PancakeSwap’s native token, CAKE, is witnessing a strong rally as it records its highest daily spot inflow in a month. The token’s surge is fueled by a spike in trading activity on the decentralized exchange (DEX), signaling growing investor interest and bullish market sentiment.

CAKE Surges Amid Strong Demand

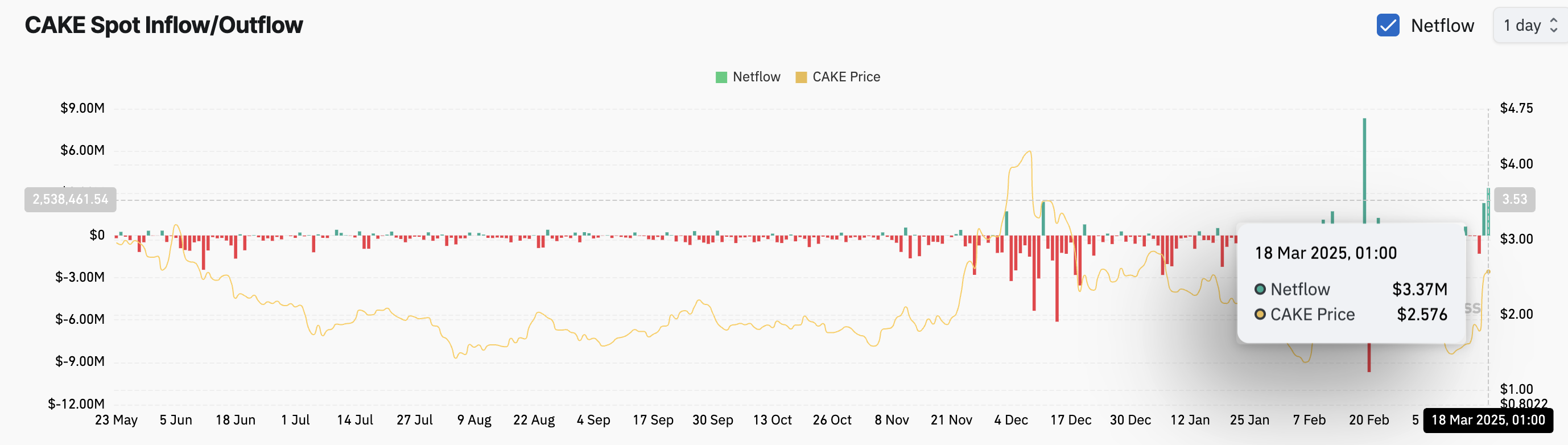

CAKE has seen a sharp uptick in trading volume, surpassing competitors like Ethereum’s Uniswap and Solana’s Raydium. This surge has driven increased buying pressure, reflected in CAKE’s spot inflows, which hit $3.37 million in a single day. Spot inflows measure the number of tokens purchased and moved into spot markets, indicating rising demand. The growing accumulation suggests that investors are positioning for further gains.

Market Sentiment and Funding Rate Signal Strength

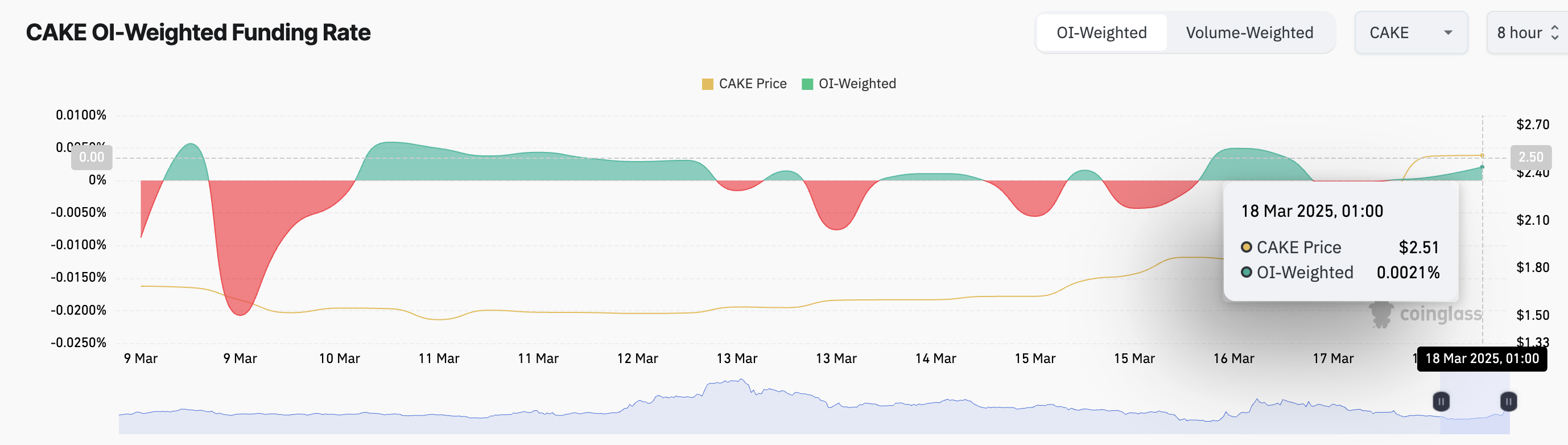

The bullish sentiment surrounding CAKE is further supported by its funding rate, currently at 0.0021%. A positive funding rate means long traders are paying short traders, indicating that the majority of traders are betting on continued price appreciation. If this trend persists, CAKE could maintain its upward trajectory, attracting more liquidity into PancakeSwap’s ecosystem.

Technical Indicators Support Bullish Momentum

CAKE’s rally has propelled it above its 20-day exponential moving average (EMA), now acting as dynamic support at $1.93. The 20-day EMA is a key indicator of short-term trends, and when an asset trades above this level, it suggests bullish momentum. If CAKE maintains this position, it could extend its gains toward the $2.90 resistance level.

However, traders should remain cautious of potential profit-taking. If buying pressure weakens and CAKE fails to sustain its rally, it could retrace to $2.41. A breakdown below this level might push the token further down to $2.01.

Also Read: BetFury x PancakeSwap Partnership: $20K BFG Syrup Pool, $50K Trading Competition & More

With strong inflows, bullish technical signals, and increasing demand, CAKE appears poised for further upside. Investors will be watching closely to see if the token can sustain its momentum or if profit-taking will slow its ascent. If the rally continues, CAKE could reinforce its position as a leading asset in the DeFi space, drawing more traders to PancakeSwap.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.