|

Getting your Trinity Audio player ready...

|

Chainlink (LINK) saw a sharp 11% decline in the past 24 hours, bringing its price down to around $12. This significant drop has put traders on high alert as key technical levels come into play, signaling potential reversals or further losses.

Market Structure and Key Levels

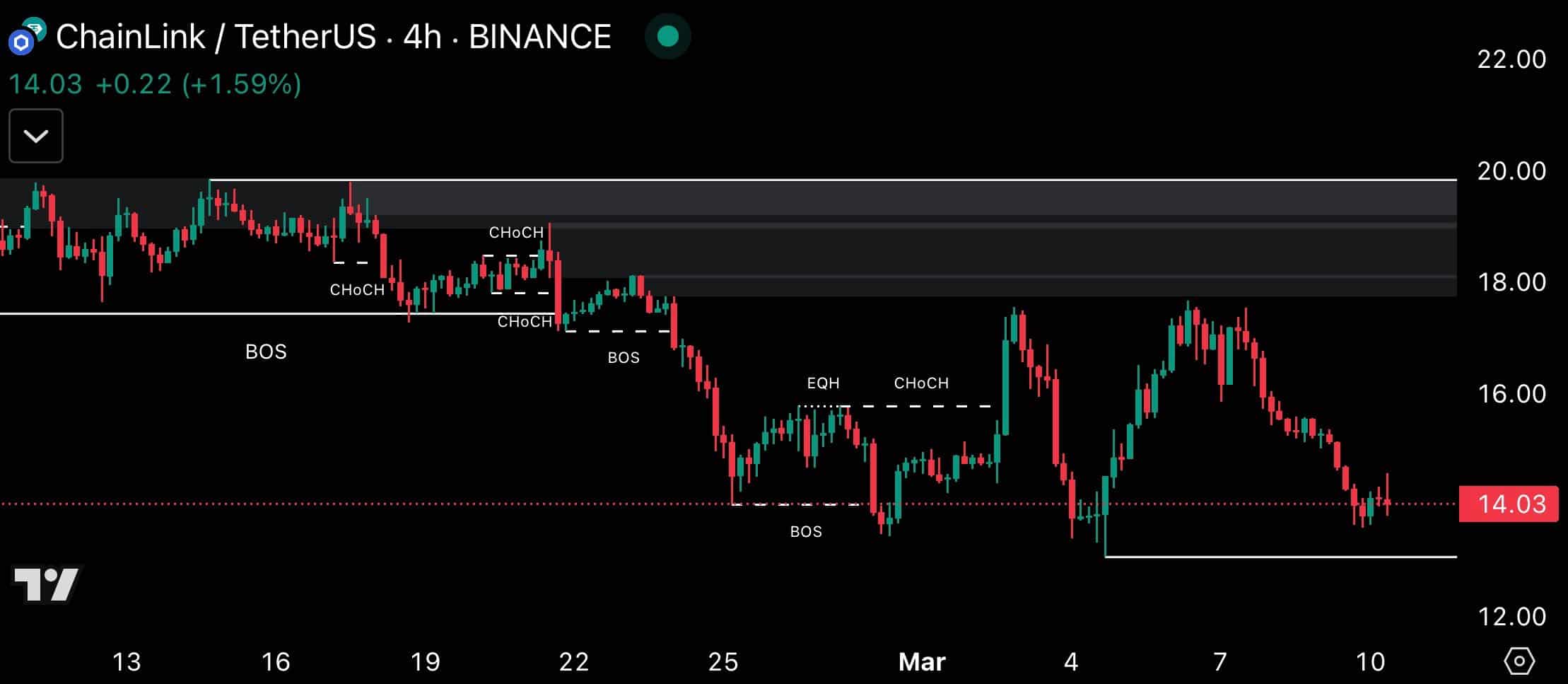

Recent price action on the 4-hour chart highlighted multiple Change of Character (CHoCH) and Break of Structure (BOS) points, indicating shifts in market momentum. LINK has been in a sustained downtrend from its recent high of $20, with critical CHoCH and BOS levels forming at $18, $16, and $14. The bearish outlook strengthened after a sweep of Equal Highs (EQH) near $16, followed by a BOS below $14.03.

Currently, the $12.00 support level is crucial. A strong bullish response from this zone could propel LINK back to the $16-$18 resistance range. However, failure to hold above $12 could trigger a retest of $10 or even push LINK lower to the $8-$9 region if selling pressure intensifies.

Profitability Insights and Market Sentiment

Analyzing the “In/Out of the Money Around Price” (IOMAP) data reveals that $12.00 is a key support zone. Around 43.78% of LINK holders—representing approximately 674.2 million LINK tokens—are in profit at this level, indicating strong buying interest. Conversely, about 55.19% of addresses, holding 605.8 million LINK, are out of the money, suggesting potential resistance above the current price.

If LINK stays above $12, a rally toward $14-$16 is likely, but a breakdown could open the door for a slide to $10. Notably, only 0.98% of holders are at breakeven around $12, meaning this level could serve as a make-or-break zone for bulls and bears alike.

Conclusion: Key Levels to Watch

The $12 threshold remains a battleground. A push above $15 would invalidate the bearish outlook, but a drop below $12 could accelerate downside pressure toward $10. Market participants should closely monitor volume and candle formations around $12 for confirmation of the next major move.

Also Read: Chainlink (LINK) Up 11% Weekly, But DMI Signals Bearish Shift—Will $15.79 Support Hold?

Will bulls defend $12, or will bears push LINK toward new lows? The coming days will be decisive.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!