|

Getting your Trinity Audio player ready...

|

Avalanche (AVAX) is currently consolidating within a symmetrical triangle pattern on the 4-hour chart, testing a crucial support level at $19. This support has been a stronghold in recent price action, raising the question: Will AVAX hold firm or break lower?

Current Price Action: A Tipping Point for AVAX?

At the time of writing, AVAX is trading at $19.56, reflecting a modest 0.20% increase over the last 24 hours. The ongoing symmetrical triangle formation suggests market indecision, with both bulls and bears awaiting a breakout direction.

If AVAX manages to break above the upper boundary of this pattern, a short-term rally could be in play. Conversely, failure to maintain the $19 support level could lead to a more substantial correction, pushing prices lower.

On-Chain Signals: Bearish or Bullish?

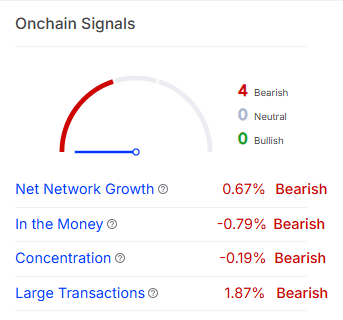

Analyzing AVAX’s on-chain metrics reveals a bearish tilt. The net network growth currently stands at -0.67%, indicating declining user adoption. Additionally, the “In the Money” metric has dropped by 0.79%, signifying that fewer investors are in profit.

Further reinforcing this cautious outlook, the concentration metric is down by 0.19%, showing minimal change in token distribution. Large transactions have also decreased by 1.87%, signaling a lack of enthusiasm from institutional investors.

Investor Sentiment: Are Holders Underwater?

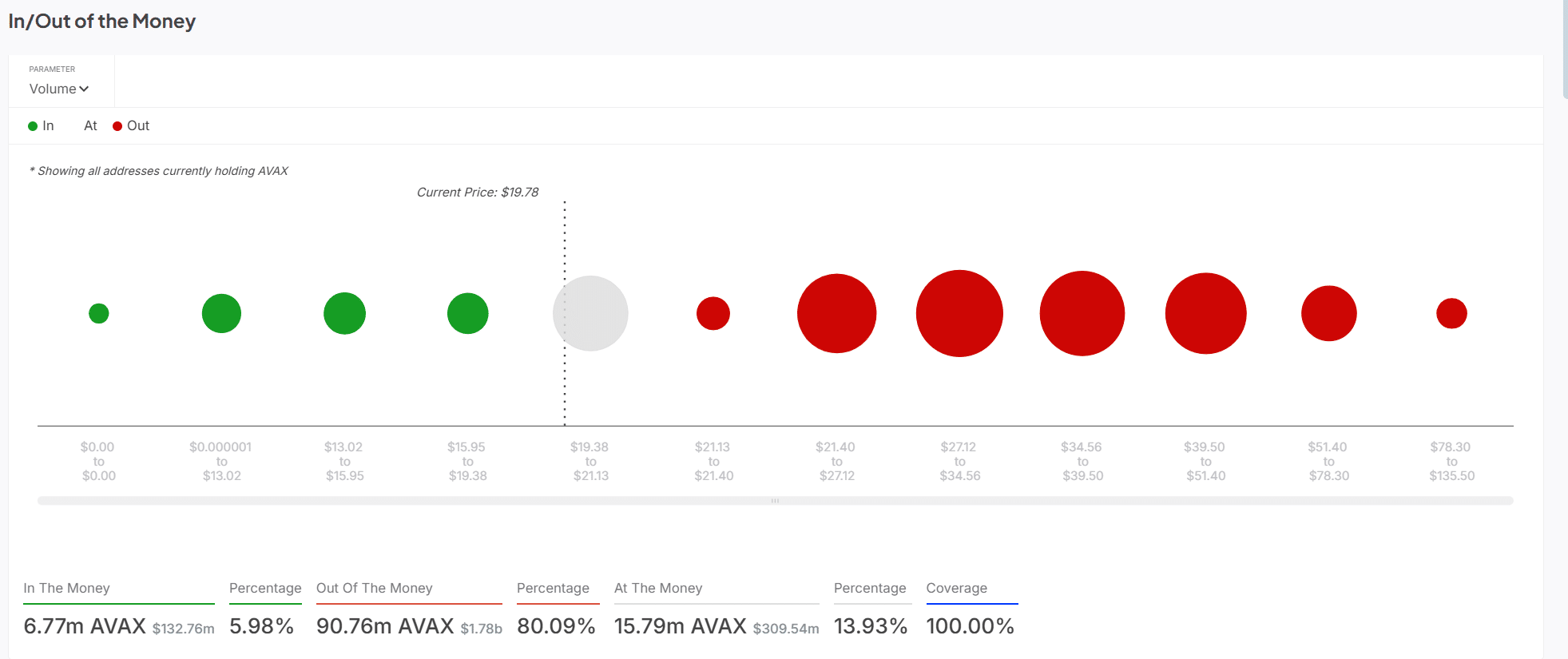

The in/out of the money analysis paints a challenging scenario for AVAX. Currently, 80.09% of holders are at a loss, with only 5.98% of addresses in profit. This suggests that if AVAX fails to hold $19, increased selling pressure could drive prices lower.

With bearish on-chain signals and a lack of strong bullish momentum, AVAX remains at risk of a breakdown. If the $19 support fails, AVAX could see further declines. However, a breakout above the symmetrical triangle’s upper resistance might pave the way for short-term gains.

Traders should keep a close watch on AVAX’s next move, as the coming hours could dictate the token’s near-term trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Avalanche (AVAX) Struggles at $20 Support: Can Bulls Reverse the Downtrend?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.