|

Getting your Trinity Audio player ready...

|

Pepe (PEPE), the popular frog-themed meme coin, continues its downward spiral, trading near $0.000012 after shedding nearly 10% at the time of writing on Monday. This follows a 12% correction in the previous week, with indicators pointing to further bearish momentum and a potential 20% crash looming.

Bearish Technical Indicators Signal Trouble

PEPE has struggled since facing rejection at a descending trendline on January 18, a resistance level formed by connecting multiple highs since December. The meme coin has dropped over 30% since that point, closing below its crucial 200-day Exponential Moving Average (EMA) at $0.000014.

If PEPE continues trading below $0.000013 on a daily basis, analysts predict the coin could slide another 20%, retesting its November 8 low of $0.000010.

Momentum indicators reinforce the bearish outlook. The Relative Strength Index (RSI) on the daily chart currently sits at 31, pointing downward. Although nearing oversold territory, there remains room for additional downside pressure. Similarly, the Moving Average Convergence Divergence (MACD) indicator shows a bearish crossover, with red histogram bars expanding below the zero line—another sell signal for traders.

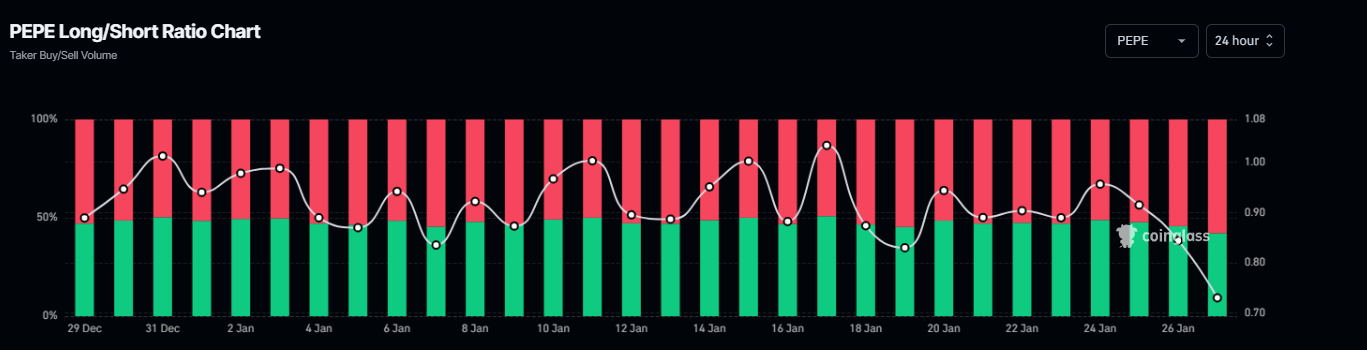

Market Sentiment and Long-to-Short Ratio

Bearish sentiment is further echoed in PEPE’s long-to-short ratio. According to Coinglass, the ratio has dropped to 0.72, its lowest in over a month. This suggests that a majority of traders are betting against PEPE’s price, signaling pessimism in the market.

Will PEPE Find Support?

For PEPE to escape its bearish trajectory, it must reclaim the $0.000014 level and sustain a rally above its 200-day EMA. However, with momentum indicators and market sentiment heavily skewed to the downside, traders should brace for further losses in the near term.

Also Read: Pepe Coin Surges 5%: Top 3 Altcoins Set to Explode in 2025

As meme coin hype wanes and technical signals align against PEPE, the path forward looks uncertain, leaving bulls scrambling for support amid mounting pressure.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.