|

Getting your Trinity Audio player ready...

|

Despite a recent pullback, SUI remains in a favorable position for recovery, fueled by ongoing bullish market conditions. This could pave the way for a potential all-time high (ATH) in the near future, as the altcoin continues to maintain positive market sentiment.

Strong Support for SUI Amid Price Decline

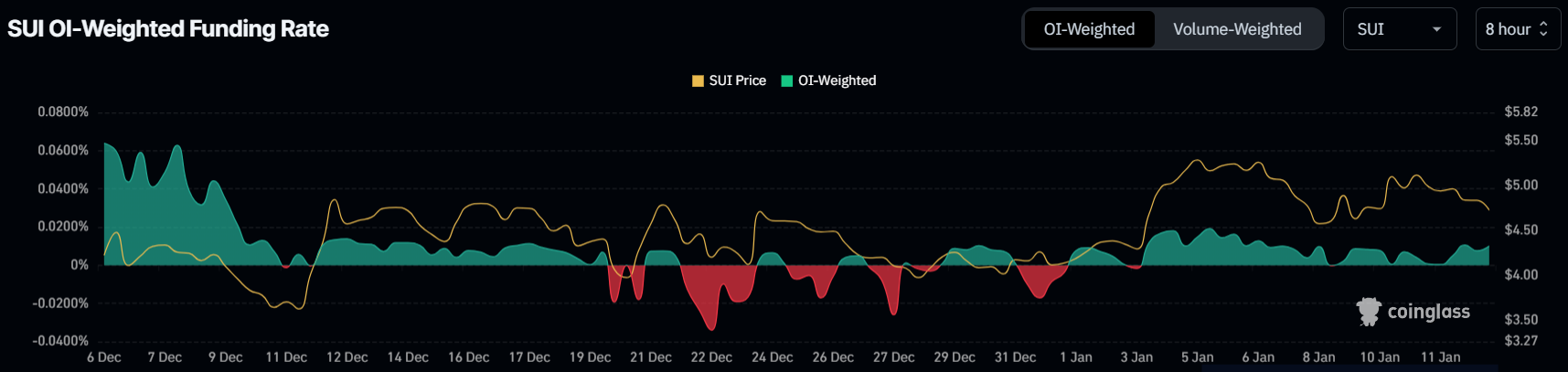

SUI’s funding rate has stayed positive for the past ten days, signaling trader optimism despite the recent 10% correction. This sustained positivity suggests that market participants are betting on a price rebound and a potential new ATH. The strong support level is a testament to the belief that SUI can recover and surge ahead, driven by favorable market conditions and a dedicated trading community.

From a technical perspective, SUI’s Relative Strength Index (RSI) remains above the neutral 50.0 mark, staying within the bullish zone. While minor downticks have been observed, they have not triggered significant downside movement. This resilience suggests that the altcoin could be in a prime position for a reversal.

Price Prediction: Avoiding Further Correction

SUI’s price recently dropped to $4.58, falling below its $4.79 support level. However, the recent decline does not necessarily signal the end of its bullish outlook. The current price is approaching the $4.35 support level, but if the altcoin can flip the $4.79 level back into support, it may rally toward its previous ATH of $5.36.

Breaking through this $5.36 barrier could set the stage for a new ATH, extending SUI’s impressive growth trajectory. On the other hand, if SUI falls below the $4.35 support level to $4.05 or lower, bearish sentiment could take hold, leading to increased selling pressure and a possible extended correction.

Also Read: Ripple vs SEC Lawsuit: Critical Deadline Looms as SEC Faces January 15 Appeal Brief Deadline

SUI’s positive market sentiment and resilient technical indicators suggest that a price recovery is possible, and the altcoin remains well-positioned to target new ATHs. However, its performance will depend on its ability to maintain support levels and continue capitalizing on the bullish trend in the crypto market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.