The crypto market is closely monitoring Terra Luna Classic (LUNC), with analysts highlighting the potential for a massive breakout that could lead to an impressive 1,100% rally. At the time of writing, LUNC is priced at $0.0001115, with a 24-hour trading volume of $23.87 million. Despite a 2.02% drop in the last 24 hours, the token has seen a modest 2.20% increase over the past week, showcasing signs of potential recovery.

With a market cap of approximately $614 million and a circulating supply of 5.5 trillion tokens, LUNC has maintained a stable position in the market. However, analysis by Javon Marks suggests that LUNC’s price chart is signaling the possibility of another breakout. Previous breakouts for LUNC have successfully met three key price targets, driven by strong volume and market participation. Marks predicts that a similar breakout could push LUNC’s price to levels of $0.00058046, $0.00098584, and $0.00139122, especially if bullish momentum continues to build.

There can be major reason for $LUNC (Terra Classic)'s patience demanding action!

— JAVON⚡️MARKS (@JavonTM1) December 30, 2024

Previous breakout and run resulted in 3 Targets being met so prices, holding another breakout, could be preparing for a similar performance which could lead into an over 1,100% run to and above… https://t.co/5vGrKl4fHn pic.twitter.com/qrzJjyIFCy

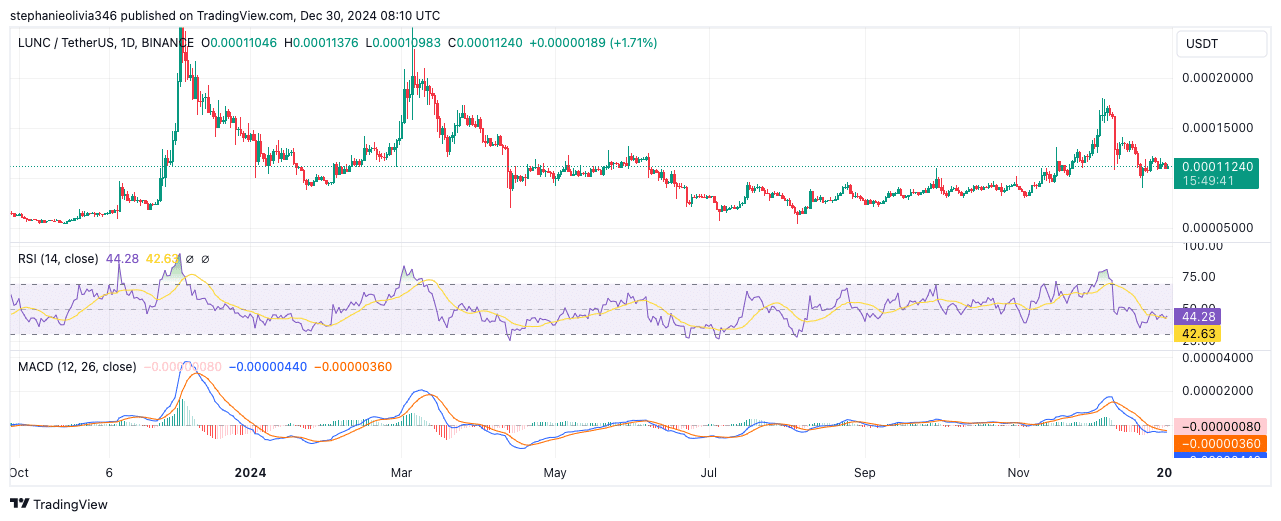

The technical analysis of LUNC’s price chart points to a consolidation phase, which may serve as a solid foundation for future price movements. Analysts have noted the formation of higher lows and a symmetrical pattern, often associated with trend continuation. These signals could indicate that LUNC is preparing for another bullish breakout.

However, some mixed signals are present. The Relative Strength Index (RSI) stands at 43.49, reflecting bearish momentum but nearing neutral territory, suggesting potential stabilization. Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bearish crossover, with weak momentum. The key support level for LUNC is identified at $0.00009883, which must hold for any meaningful recovery.

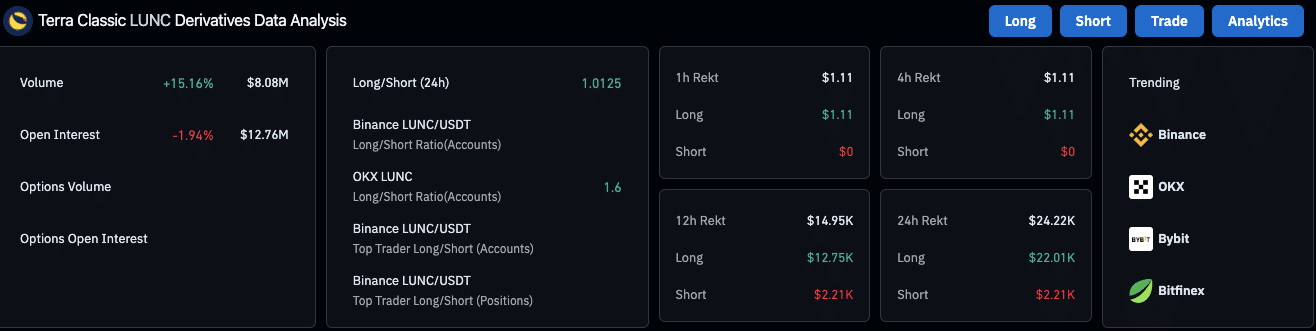

In the derivatives market, Terra Luna Classic has seen a 15.16% increase in 24-hour trading volume, reaching $8.08 million. While this suggests heightened interest among traders, the decline in Open Interest by 1.94% to $12.76 million indicates some uncertainty. A mixed long/short ratio further reflects this indecision, with Binance showing near-equal sentiment, while OKX traders maintain a slightly bullish outlook.

With low liquidation activity and growing market participation, Terra Luna Classic remains a closely watched asset. Traders are eagerly awaiting the next moves as LUNC’s price action could soon set the stage for a significant breakout.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Terra Luna Classic (LUNC) Burns 19.6M Tokens as Price Stabilization Efforts Gain Momentum