|

Getting your Trinity Audio player ready...

|

Spot Bitcoin ETFs have experienced a significant rebound in inflows following a drop in the Core Consumer Price Index (CPI) for December, which ignited rallies in both global equity and crypto markets. On Wednesday, Bitcoin ETF inflows surged to $755 million, with Fidelity’s FBTC leading the way, attracting $463 million. This surge coincided with Bitcoin’s price soaring past the $100K mark, driven by a robust uptick in the S&P 500.

Bitcoin ETF Inflows Rebound

After a four-day streak of outflows, the spot Bitcoin ETF saw a remarkable reversal. Investors rushed back into Bitcoin investment products, purchasing over 7,548 BTC—far exceeding the daily production rate of 450 BTC. Fidelity’s FBTC led this surge, garnering $463 million, while Ark Invest’s ARKB trailed with $138 million in inflows. Notably, BlackRock’s iShares Bitcoin Trust (IBIT) saw $31 million in inflows, accompanied by a massive $2.35 billion in trading volumes, signaling growing interest in Bitcoin ETFs across global markets.

In addition to U.S. demand, international markets are also showing strong interest in Bitcoin ETFs. Bitwise Invest’s CEO, Hunter Horsley, shared that inquiries from global markets continue to rise, highlighting the widespread appeal of these investment products.

Global Markets React to CPI Data

The drop in Core CPI inflation, which fell to 3.2% in December, below the expected 3.3%, was a key catalyst for the market rally. This sparked a sharp rise in global equities and cryptocurrencies. The S&P 500 closed with a 100-point gain, adding a staggering $900 billion in market capitalization.

Bitcoin’s Price Outlook

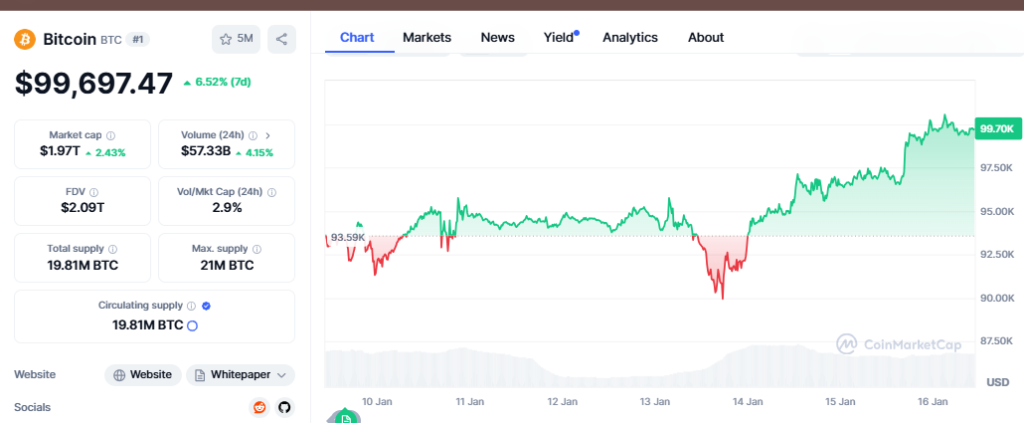

Bitcoin’s price surged above $100K but faced a slight retracement, trading at $99,597 at press time. On-chain data from Santiment shows strong fundamentals backing the rally, with large Bitcoin holders resuming accumulation after a brief pause. Despite small retail traders cashing out, the overall sentiment remains bullish, suggesting that Bitcoin could soon break new all-time highs.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Bitcoin ETFs See $900M+ Inflows as Demand Surges: BlackRock, Fidelity Lead the Charge

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.