|

Getting your Trinity Audio player ready...

|

Ondo Finance (ONDO) has made a significant impact in the decentralized finance (DeFi) sector, surpassing $1 billion in total value locked (TVL) within just 30 days. This staggering 57% increase cements Ondo’s dominance in the rapidly expanding tokenized U.S. Treasuries market, which now boasts a total market value exceeding $4 billion.

With such rapid growth, ONDO is quickly emerging as a formidable player in the DeFi space. However, its recent price action and market indicators suggest potential volatility in the short term.

ONDO Price Action: A Bearish Turn?

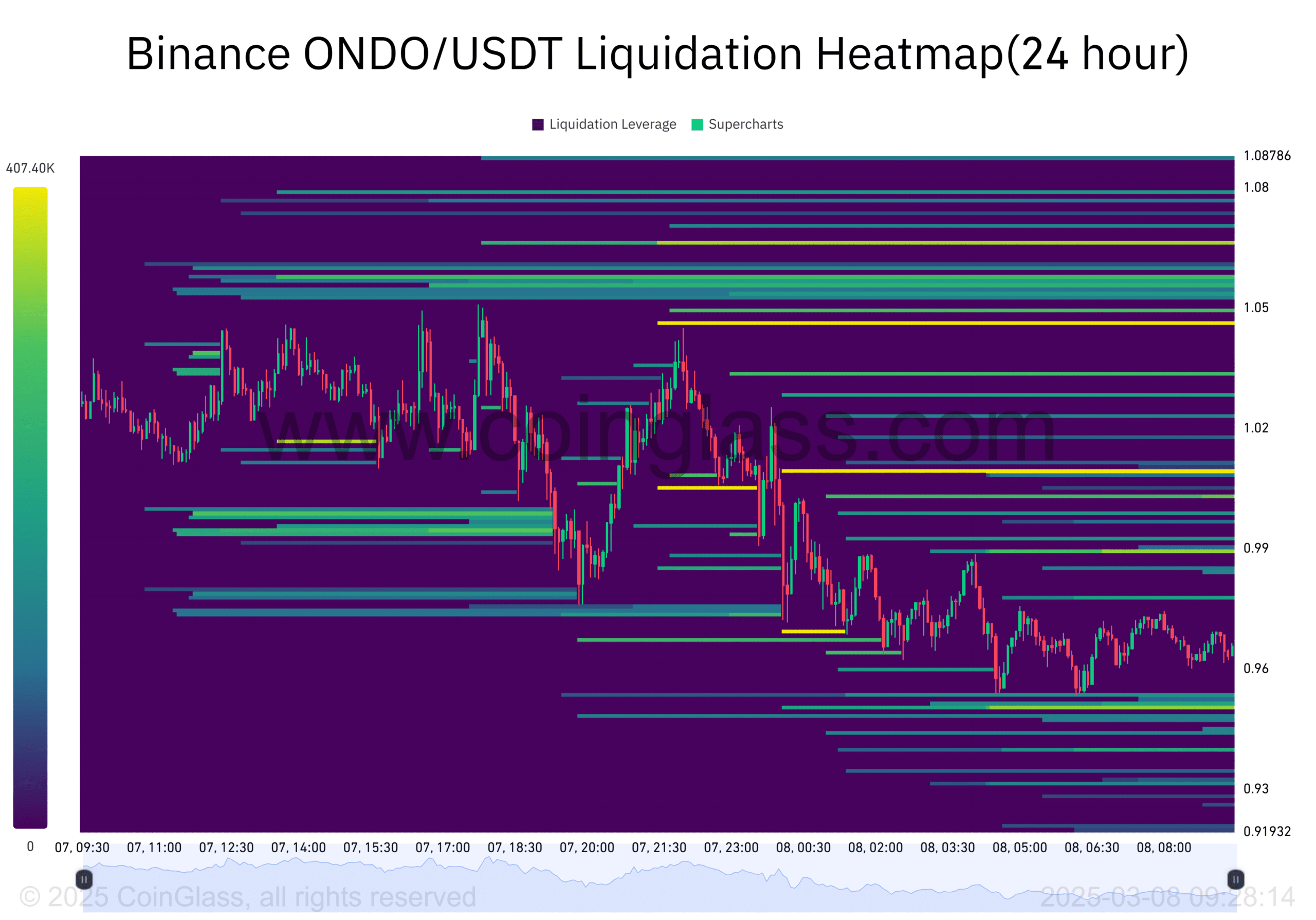

ONDO’s price movements have shown a pattern of uncertainty. The token has been consolidating within a symmetrical triangle formation after an initial sharp rally. At the time of writing, ONDO was trading at $0.96, marking a 6.26% decline over the past 24 hours. This downward trend raises concerns about short-term price stability despite its overall positive trajectory.

