|

Getting your Trinity Audio player ready...

|

Solana (SOL) has faced a steep decline, recently plunging to a three-month low of $160. For traders who saw SOL nearing $293 in January, this drop has been alarming. With bearish sentiment intensifying, many are wondering whether a reversal is imminent.

Panic Selling as Sentiment Turns Bearish

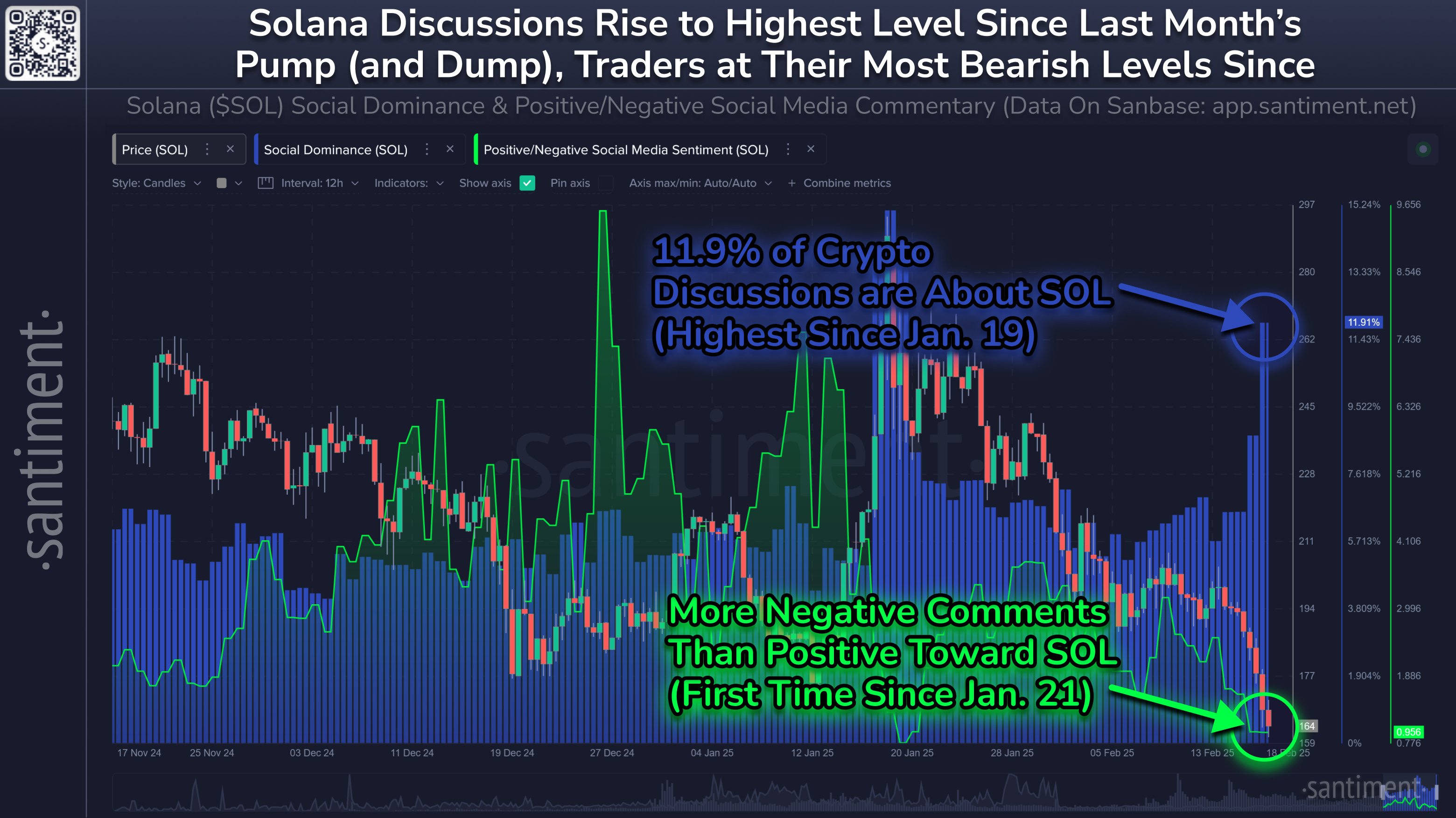

According to market intelligence platform Santiment, Solana’s sentiment has hit its lowest point since January 20, when the market last experienced a sharp correction. Social media discussions around Solana have surged, reflecting growing uncertainty. Historically, extreme bearish sentiment often precedes a trend reversal, as oversold conditions present opportunities for strategic investors.

The recent decline has also contributed to widespread crypto market liquidations, adding to the pressure on SOL. However, this panic selling could set the stage for a potential bounce.

Technical Indicators Suggest a Reversal Could Be Near

Despite the downtrend, technical indicators hint at a possible recovery. The 4-hour Relative Strength Index (RSI) shows a bullish divergence—while SOL’s price has been making lower lows, the RSI has been forming higher lows. This suggests that selling momentum is weakening, increasing the likelihood of a rebound.

Also Read: Whales Defend SOL at $200 – Will Support Trigger the Next Breakout?

If SOL manages to break above the key resistance level at $173, it could confirm the start of a recovery. The next resistance targets are $195.81 and $216.90, both of which served as consolidation zones in previous price movements.

Will Solana Rebound?

For now, traders are closely monitoring Solana’s price action. If SOL stabilizes around its current levels while sentiment remains pessimistic, a short-term rally could be in the cards. The combination of oversold conditions, rising bearish sentiment, and weakening selling pressure makes a potential rebound more likely.

In the volatile crypto market, patience is key. If Solana can reclaim critical resistance levels, traders could see a swift recovery. However, a failure to hold support at $160 could lead to further declines, making risk management crucial in the coming days.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.