The cryptocurrency market is currently grappling with bearish momentum, and Ethereum is feeling the brunt of it. Over the past week, Ethereum (ETH) has faced a significant price drop, fueled in part by the actions of Justin Sun, the founder of Tron. Sun’s decision to offload a substantial portion of his ETH holdings has raised concerns across the crypto community, leaving many questioning the reasons behind the market’s downturn.

Justin Sun’s Impact on Ethereum

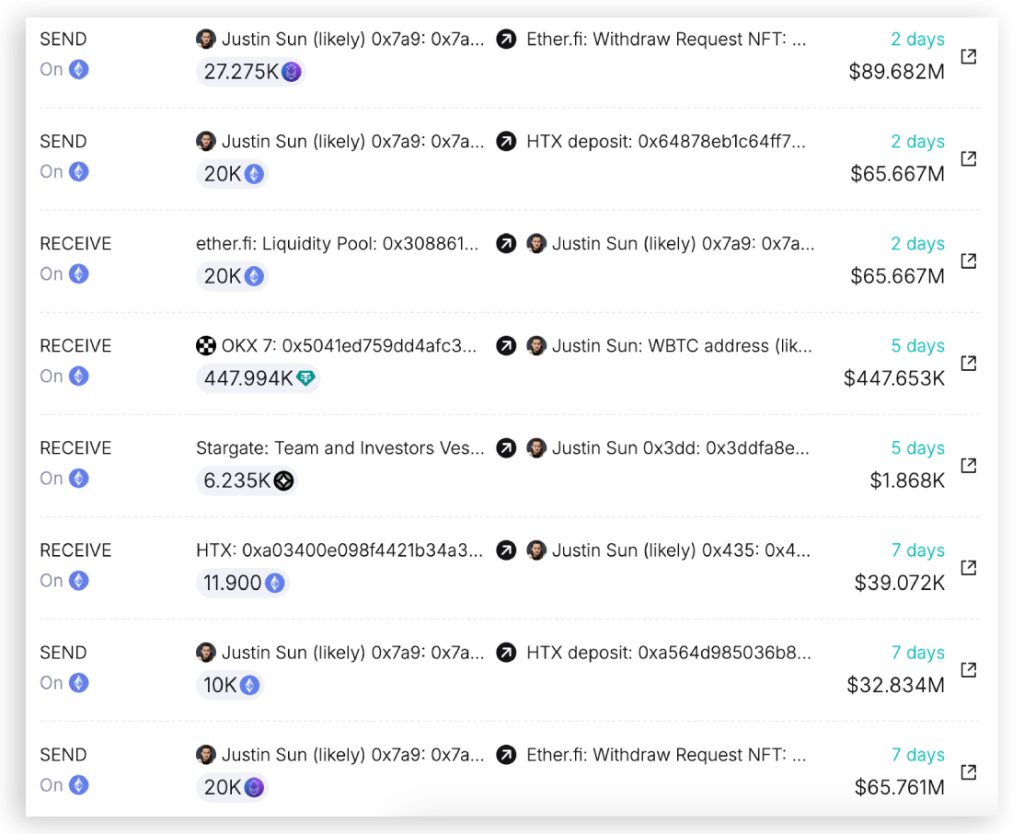

Since November 10, Justin Sun has been busy depositing large amounts of ETH into HTX (formerly Huobi). According to Spot on Chain data, Sun has moved a staggering 108,919 ETH, worth around $400 million, into the exchange. Most of these transactions took place when ETH prices were near their highs, averaging $3,674 per ETH. Adding to the concern, Sun has also unstaked 42,904 ETH from Lido Finance, valued at approximately $139 million. This move has sparked speculation that he may transfer these funds to HTX as well.

With such significant selling and staking activity, it’s no surprise that Ethereum’s price has taken a hit. As of now, Ethereum is trading at $3,304—a 17% drop from its recent rejection at $4,000. In the past 24 hours alone, ETH has fallen by another 2.19%, and trading volume is down by 8.57%.

Technical Outlook and Market Sentiment

The market sentiment is overwhelmingly bearish, with 54% of open trades on Ethereum being short positions. The long-short ratio sits at 0.8495, indicating more traders are betting on further declines. However, there’s a silver lining: 78% of Ethereum holders are still in profit at the current price level.

Technically speaking, Ethereum is approaching a critical support level at $3,260. If the price falls below this threshold, it could trigger a further decline toward $3,000, where the 200-day moving average might offer some support. With the Relative Strength Index (RSI) at 39.28—near oversold territory—and the Average Directional Index (ADX) showing continued bearish momentum, the outlook for Ethereum remains uncertain.

What’s Next for Ethereum?

The big question now is whether Ethereum can maintain its position above $3,260. If not, a drop to $2,800 could be on the cards, especially if whales like Justin Sun continue to liquidate their holdings. While some analysts believe Ethereum is still in a “safe zone,” others warn that ongoing market volatility and low weekend trading volumes could exacerbate the downturn.

Also Read: Ethereum’s Golden Cross Sparks Bullish Momentum: $6K to $8K Targets in Sight

As Ethereum faces these challenges, investors should remain cautious and closely monitor market developments. The reaction to Justin Sun’s actions has highlighted the potential for further volatility in the coming days.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.