|

Getting your Trinity Audio player ready...

|

The U.S. spot Bitcoin ETF market is experiencing heightened volatility, with net outflows nearly doubling amid concerns over former President Donald Trump’s controversial crypto reserve proposal. On March 4, Bitcoin ETFs recorded staggering outflows of $143.43 million, triggering a wave of liquidations across the market. Meanwhile, Ethereum ETFs rebounded with a net inflow of $14.6 million, breaking an eight-day losing streak.

Bitcoin ETFs Face Heavy Selling Pressure

According to data from Farside, Bitcoin Spot ETFs saw outflows nearly double from the previous day’s $74.19 million. Leading the sell-off, Fidelity’s FBTC lost $46.08 million, while ARK 21Shares’ ARKB followed closely with $43.92 million in redemptions. Franklin Templeton’s EZBC also faced heavy withdrawals, with investors pulling out $35.71 million.

Other Bitcoin ETFs, including those from Bitwise, Invesco Galaxy, and WisdomTree, also experienced outflows. However, Grayscale’s mini Bitcoin Trust managed to record a net inflow of $35.77 million, providing slight relief amid the broader sell-off.

Bitcoin Price Drops, Triggers Massive Liquidation

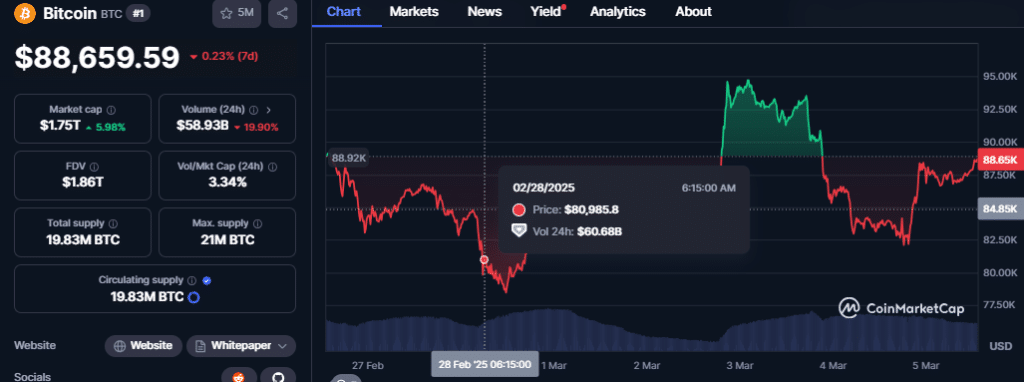

Bitcoin’s price experienced sharp fluctuations, briefly reaching $87,620 before retracing, marking a 5.4% increase. The volatility triggered widespread liquidations, with traders losing approximately $479 million within 24 hours. Binance’s XRP/USDT pair saw the largest single liquidation, valued at $6.82 million.

Ethereum ETFs Return to Positive Territory

Ethereum ETFs bucked the trend, recording net inflows of $14.58 million after eight days of consecutive outflows. Fidelity’s FETH led the recovery with $21.67 million in fresh capital, followed by Grayscale’s ETHE with $10.71 million. The mini Bitcoin Trust fund also attracted $8.46 million in new investments. However, BlackRock’s IBIT faced a setback with outflows of $26.27 million.

Ethereum showed signs of recovery, climbing 6% to trade near $2,200. However, the asset faces stiff resistance at $2,280. If Ethereum breaks above this level, it could rally towards $2,500. Conversely, failure to hold support may lead to a decline below $1,900.

Also Read: Bitcoin’s Role as a Financial Hedge Weakens Amid Market Shifts

The ongoing ETF turbulence underscores the market’s sensitivity to regulatory and political developments, with investors closely watching for further updates on Trump’s crypto policies.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!