|

Getting your Trinity Audio player ready...

|

Bitcoin’s [BTC] price has faced challenges in breaking the $100,000 mark for nearly three weeks now. Despite recent price movements, Bitcoin continues to trade sideways, caught in a volatile range. At the time of writing, BTC was priced at $97,834, reflecting a slight 0.31% drop in the daily charts. However, Bitcoin managed to rise by 3.07% over the past week, showing its potential for upward movement despite the market’s volatility.

The fluctuation in Bitcoin’s price can largely be attributed to a decline in retail investor interest. As the market seeks stability, Bitcoin is shifting from weaker hands to stronger hands, with institutional and experienced traders increasingly dominating the market.

Bitcoin’s Retail Investor Exodus

As Bitcoin neared the $100k mark, retail investor demand surged by over 30%, according to CryptoQuant. This spike typically indicates a surge in enthusiasm and fear of missing out (FOMO) among smaller investors. Historically, such spikes often precede market tops, which was evident when Bitcoin hit its all-time high (ATH) of $108k. Following this, retail demand experienced a sharp 16% decline, signaling that retail investors had exited their positions quickly amid the correction.

A drop below 10% in retail demand is a clear sign that retail interest has significantly waned. While this may seem like a negative development, it presents a buying opportunity for larger traders who are now in control.

