|

Getting your Trinity Audio player ready...

|

Solana (SOL) has surged past a key technical pattern, igniting bullish sentiment among traders. The breakout from a falling wedge formation has fueled speculation about a potential rally, with some analysts predicting a price target of $230. However, market risks remain, making SOL’s next move critical for investors.

SOL’s Breakout Confirms Weakening Selling Pressure

A falling wedge pattern occurs when an asset’s price trends downward while forming progressively lower highs and lower lows within a narrowing range. This pattern is often a precursor to a bullish breakout, as the declining range suggests diminishing selling pressure.

SOL broke out of this pattern on March 19 and has since gained 10%, signaling growing investor confidence. Historically, such breakouts indicate that sellers are losing control, allowing buyers to push prices higher. This is reinforced by increasing trading volume, which validates the strength of the breakout.

Rising Open Interest Signals Strong Market Conviction

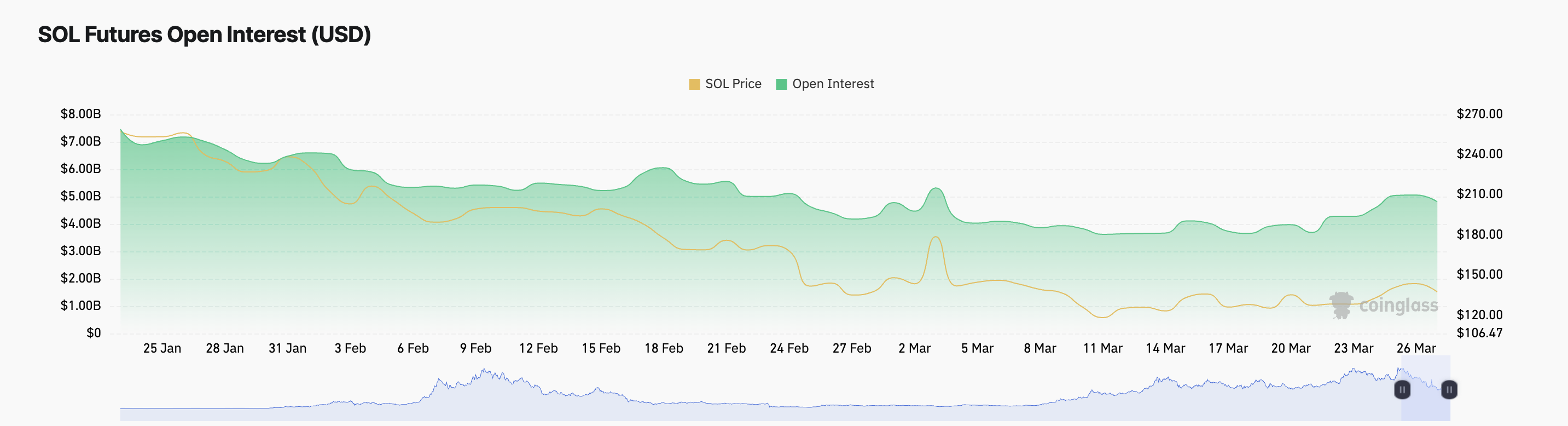

Open interest—the total number of unsettled derivative contracts—has surged alongside SOL’s price. Currently standing at $4.81 billion, it has jumped 22% since the breakout. A rise in open interest during a price rally indicates strong market participation and trader confidence in the uptrend.

