|

Getting your Trinity Audio player ready...

|

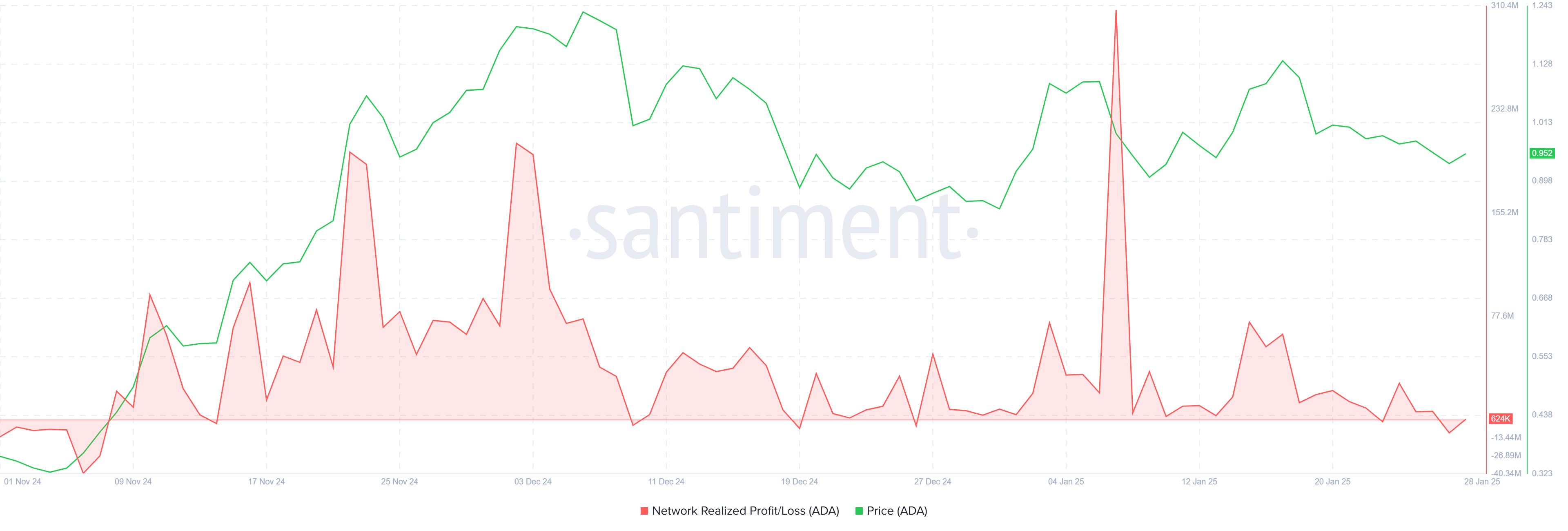

As Bitcoin continues its upward trajectory, Cardano (ADA) is facing heightened bearish pressure, raising concerns among investors about its near-term prospects. Recent data reveals a surge in realized losses for ADA, with many investors opting to sell despite the declining price. This trend suggests a growing sense of unease, as sellers exit positions at a loss — the highest level of such activity observed in two months. This shift in sentiment signals a potential pause in market activity as investors reevaluate their positions.

Cardano’s declining correlation with Bitcoin is also becoming a significant point of concern. Once closely tied to Bitcoin’s price movements, ADA’s correlation has now dropped to just 0.40, signaling a growing detachment from the leading cryptocurrency. Historically, this divergence has been followed by corrections for ADA, as it loses support from Bitcoin’s broader market influence. The weakening connection to Bitcoin raises questions about Cardano’s ability to chart a recovery on its own, making it more vulnerable to standalone volatility.

At present, ADA’s price sits at $0.95, down nearly 10% in the past 24 hours, and remains below the critical $0.99 barrier. This struggle to reclaim key resistance levels amid ongoing selling pressure has left ADA hovering just below the psychological $1.00 support. If the current bearish trend continues, ADA could fall further to $0.85, a level it nearly tested during yesterday’s session.

Also Read: Cardano and Dogecoin Set for Major Gains Amid Trump Presidency: February 2025 Forecast

However, should ADA manage to rebound above $0.99, it could set the stage for a recovery, with $1.13 emerging as the next target resistance. Such a move would invalidate the bearish outlook and potentially restore investor confidence, offering a glimmer of hope for a turnaround. Until then, ADA’s path forward remains uncertain as it navigates through a period of increased volatility.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.