|

Getting your Trinity Audio player ready...

|

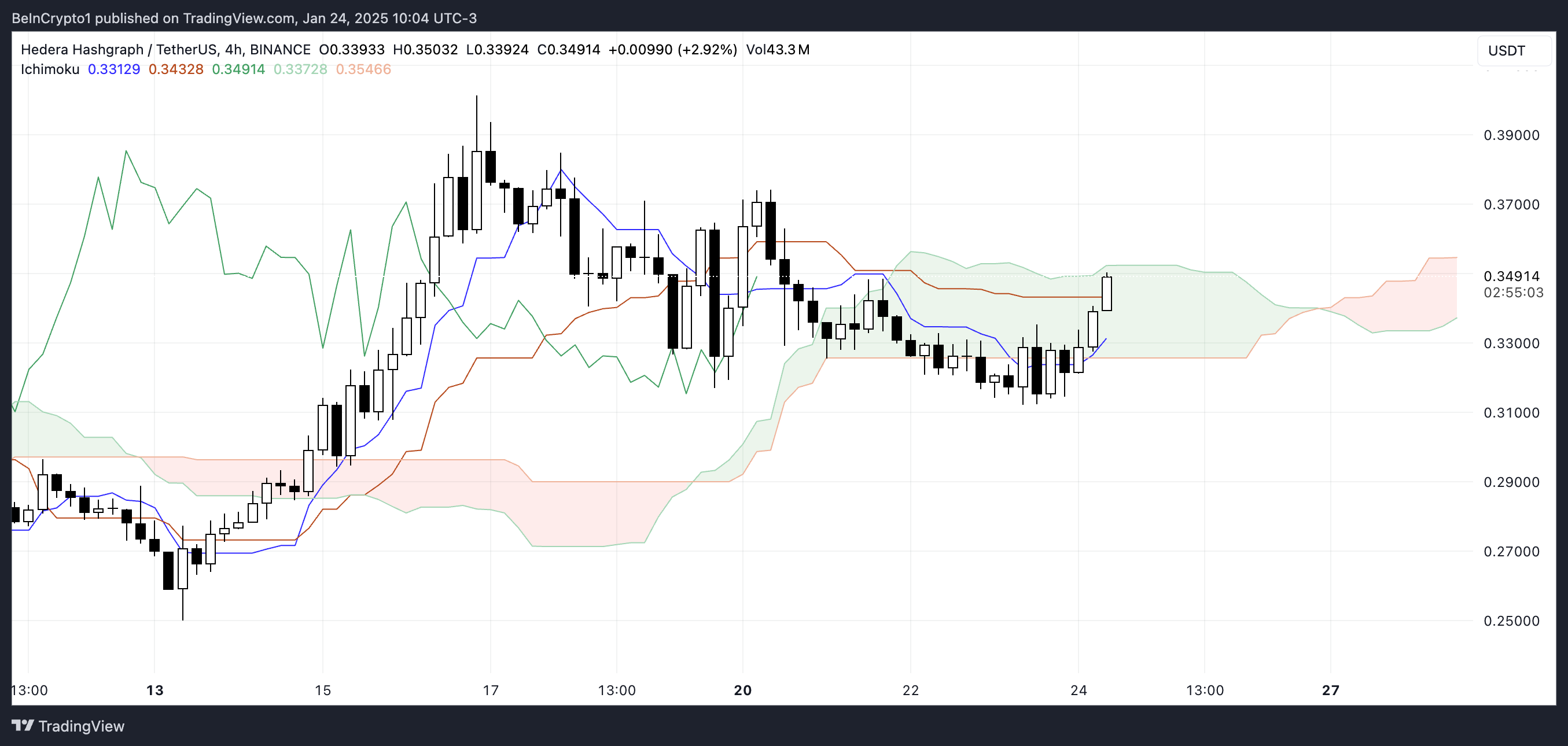

Hedera (HBAR) shows promising signs of an upward rally, supported by the Ichimoku Cloud chart and other technical indicators. The bullish sentiment is anchored by a breakout above the cloud, with both the Tenkan-sen and Kijun-sen lines trending upward. These signals indicate short-term momentum aligning with broader market optimism.

If HBAR breaks the resistance level at $0.374, it could potentially surge toward $0.40, representing a 14.2% upside. However, a reversal may test key support levels at $0.31, $0.296, or even $0.25 if selling pressure intensifies.

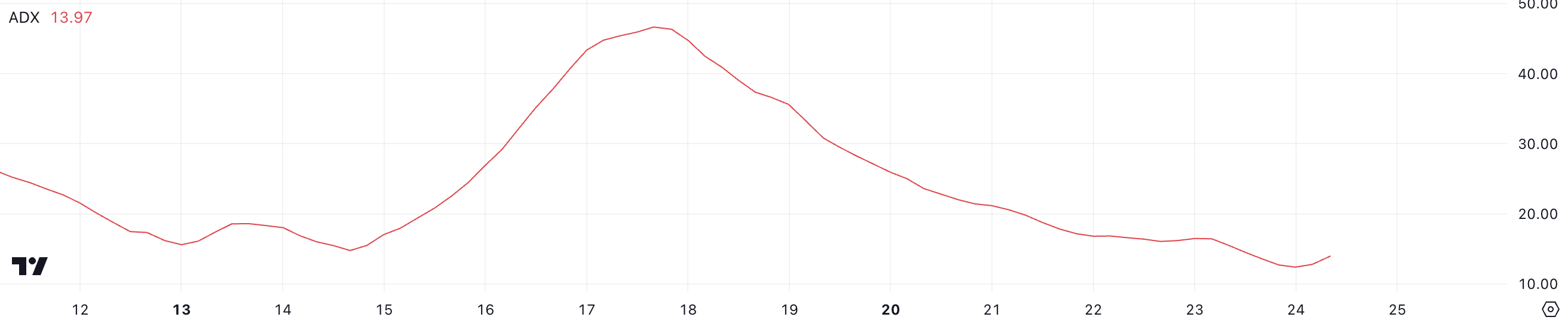

HBAR’s ADX Signals Early Uptrend

The Average Directional Index (ADX), a critical tool for assessing trend strength, stands at 13.97, slightly up from 12.7 yesterday. While still below the 20 threshold—indicating a weak trend—the rise suggests an early-stage uptrend.

The ADX’s upward movement hints at growing momentum, which, if sustained, could solidify HBAR’s bullish trajectory. Traders are closely monitoring this indicator for confirmation of a stronger trend that may propel prices higher.

Ichimoku Cloud Supports Bullish Setup

HBAR’s position above the Ichimoku Cloud signals a favorable trading zone, with a green cloud (Senkou Span A above Senkou Span B) ahead, providing potential support during pullbacks. This setup is bolstered by the upward-trending Tenkan-sen (blue) and Kijun-sen (red), reinforcing the bullish narrative.

If the price remains above the cloud, HBAR’s bullish structure is likely to persist. However, a dip back into the cloud could signal consolidation or weakening momentum, although the green cloud below may provide a safety net.

HBAR Outlook: Eyes on $0.40

With the potential for a golden cross in the coming days, HBAR is positioned for a significant rally if resistance at $0.374 is breached. Conversely, a failure to maintain current levels could see support at $0.31 come into play, with a drop to $0.296 as the next defensive line.

Also Read: Hedera (HBAR) Price Faces Decline Amid Invalidated Bull Flag: Is a 30% Drop on the Horizon?

As momentum builds, Hedera investors are watching closely for confirmation of a sustained uptrend.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.