|

Getting your Trinity Audio player ready...

|

The Aave (AAVE) cryptocurrency is making headlines as it clings to its crucial support level, fueling bullish sentiment in the altcoin market. With the broader crypto landscape showing signs of optimism, many are asking: will AAVE surge toward a new all-time high (ATH) this altcoin season?

AAVE Holds Strong at $290 Support Zone

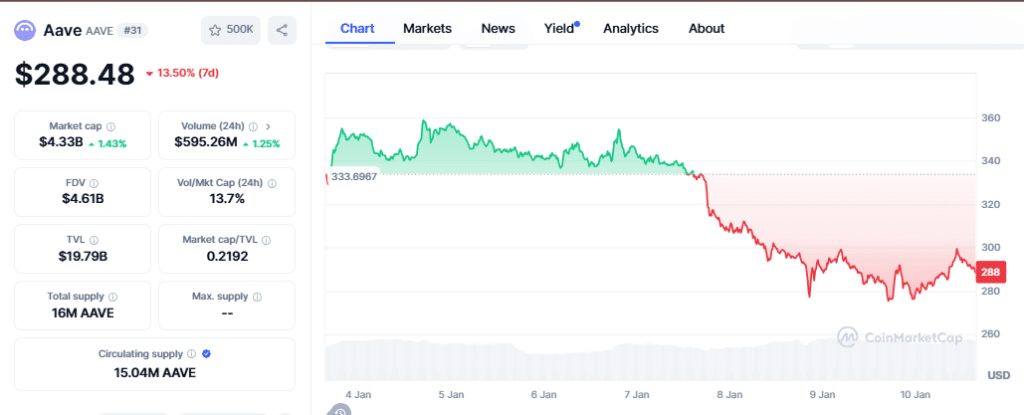

AAVE has demonstrated resilience, maintaining its price above the critical $290 support level. Following an intraday price increase of 5.32%, the token’s market capitalization now stands at an impressive $4.44 billion, accompanied by a robust 24-hour trading volume of $594.73 million. This positions AAVE as the 31st largest cryptocurrency globally.

Technical indicators suggest a favorable outlook for the token. The Relative Strength Index (RSI) shows a bullish curve on the daily chart, signaling increasing buying pressure. Furthermore, a potential positive crossover in the RSI trendline bolsters expectations of continued upward momentum.

Adding to this optimism, the 50-day Exponential Moving Average (EMA) is nearing a bullish convergence on AAVE’s price chart. This key indicator hints at the likelihood of sustained growth in the near term.

Can AAVE Rally to New Heights?

If the current bullish momentum persists, AAVE could breach its immediate resistance level at $300. Analysts predict that intensified buying activity could propel the token toward its next major resistance at $350 in the coming weeks.

However, a reversal cannot be ruled out. If bears seize control, AAVE might falter, breaking below its $290 support zone. In such a scenario, the token could dip to its lower support at $250.

AAVE’s ability to maintain its key support trendline amidst growing bullish sentiment suggests it is well-positioned for potential gains. As the altcoin market heats up, all eyes are on AAVE to see if it can capitalize on this momentum and set new price milestones. Traders should monitor market dynamics closely, as the coming weeks will likely be pivotal for AAVE’s trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!