|

Getting your Trinity Audio player ready...

|

The meme coin Bonk (BONK) is grappling with a bearish stretch, with recent on-chain data painting a bleak picture for holders. Although BONK bounced 16.5% off its recent lows—buoyed by Bitcoin’s [BTC] rebound from $74.5K to $80K—the outlook remains grim, according to recent data analyzed by AMBCrypto.

One of the few bright spots was BONK’s successful defense of the $0.0000096 support level, last tested in early March. This level has held firm during the latest market correction, signaling potential accumulation. However, further upside may be capped unless bullish momentum returns to the broader altcoin market.

On-chain metrics point to deep losses and waning interest

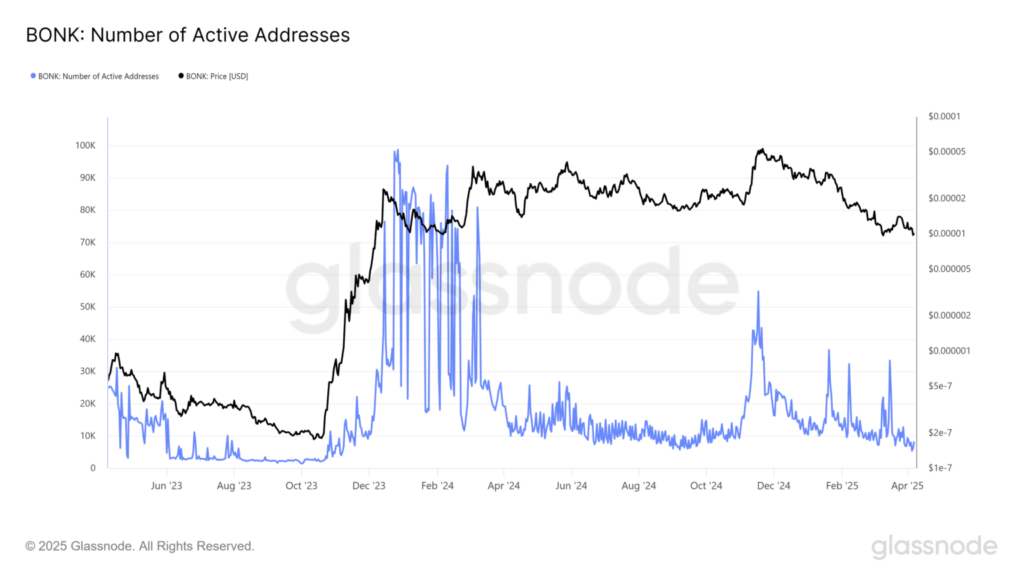

Glassnode data reveals that active addresses for BONK have been in decline since peaking at 54,914 on November 17, 2023. New addresses have followed a similar downward trajectory, highlighting reduced demand and user engagement. Without a turnaround in these metrics, BONK’s price recovery may remain elusive.

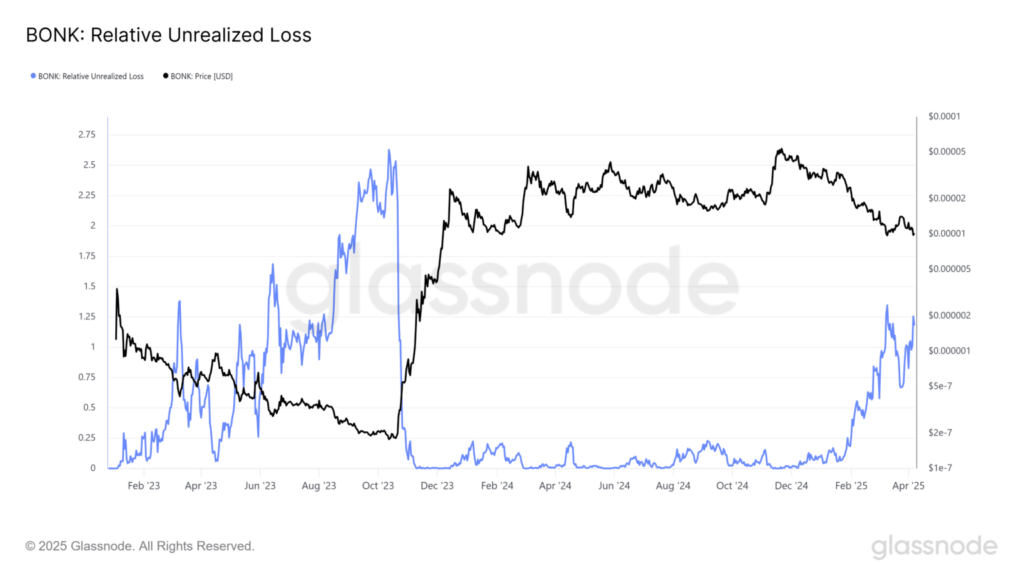

The pain for holders is further emphasized by the Relative Unrealized Loss (RUL), which shows losses at levels not seen since March 2023. While this might suggest BONK is in an undervalued phase, it does not ensure a trend reversal is imminent.

