|

Getting your Trinity Audio player ready...

|

Hedera (HBAR) is showing promising signs of a market recovery after a recent downturn that saw its market cap drop to $10.11 billion. Despite this decline, HBAR’s price action and key indicators point to a potential rebound, with the possibility of reclaiming its all-time high and reigniting investor confidence.

Market Cap and Price Action: Signs of Recovery

As of December 3, HBAR’s market cap peaked at $14.20 billion, the highest since the Hedera Mainnet launched in September 2019. This surge in market cap is largely attributed to HBAR’s impressive price increase, which saw a 600% jump within weeks. However, following this spike, the token’s value dropped from $0.38 to $0.26, signaling a temporary pause in its bullish momentum.

Despite this recent dip, HBAR has shown resilience. Over the past 24 hours, the token has rebounded, signaling a potential renewal in buying interest. If this recovery continues, HBAR’s market cap could return to the $14 billion level, a critical milestone for the altcoin.

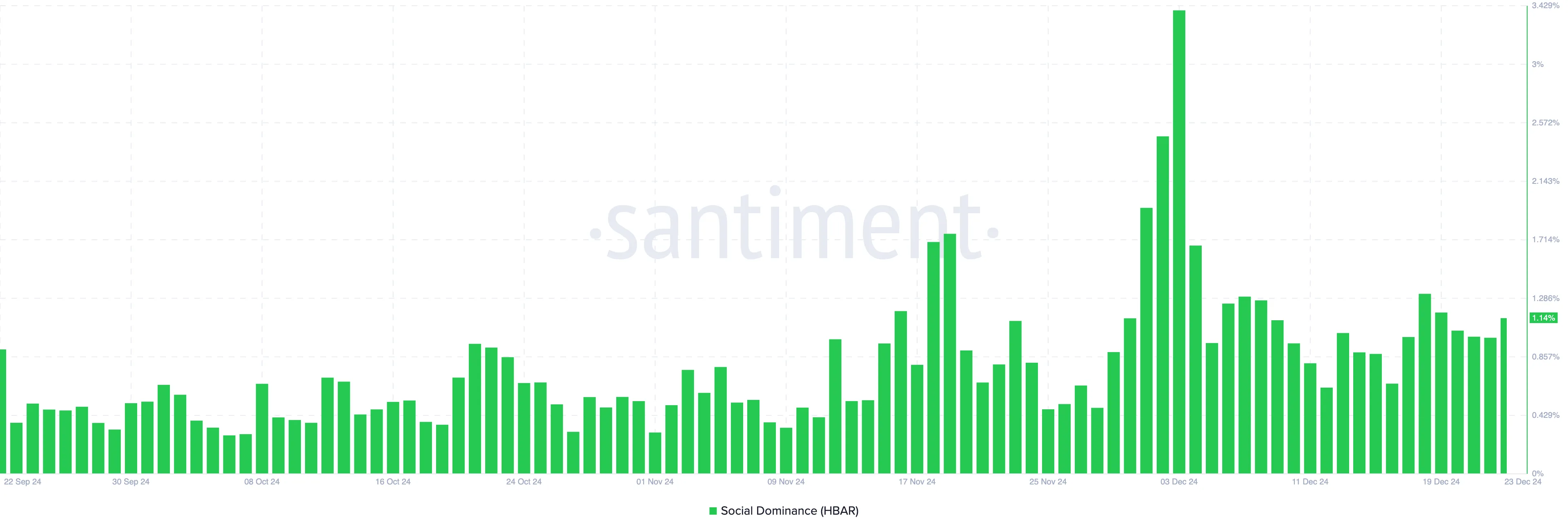

On-Chain Data: Social Dominance Surge

Further supporting HBAR’s recovery is a notable increase in its social dominance. According to on-chain data from Santiment, HBAR’s social dominance reached 1.14%, a key indicator of growing attention within the cryptocurrency community.

This rising social dominance suggests that HBAR is attracting more discussions, often a precursor to a bullish sentiment shift. If this trend continues, it could fuel further price gains, helping to drive the token’s market cap back toward $14 billion.

Bullish Technical Indicators: Price Could Hit $0.45

From a technical standpoint, HBAR shows signs of bullish momentum. Analysts highlight the formation of a bull flag pattern on the HBAR/USD chart, which indicates that the token could be primed for another price surge. The bull flag pattern typically follows a strong upward rally (the “flagpole”) and is followed by a consolidation phase (the “flag”), signaling a brief pause before another sharp price increase. If this pattern plays out, HBAR could potentially rise to $0.45.

However, the outlook remains cautious. If selling pressure intensifies, HBAR’s value could dip to $0.17.

In conclusion, HBAR’s current market indicators suggest that a recovery is possible. With its market cap potentially heading back to $14 billion and bullish technical patterns in play, HBAR could see significant price growth in the coming months.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!