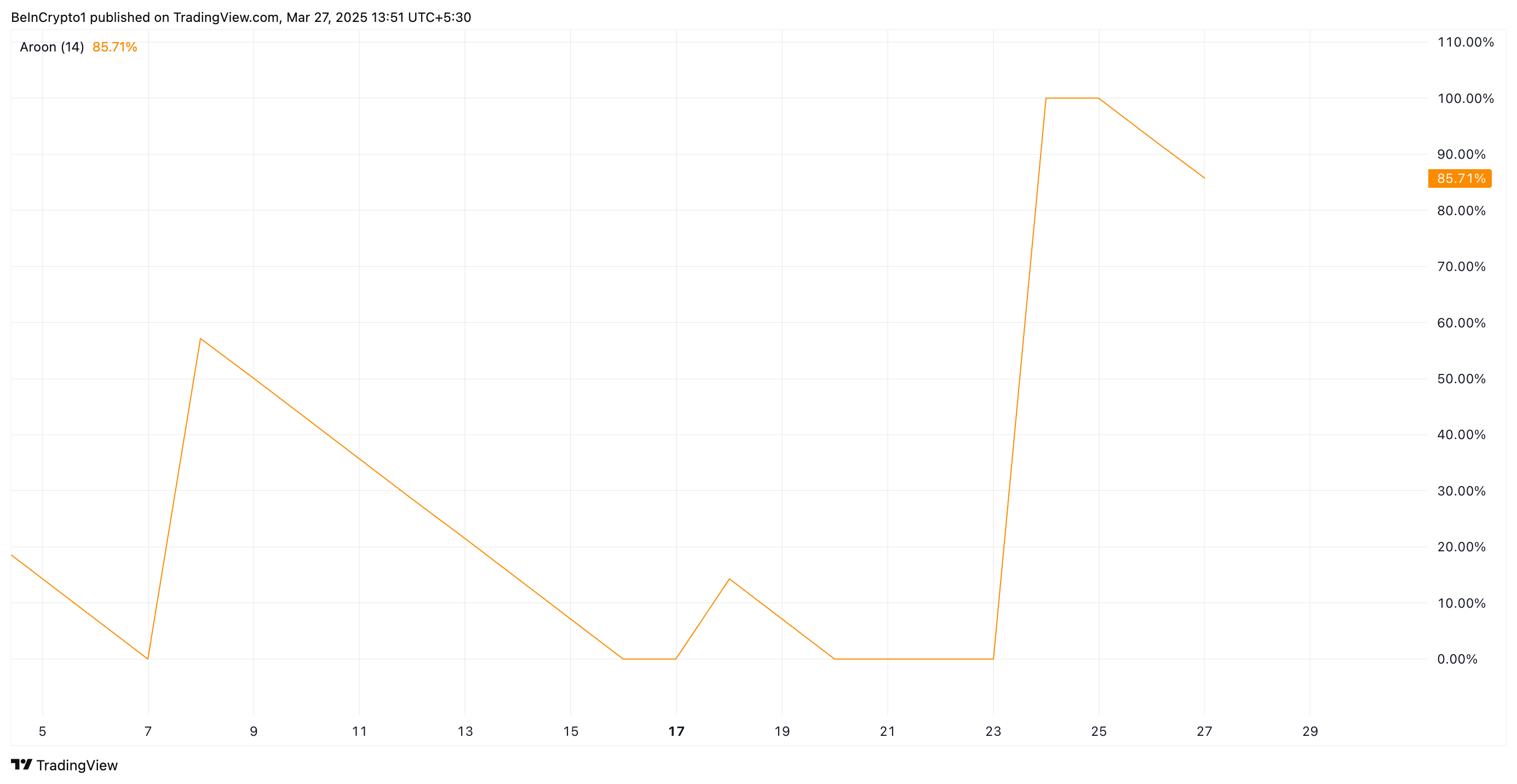

Additionally, SOL’s Aroon Up Line, a key technical indicator, stands at 85.71%, suggesting a robust bullish trend. The Aroon Indicator measures the time since the highest and lowest price points occurred, and a high reading signifies strong upward momentum.

SOL’s Price Target: $230 or a Potential Pullback?

If SOL follows historical patterns associated with falling wedge breakouts, its price could rise by 67%, reaching a potential target of $230.22. This projection is based on the maximum height of the wedge added to the breakout level.

However, risks remain. A resurgence of selling pressure could invalidate this bullish outlook, pushing SOL’s price down to $112. Traders should watch for key support and resistance levels to gauge the sustainability of the current uptrend.

Also Read: TRON (TRX) Outpaces Ethereum & Solana in Fees: Is a Breakout to $0.40 Imminent?

SOL’s recent breakout and rising market indicators suggest strong bullish momentum. However, investors should remain cautious, as market volatility could still influence price movements.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.