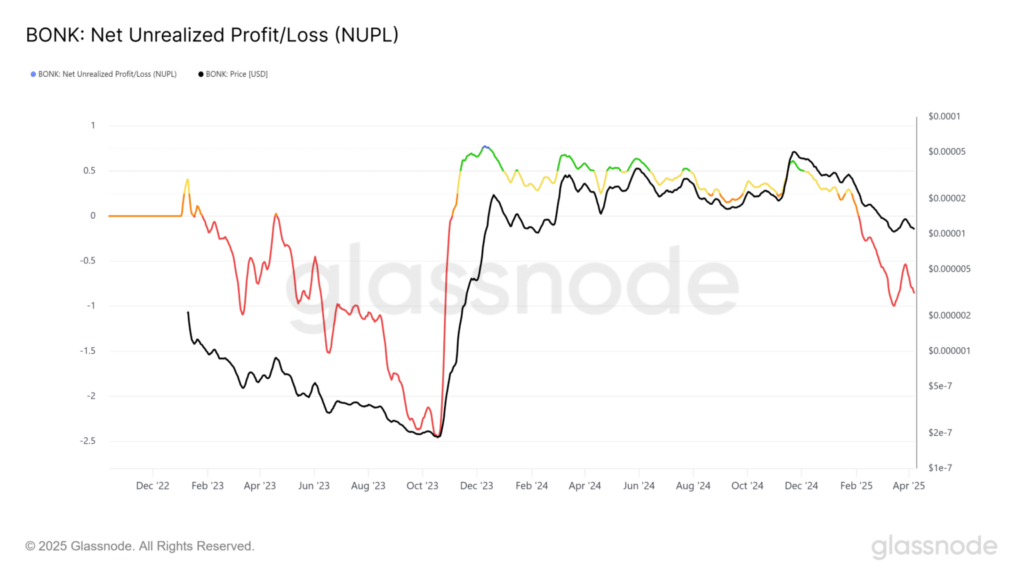

The Net Unrealized Profit/Loss (NUPL) indicator has also plunged into negative territory, reflecting a market deep in capitulation. Though less severe than October 2023, the continued decline underlines persistent bearish sentiment.

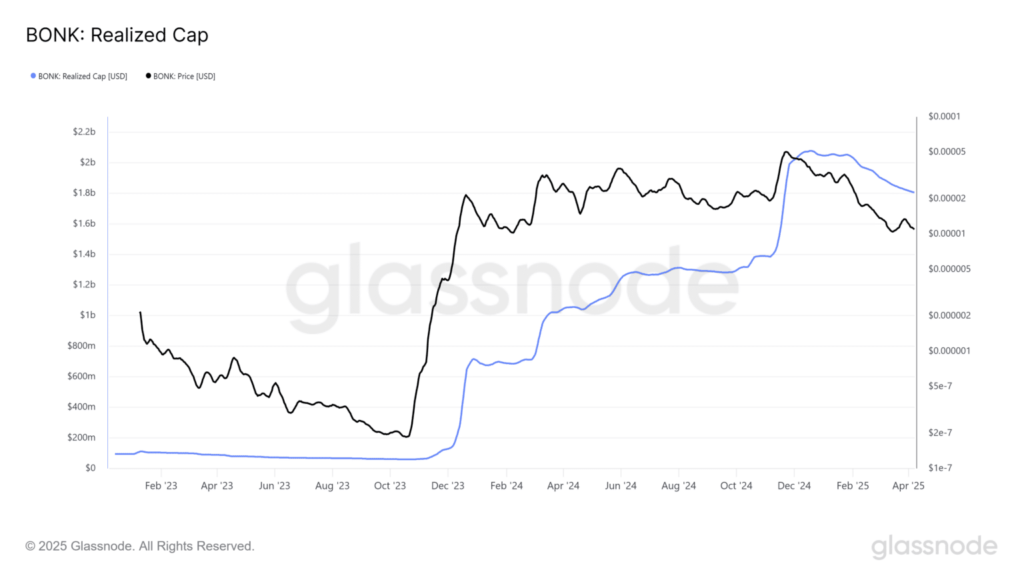

Adding to concerns, BONK’s realized cap stands at $1.8 billion, significantly higher than its current market cap of $800 million. This discrepancy indicates that many investors are holding at a loss, and the downtrend in realized cap suggests ongoing sell-offs below cost basis.

Also Read: Bonk Inu Acquires Exchange Art: Can This Move Trigger a BONK Price Surge?

Outlook: Watch for trend reversals

While BONK has shown resilience at key support, the recovery remains fragile. Investors should monitor upticks in active and new addresses, alongside realized cap stabilization. A sustained shift in these indicators—along with Bitcoin maintaining its bullish tone—could offer the first signs of a long-term recovery. Until then, the bears remain firmly in control.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.