MicroStrategy, the largest corporate holder of Bitcoin, has made a bold move to align its strategic focus with the evolving digital asset landscape. On December 20, the company expanded its Board of Directors from six to nine members, incorporating high-profile crypto advocates. This decision underscores its commitment to innovation in the digital economy.

Saylor’s Vision for a Strategic Bitcoin Reserve

Michael Saylor, MicroStrategy’s Executive Chairman, outlined an ambitious proposal for a Strategic Bitcoin Reserve (SBR) as a potential solution to global economic challenges. Saylor believes this initiative could enhance the dollar’s dominance while unlocking unprecedented growth opportunities in the digital asset sector.

According to Saylor, a robust digital asset policy could spearhead a capital markets renaissance, potentially driving the digital currency market valuation to $10 trillion. He projects this growth to boost the digital economy’s valuation from $1 trillion to a staggering $590 trillion, positioning the United States as a global leader in the sector. Moreover, he envisions the SBR creating demand for U.S. Treasuries, reinforcing economic stability.

A strategic digital asset policy can strengthen the US dollar, neutralize the national debt, and position America as the global leader in the 21st-century digital economy—empowering millions of businesses, driving growth, and creating trillions in value. https://t.co/7n7jQqPkf1

— Michael Saylor⚡️ (@saylor) December 20, 2024

Skepticism Surrounding SBR’s Viability

Despite its transformative potential, the SBR concept has faced criticism from notable industry figures like venture capitalist Nic Carter. Carter argues that Bitcoin’s inherent volatility undermines its reliability as a reserve asset, citing its recent price fluctuation from over $108,000 to $92,000. He warns that such volatility could destabilize markets and weaken the dollar’s global standing rather than strengthening it.

New Crypto Expertise on MicroStrategy’s Board

In a move to bolster its strategic vision, MicroStrategy has appointed three prominent figures to its board: Brian Brooks, Jane Dietze, and Gregg Winiarski.

- Brian Brooks: Former Binance US CEO and ex-Acting Comptroller of the Currency, Brooks brings extensive experience in crypto regulation and leadership roles at Coinbase and BitFury Group.

- Jane Dietze: As the Chief Investment Officer at Brown University and a board member at Galaxy Digital, Dietze adds institutional investment insight.

- Gregg Winiarski: With his tenure as Chief Legal Officer at Fanatics Holdings, Winiarski contributes legal expertise in emerging markets.

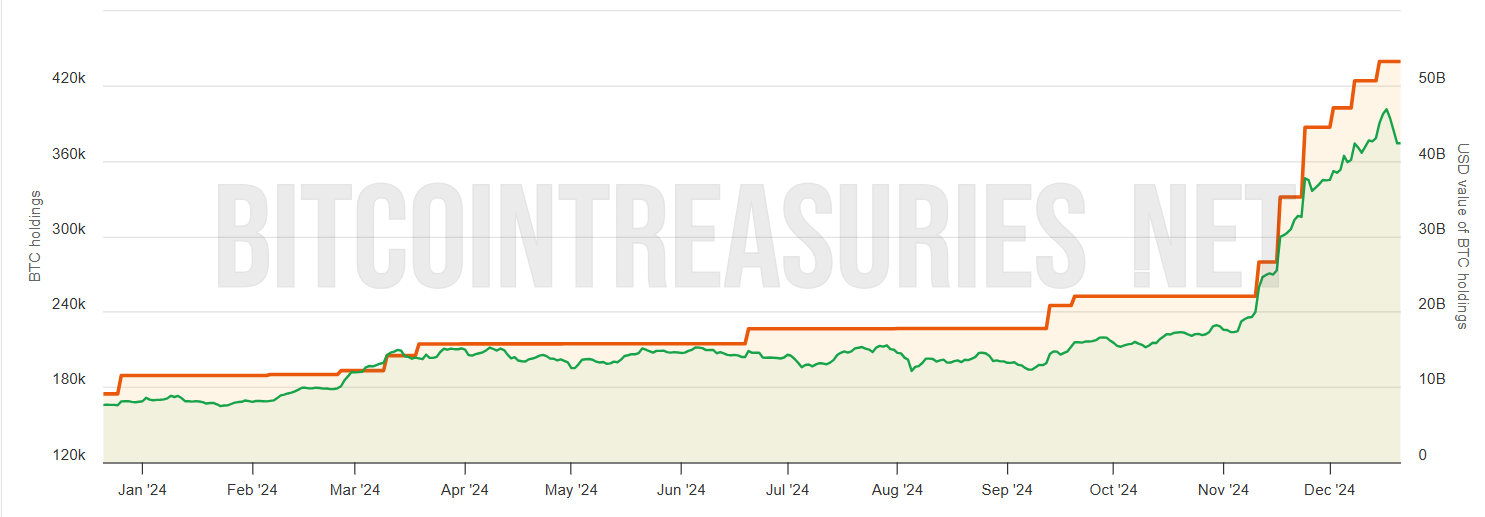

MicroStrategy’s Bitcoin Holdings

As the largest publicly traded corporate holder of Bitcoin, MicroStrategy owns 439,000 BTC valued at over $43 billion. These developments reflect the company’s commitment to integrating cryptocurrency into its core strategy and shaping the future of digital assets.

With its revamped board and bold proposals, MicroStrategy positions itself at the forefront of the crypto revolution, despite lingering debates about the feasibility of its vision.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.