|

Getting your Trinity Audio player ready...

|

Ripple’s (XRP) on-chain payment volume has faced a dramatic decline, with transactions dropping by 87% from 1.49 billion on January 1 to just 200 million by the month’s end. This sharp reduction signals a slowdown in XRP’s primary use case: cross-border payments and remittances. Historically, XRP has been marketed as a high-efficiency payment network, widely used by financial institutions for rapid and cost-effective transactions. However, the latest slump raises questions about whether XRP is losing its appeal among banks and fintech companies, especially with fewer active accounts on the XRP Ledger.

Despite the fall in payment volume, XRP’s price has remained resilient, hovering around $3.10. This stability is noteworthy as it indicates that the token’s price is less sensitive to fluctuations in transaction volume, signaling strong investor confidence. XRP’s price remains above key technical support levels, including the 50-day Exponential Moving Average (EMA), which suggests a bullish outlook in the short term.

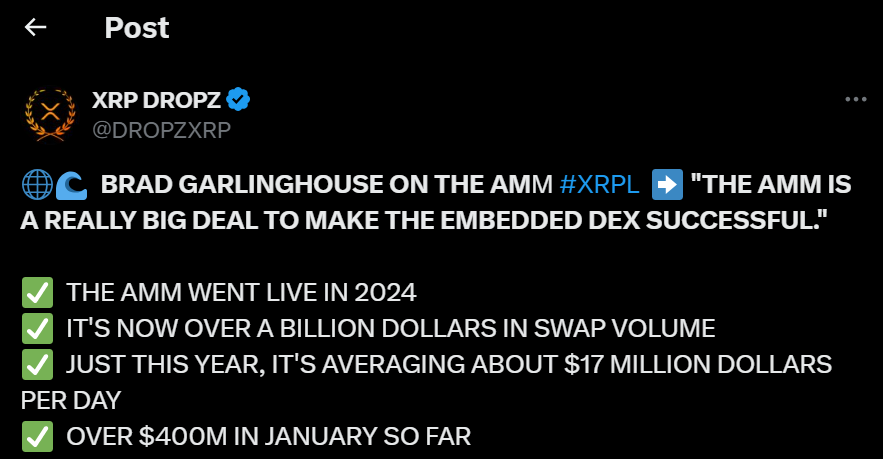

However, XRP’s decentralized exchange (DEX) has seen impressive growth. January saw over $400 million in trading volume, a substantial increase that highlights the growing adoption of XRP’s DEX functionalities. Brad Garlinghouse, CEO of Ripple, emphasized the importance of the DEX in making 2024 a pivotal year for the company. The DEX operates directly within the XRP Ledger, making it a more integral part of the network than traditional standalone applications.

The rise of DEX trading comes as anticipation builds for a potential spot XRP ETF, which JPMorgan analysts predict could attract over $8 billion in inflows. Such a development could further bolster XRP’s market position, particularly as Ripple recently secured a New York money transmitter license, which may increase institutional adoption.

Also Read: Ripple’s RLUSD Gains AMM Support as XRP Ledger Activates Game-Changing Clawback Feature

With XRP holding strong despite the payment volume slump, analysts predict that breaking key resistance levels at $3.20 and $3.50 could pave the way for a move towards $4. However, critical support remains at $2.86. As XRP continues to evolve, its DEX growth and potential ETF approval could position it for substantial gains in the near future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.