|

Getting your Trinity Audio player ready...

|

Blockchain tracker Whale Alert has reported a significant transfer of 60 million XRP, valued at over $132 million, between two unidentified wallets. This transaction has sparked discussions among analysts, with some predicting a potential rally that could drive XRP to new all-time highs.

Whale Moves Signal Market Anticipation

The massive XRP transfer has drawn attention to the actions of large holders, often seen as precursors to major market moves. This development aligns with increased speculation surrounding XRP’s price trajectory, especially as talks of a possible XRP-focused ETF gain momentum.

EGRAG Crypto, a prominent market analyst, remains optimistic, forecasting a surge to $27. The analyst highlights XRP’s position above its Break of Structure (BOS) level and its alignment with the 21 Exponential Moving Average (EMA), both seen as bullish indicators.

#XRP IS FAVOLOSO 🇮🇹 – Confirmation of $27 Incoming! #XRP is currently ranging above the BOS and patiently waiting for its rendez-vous avec mon amour 🇫🇷 with the 21 EMA.

— EGRAG CRYPTO (@egragcrypto) December 23, 2024

When this meeting happens ABOVE the BOS and the 21 EMA crosses it, tagging #XRP price, I will confidently… pic.twitter.com/eSDxLti0V4

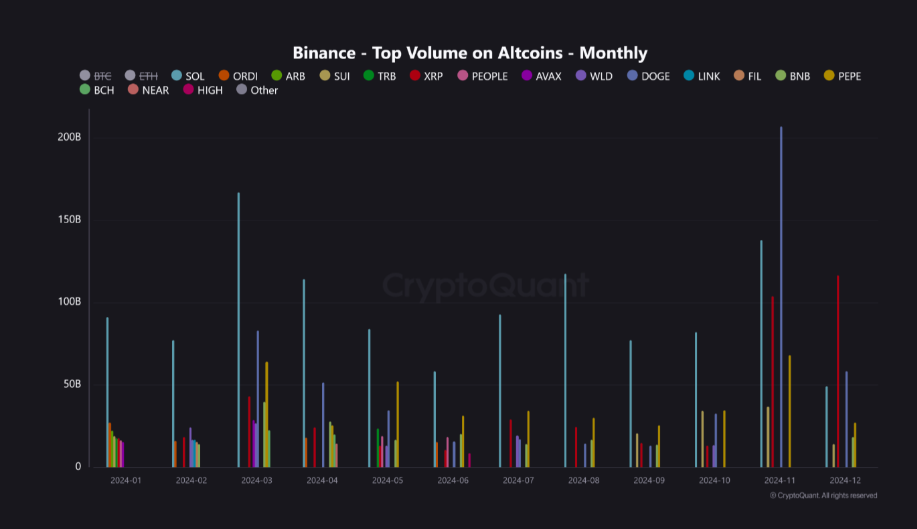

Adding to the momentum, CryptoQuant data revealed XRP as the most traded altcoin on Binance’s futures market in December, with a trading volume of $116.6 million. This surge in activity suggests growing interest ahead of the anticipated “Santa Claus rally.”

Historical Patterns Point to a Breakout

Market analysts have drawn parallels between XRP’s current behavior and its 2017 bull run. Crypto Vilian, a well-known trader, noted a familiar pattern: steep declines followed by recovery, consolidation, and explosive breakout.

Crypto Vilian predicts that XRP’s market cap could exceed $1 trillion in this cycle, translating to a price of over $17. However, this ambitious target hinges on broader market trends and Bitcoin’s performance as a market anchor.

Short-Term Outlook Remains Mixed

While long-term prospects appear bullish, XRP’s short-term technical indicators suggest potential bearish pressure. The daily chart shows a descending triangle pattern, with support at $2.19 and a downward trendline pointing to $1.69 if breached. Conversely, a rebound above $2.50 could invalidate bearish predictions and set the stage for a retest of $2.90.

Also Read: Ripple vs. SEC: Four Years of Legal Battles, Key Ruling, and XRP’s 500% Price Surge

On-chain data from Messari reveals profit-taking among large holders, further contributing to consolidation. However, market sentiment could shift with positive developments in Ripple’s SEC case and the potential resignation of SEC Chair Gary Gensler in January.

As XRP navigates this volatile phase, its price trajectory remains a focal point for traders eyeing a possible breakout.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!