its March highs, hinting at weak buying pressure. Meanwhile, the Chaikin Money Flow (CMF) has stayed below -0.05 for much of the past three months, signaling persistent outflows and dominant selling pressure.

Also Read: Dogwifhat (WIF) Faces Bearish Pressure: Can It Rebound Amid Market Uncertainty?

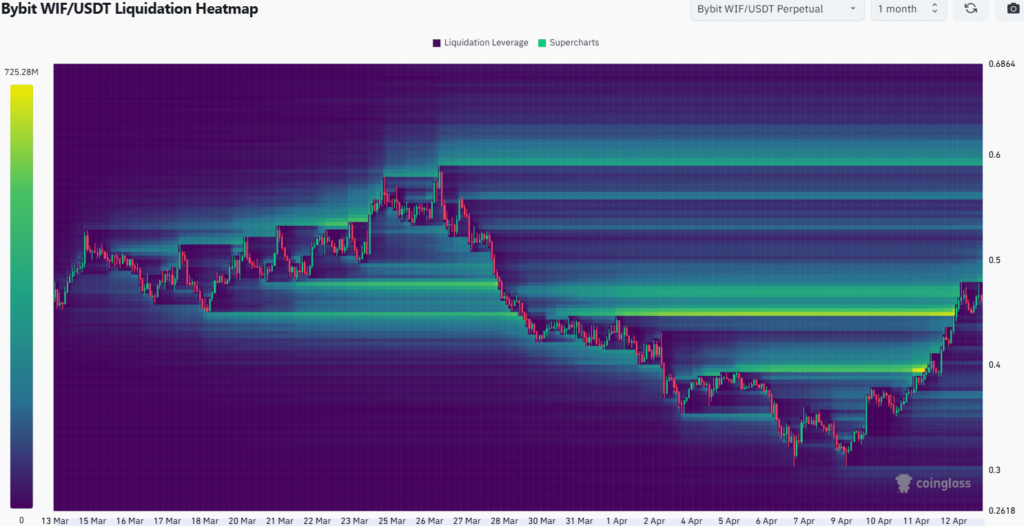

According to liquidation data from Coinglass, short positions were wiped out in the $0.45-$0.47 range, allowing bulls to stabilize WIF above $0.42. However, liquidity has since started to cluster around $0.48-$0.5, making it a likely near-term target. Further upside appears capped at $0.6 due to heavy resistance.

Unless Bitcoin continues its upward trajectory, WIF’s rebound could stall. A consolidation phase around $0.46, followed by a move toward $0.5 and a subsequent reversal, is currently the most probable scenario. Traders eyeing short positions should closely monitor the $0.5-$0.55 zone and broader BTC trends for confirmation.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.