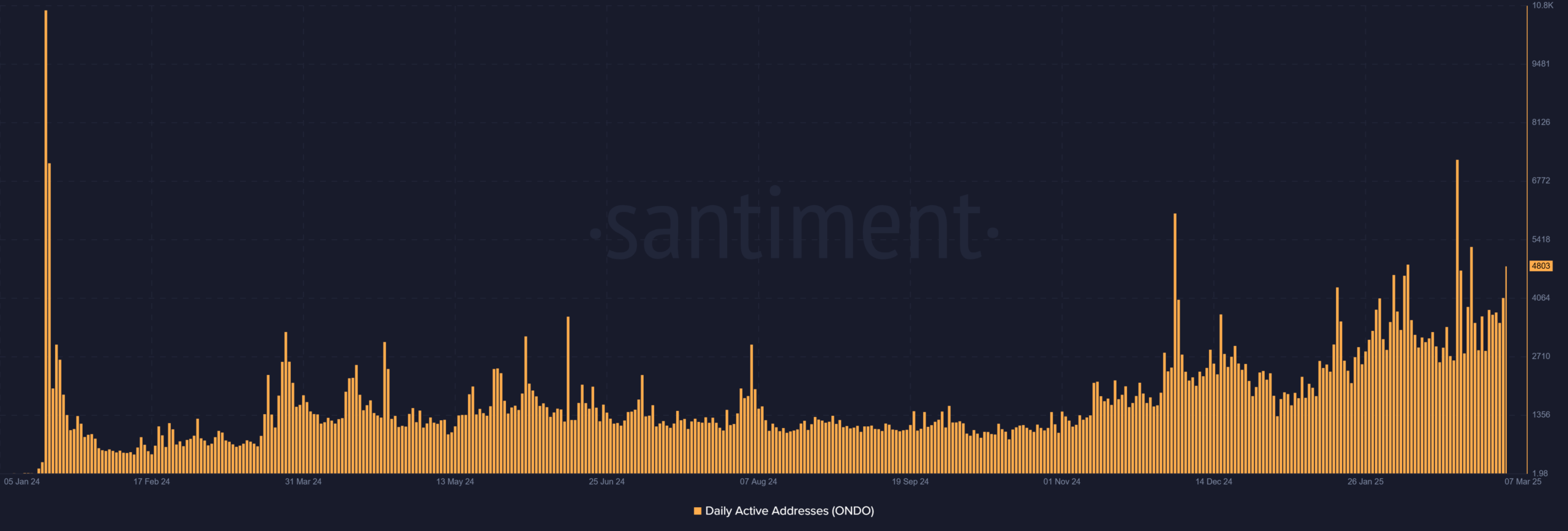

User Activity on the Rise

A notable development is the increase in ONDO’s daily active addresses, which reached 4,803. This uptick in user engagement signals growing adoption of Ondo’s platform and the broader tokenized treasuries sector. Increased daily activity suggests heightened investor interest, but whether this momentum can be sustained remains uncertain given broader market conditions.

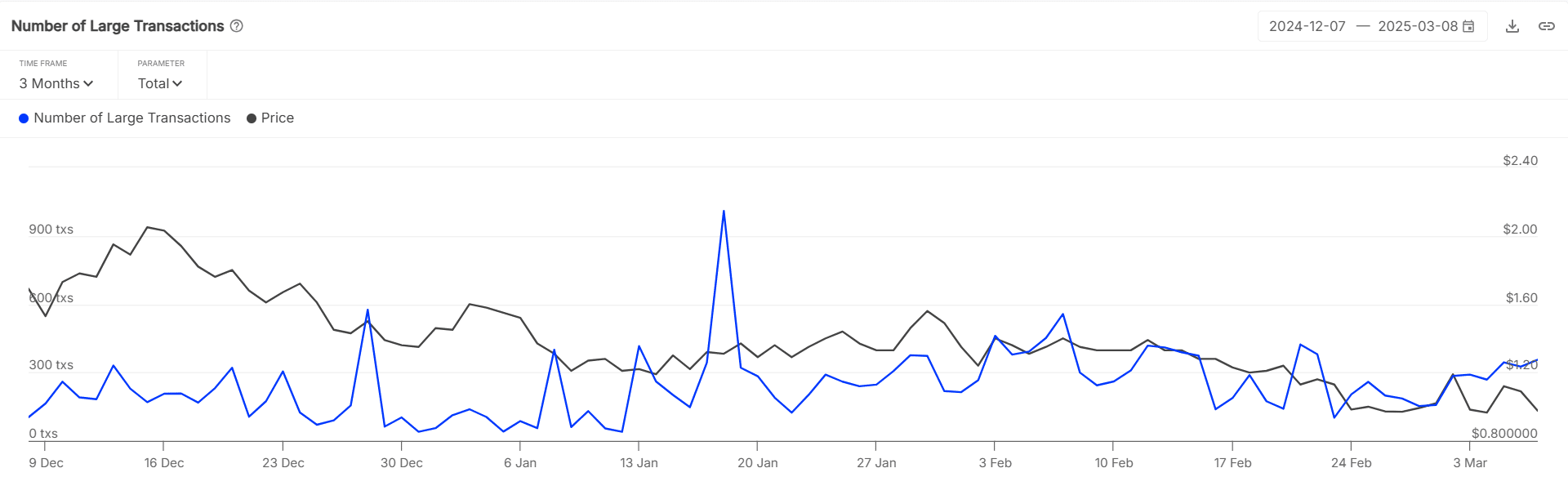

Large Transactions Declining: A Cautionary Signal?

While user activity is rising, ONDO has seen a 1.09% decrease in large transaction volumes. This decline suggests that institutional investors and large holders may be stepping back, possibly in response to the recent price dip. The cautious stance from major players could indicate a wait-and-see approach before committing more capital.

Analysis of ONDO’s liquidation heatmap reveals heightened liquidation activity in the $0.96–$1.00 range. Many traders appear to be at risk at these levels, potentially leading to increased volatility. If the token’s price continues testing this range, a surge in liquidations could trigger sharp fluctuations in price.

Despite its impressive growth in TVL and user activity, ONDO faces short-term challenges, including price fluctuations, declining large transactions, and liquidation risks. While its strong foothold in the tokenized treasuries market remains intact, maintaining this momentum amidst potential market headwinds will be key to its long-term success.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ripple & Ondo Finance’s Bold Move—Is This the Future of Institutional Blockchain Adoption?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.