|

Getting your Trinity Audio player ready...

|

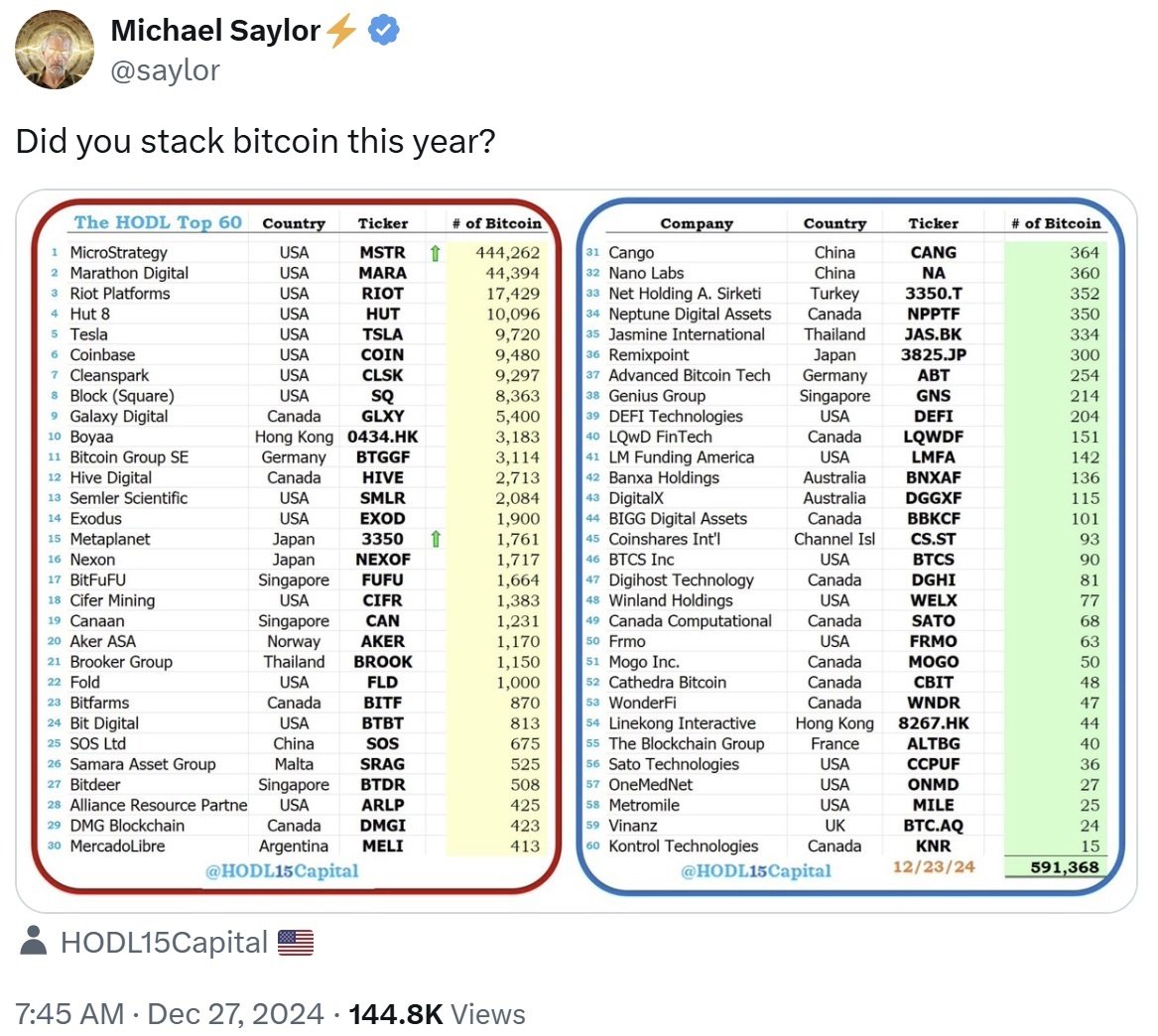

Michael Saylor, executive chairman of Microstrategy, shared a detailed list on social media platform X, revealing the top 60 publicly traded companies holding the largest amounts of Bitcoin. Compiled by Hodl15capital, the list underscores the dominance of U.S.-based firms in the growing cryptocurrency space, with Microstrategy holding a commanding lead.

Microstrategy’s Bitcoin holdings stand at an impressive 444,262 BTC, far surpassing the second-largest holder, Marathon Digital, which owns 44,394 BTC. Other top contenders include Riot Platforms with 17,429 BTC, Hut 8 with 10,096 BTC, and Tesla, which holds 9,720 BTC. The list highlights the increasing trend of corporations adding Bitcoin to their portfolios, a move that has proven beneficial for Microstrategy. The company’s aggressive Bitcoin acquisition strategy has led to a remarkable 400% surge in its stock price in 2024, propelling it into the Nasdaq 100 Index.

Saylor’s optimism about Bitcoin’s future is evident, with the Microstrategy executive predicting that Bitcoin could reach a staggering $13 million per coin by 2045. To expand its Bitcoin reserves even further, Microstrategy plans to raise $42 billion over the next three years through debt and equity offerings, solidifying its commitment to the cryptocurrency.

Other notable companies on the list include Coinbase with 9,480 BTC, Block with 8,363 BTC, and Galaxy Digital with 5,400 BTC. International companies are also getting involved, with Germany’s Bitcoin Group SE holding 3,114 BTC, and firms from Hong Kong, Japan, China, and Singapore contributing to the global adoption of Bitcoin. In total, the 60 companies listed hold 591,368 BTC, showcasing the growing institutional interest in Bitcoin.

Governments are also joining the Bitcoin movement. El Salvador, which made Bitcoin legal tender in 2021, has accumulated around $600 million in Bitcoin reserves. The U.S. is reportedly considering a strategic Bitcoin reserve to enhance economic resilience. Meanwhile, Bhutan’s government holds nearly $1.13 billion in Bitcoin, further emphasizing the shift towards diversifying national reserves amid economic uncertainty and inflation.

Also Read: MicroStrategy’s Bold Move: Shareholders to Vote on Raising Capital for More Bitcoin Purchases

As Bitcoin continues to gain traction among both corporations and governments, it’s clear that its role in global financial strategies is expanding rapidly.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.