|

Getting your Trinity Audio player ready...

|

Chainlink (LINK) has garnered significant attention over the past 24 hours as large investors, or whales, accumulated a staggering 1.35 million LINK tokens. This activity underscores growing confidence in Chainlink’s long-term value and could be linked to upcoming network upgrades, expanding use cases, or an improving cryptocurrency market.

LINK’s Current Market Snapshot

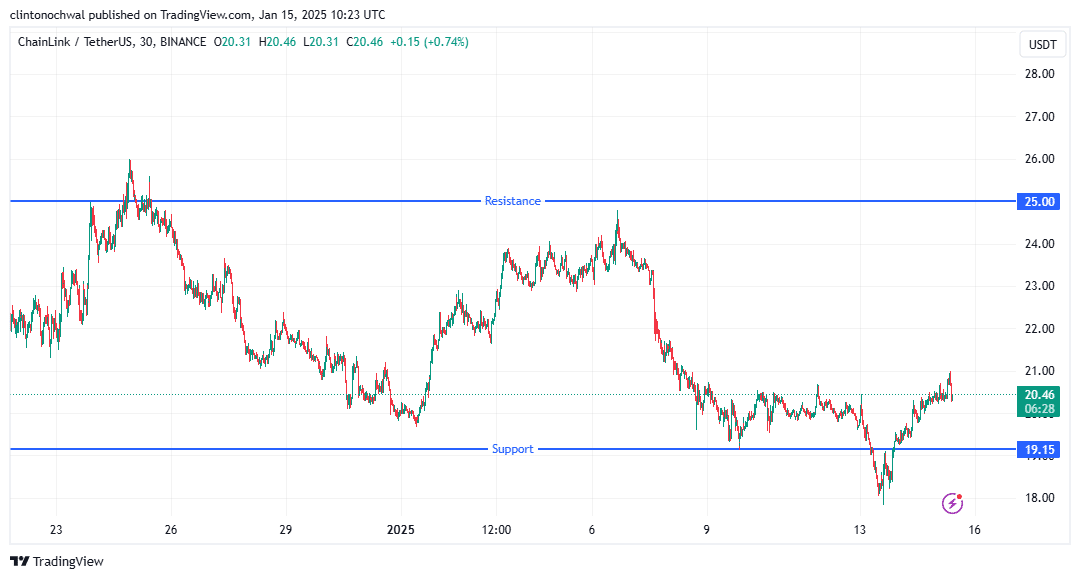

As of now, LINK trades at $20.40, up 3.39% in the last 24 hours. Its 24-hour trading volume stands at $496 million, reflecting robust trader interest. Over the past week, LINK has consolidated within a $19 to $25 range, signaling a phase of stability despite being 61.55% below its all-time high of $52.99 (May 2021).

Chainlink’s ability to sustain its price above the critical $20 mark demonstrates resilience, positioning it as a key asset in the cryptocurrency ecosystem and an attractive option for long-term investors.

Whale Accumulation as a Catalyst

Historically, whale accumulation often precedes significant price movements. LINK’s strong support at $19.15 highlights substantial buying interest, which, if sustained, could propel the token towards its $25 resistance level. This trend aligns with Chainlink’s growing adoption in Decentralized Finance (DeFi) and its reputation as a leading blockchain oracle provider.