Shifting Market Dynamics

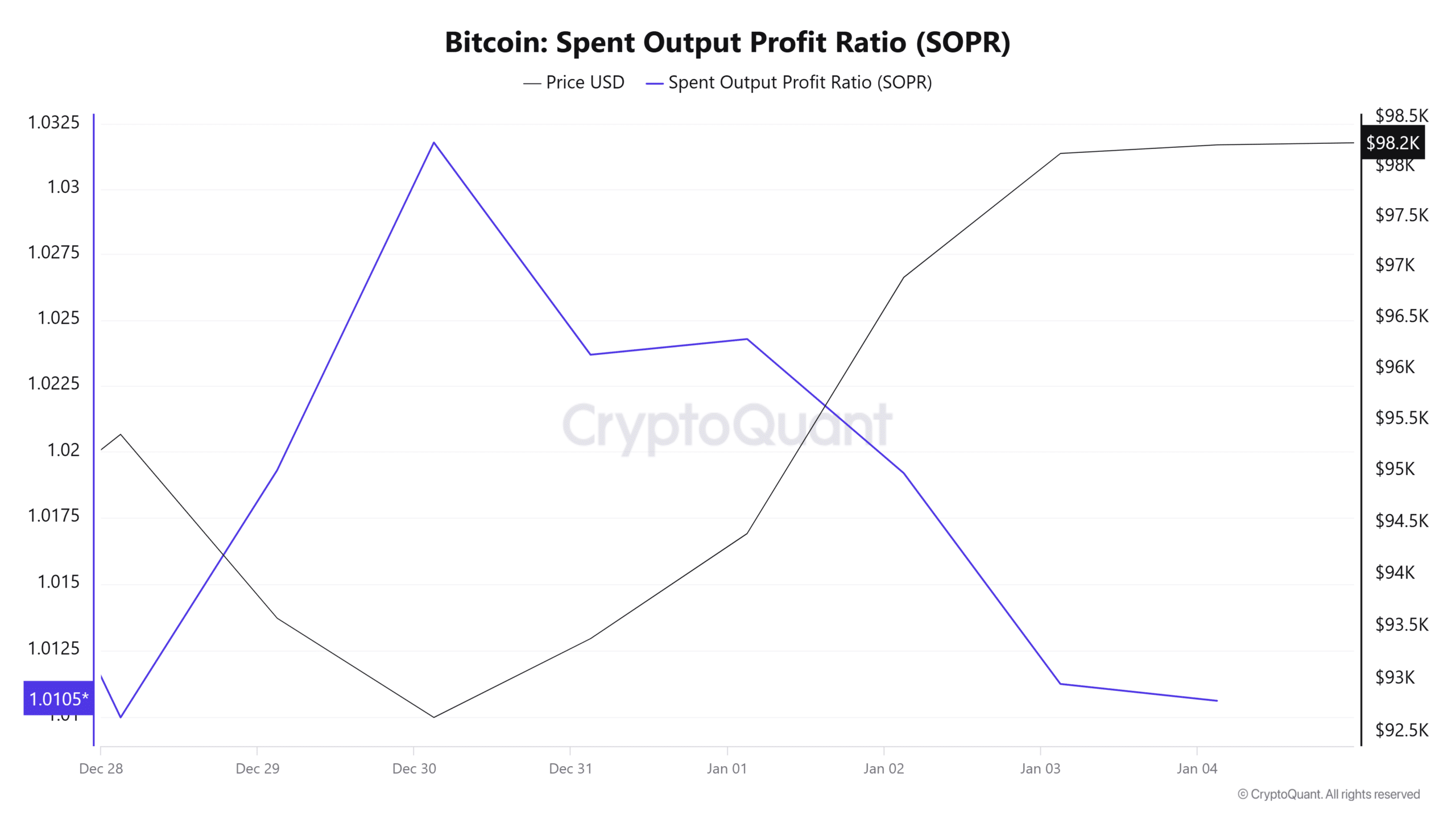

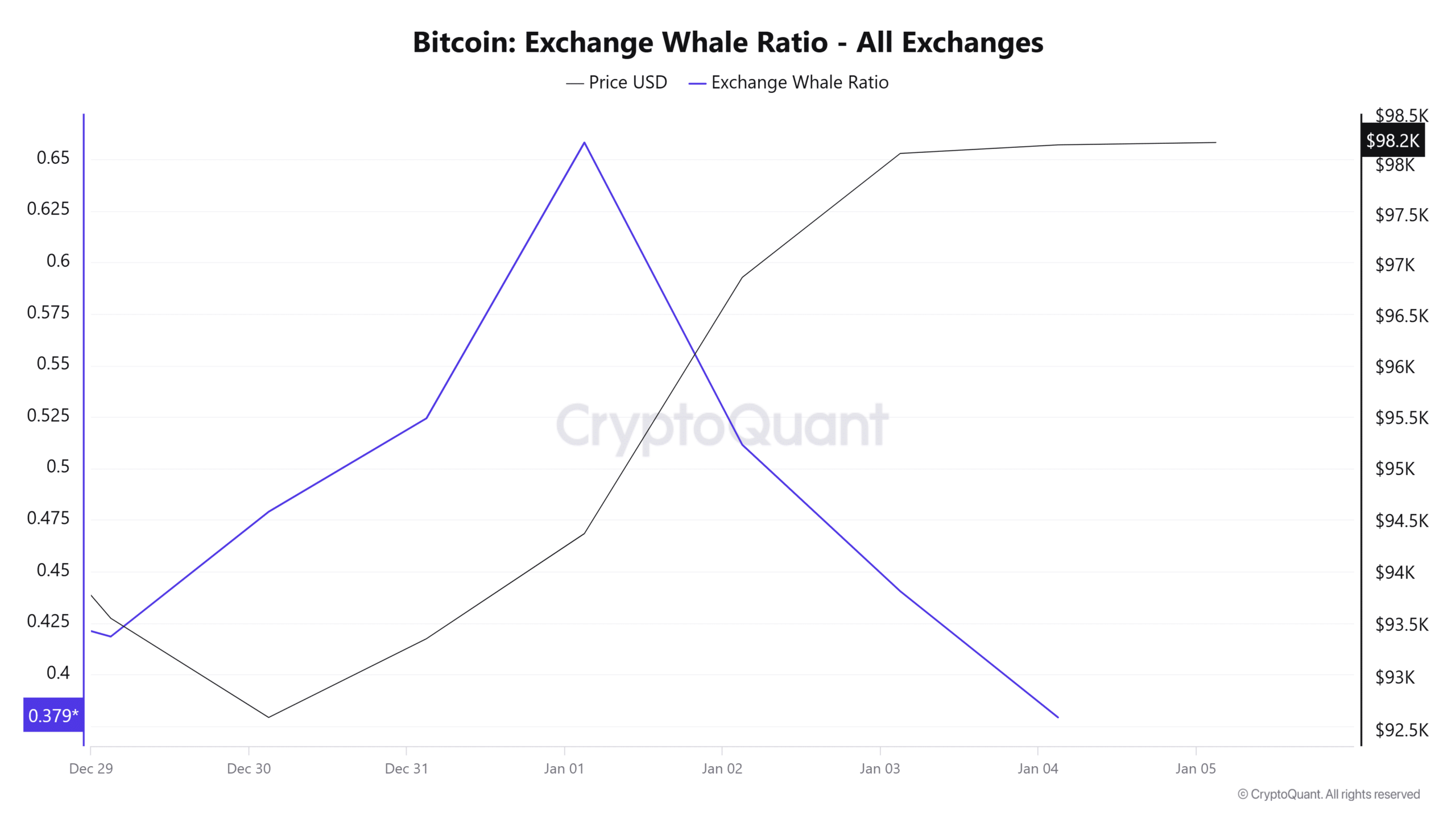

Bitcoin’s market activity is showing signs of a shift from retail traders to “smart money” accumulation. The drop in retail demand signals that the market is cooling after a speculative frenzy. The recent decline in the Spent Output Profit Ratio (SOPR) further highlights this transition, suggesting that holders are confident in holding their positions through corrections. Additionally, the exchange whale ratio has fallen to 0.37, showing that whales are moving their BTC to private wallets, signaling bullish sentiment.

With these trends in mind, Bitcoin is poised for potential future gains. If Bitcoin reclaims the $98,700 level, it could be on track to break the $100k barrier again. However, if market conditions shift negatively, BTC could dip to $96,100.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Bitcoin (BTC) Targets $110K: Can the Bull Run Overcome Political Uncertainty and Key Resistance?

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!