|

Getting your Trinity Audio player ready...

|

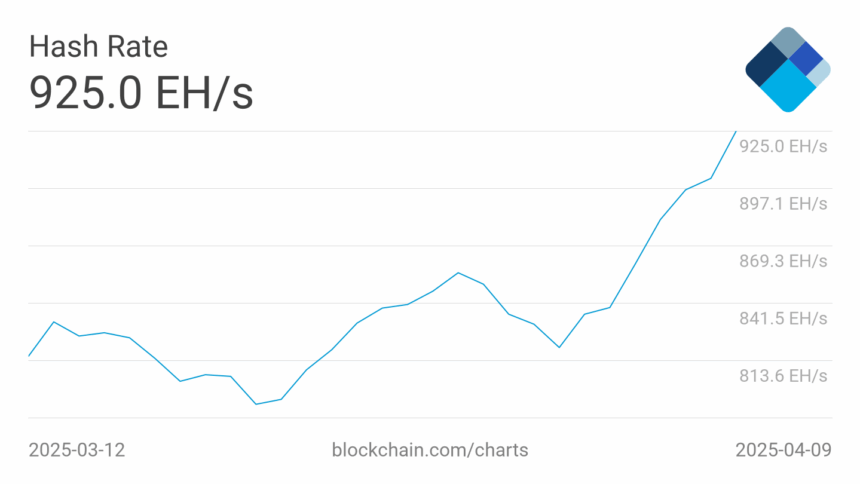

As Bitcoin continues to dominate headlines due to dramatic price swings spurred by the ongoing global tariff war, its network fundamentals remain robust. Most notably, Bitcoin’s hashrate—an essential metric of network security and mining strength—has reached a new all-time high of 924.98 exahashes per second (EH/s), edging closer to the historic milestone of 1000 EH/s.

According to blockchain explorer data, this surge in computational power marks a continuation of the uptrend observed since April 2, reflecting growing miner confidence and investment in Bitcoin infrastructure.

The record-setting hashrate coincides with a broader rise in network activity. Daily transaction volumes have climbed by 12%, while the number of newly created wallet addresses has surged 15% over the past week. These indicators signal heightened user engagement and increased adoption of Bitcoin both as a store of value and a medium of exchange, despite—or perhaps because of—the financial instability triggered by escalating global trade tensions.

Bitcoin’s hashrate represents the cumulative power miners use to validate transactions and secure the blockchain. A higher hashrate generally means a more secure network, as it becomes increasingly difficult and resource-intensive to manipulate transaction data or execute a 51% attack.

This robust growth in on-chain activity is fueling speculation about whether Bitcoin’s price will soon reflect these bullish fundamentals. Historically, rising hashrate often precedes price rallies, suggesting that miners anticipate future profitability.

Yet, with Bitcoin’s price currently caught in a volatile cycle amid economic uncertainty, analysts remain cautiously optimistic. While some believe the increasing hashrate is a precursor to another bull run, others warn that macroeconomic pressures from the tariff war may continue to overshadow technical signals.

Still, the resilience of Bitcoin’s network in turbulent times reaffirms its role as a decentralized, censorship-resistant asset. As global markets reel from protectionist policies, Bitcoin’s surging hashrate stands as a silent testament to the growing trust in its long-term value proposition.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Bitcoin ETF Outflows Hit $127 Million as U.S. Stocks Surge Post Trump’s Tariff Announcement

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!