Active Addresses and Network Growth

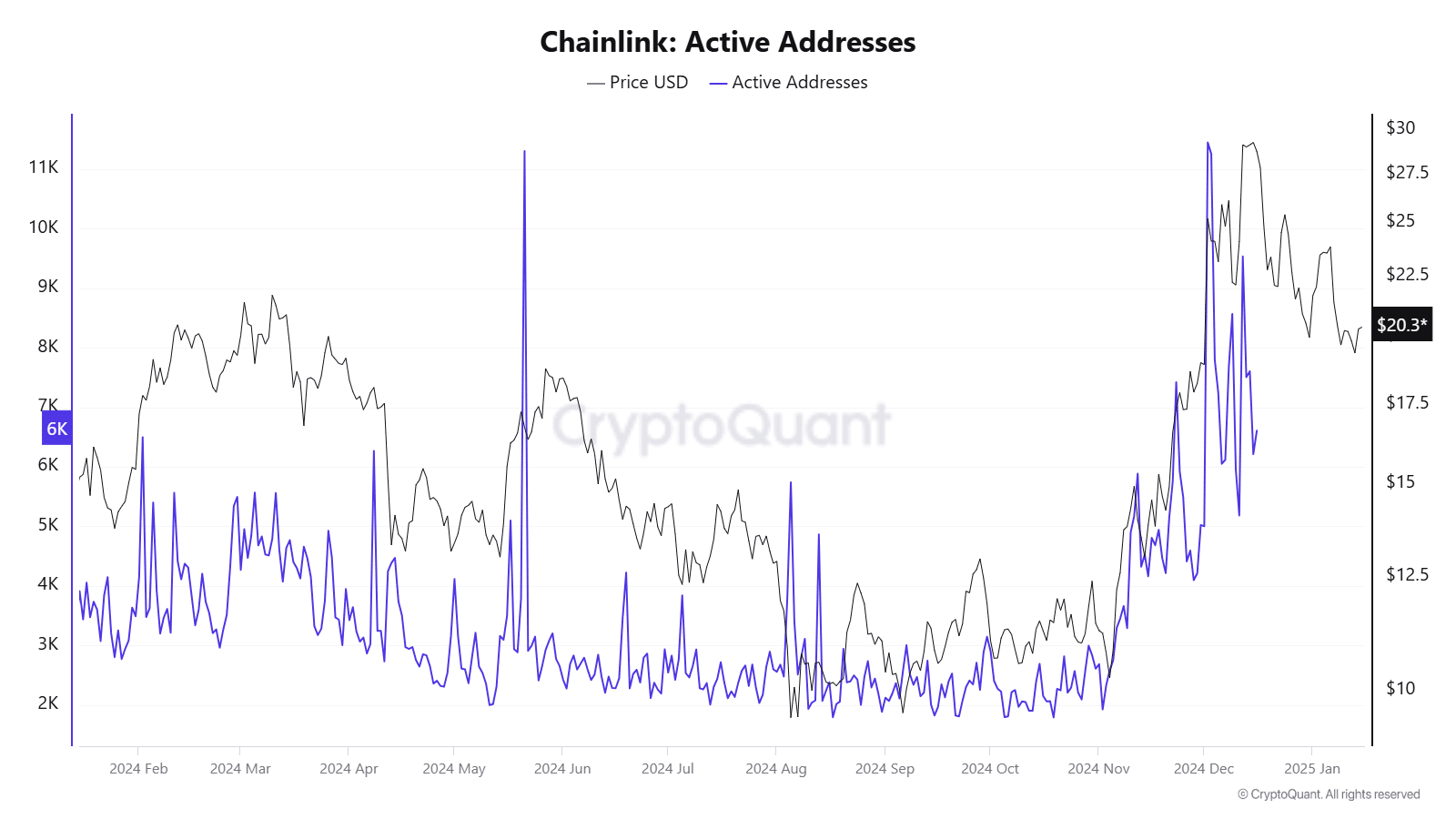

Chainlink has also witnessed consistent growth in active addresses, reflecting increased network usage and adoption. The platform’s oracles, vital for enabling smart contract functionality across multiple blockchains, have bolstered its reputation in real-world applications.

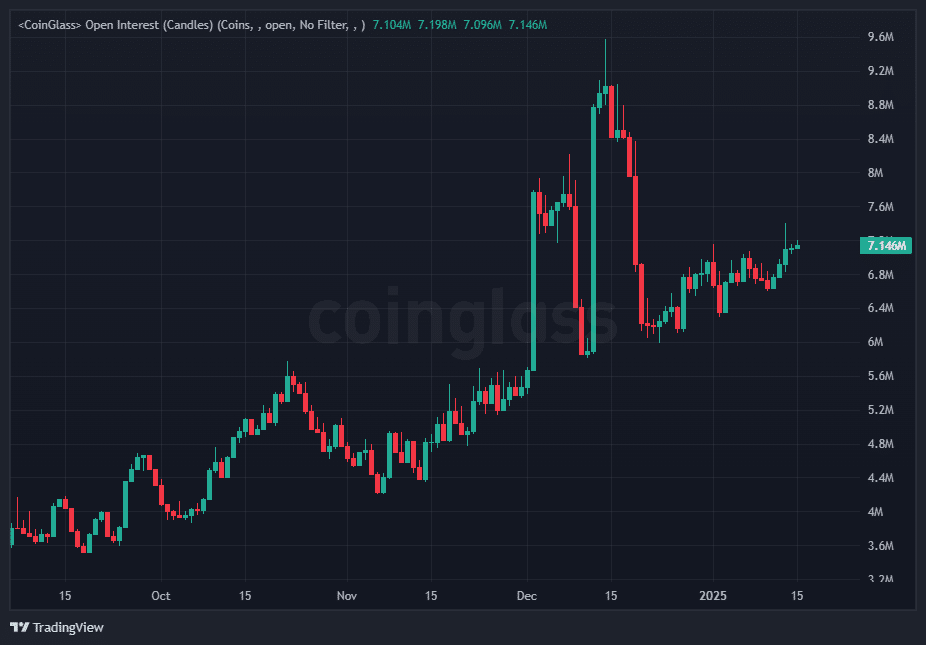

Open Interest (OI) in LINK futures contracts has surged, suggesting heightened trader speculation. A steady rise in OI, coupled with price stability or growth, often reinforces bullish momentum. Meanwhile, the narrowing Market Value to Realized Value (MVRV) Long/Short Difference indicates market equilibrium. Such phases historically precede sharp price movements, making LINK a token to watch closely.

Chainlink’s combination of whale activity, active address growth, and increased OI signals strong potential for a breakout. With key metrics pointing to heightened investor confidence, LINK could be poised for a significant upward trajectory. Traders and investors should monitor these developments closely for potential opportunities.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Chainlink (LINK) Surge: Can $30 Be the Next Target as Bitcoin’s Rally Fuels Market Momentum?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.